Which Car Insurance – Our ratings and reviews are not influenced by our advertising relationships, but we may receive a commission from our affiliate links. This content is independently created by the editorial team. Find out more about it.

By some estimates, more than 500 companies sell auto insurance in the US, but despite the vastness of the market, only a few companies sell the majority of auto insurance. In fact, the top eight companies sell 73% of auto insurance by premium.

Contents

- Which Car Insurance

- What Is Comprehensive Auto Insurance And What Does It Cover?

- Car Insurance Discounts (2024 Guide)

- How Much Car Insurance Do I Need?

- Car Insurance Vs. Car Warranty

- How Much Does Car Insurance Cost?

- Oc] Car Insurance Prices Top Latest Cpi Report

- Car Insurance Mistakes

- What Is Non Owner Car Insurance And Do You Need It?

- Related posts:

Which Car Insurance

It is always a good idea to check with several smaller companies when purchasing insurance. You may find an unknown provider that offers great service at a low price. But you will probably try it with some big brands. Here are our reviews of the eight largest US auto insurance companies in 2024.

What Is Comprehensive Auto Insurance And What Does It Cover?

Liberty Mutual offers the cheapest car insurance outside the US in our review, available only to select customers. The company offers several discounts to keep costs low, including clean records, multiple Liberty Mutual policies, home ownership, US military membership, good student and online purchase policies.

The company was ranked 11th in JD Power’s customer satisfaction survey. According to the NAIC, the number of complaints is higher than average.

State Farm is the largest auto insurance company and one of the most recognized brands in the US. The company offers many discounts on car insurance, including multiple policies, accident-free, defensive driving and certain vehicle safety features. . It also offers a usage-based insurance program called Drive Safe and Save, which offers a 30% discount on safe driving.

The Stair Clear corporate program is also included. Steer Clear, an app-based program aimed at under-25s, helps these new drivers develop safer driving habits by offering additional discounts.

Car Insurance Discounts (2024 Guide)

In the 1990s, Progressive was one of the first insurance companies to offer online quotes and sales. Today, the company continues to provide tools that make online shopping easier. These tools include Name Your Price, which lets you see the best combination of coverage based on your budget.

Progressive also pioneered UBI (Utilization Insurance). Its Snapshot program offers an average discount of $94 at sign-up and $231 at the end of the six-month observation period. This is the only UBI program we know of that ends in just six months. So once you get the discount, the company won’t track your driving habits.

GEICO offers extensive discounts. Includes industry standard offerings such as Good Driver, Good Student, multiple GEICO policies, multi-vehicle insurance and certain vehicle safety features. Offers discounts to members of the military and many professional and academic affiliations.

The company ranked ninth in JD Power’s customer satisfaction survey, and Crash Networks’ C grade is lower than some of the other companies in our review. However, according to the National Association of Insurance Commissioners (NAIC), GEICO received a lower than average number of consumer complaints.

How Much Car Insurance Do I Need?

Allstate is the most expensive insurance company in our review. But like other major insurance companies, it offers wide discounts to help you save money. According to the NAIC, it ranks fifth in JD Power’s customer satisfaction survey and has a below-average number of complaints.

Allstate is our pick for low-mileage drivers. Its DriveWise UBI program helps customers save if they drive fewer miles than average. Those looking to cut back on their driving (such as retirees, urban dwellers who rely on public transportation, or those who work from home) can try the company’s MileWise program. This is a true “pay as you go” insurance program where you pay a daily fee and a per mile rate.

USAA insurance is only for members of the US military and their families. The company offers many discounts and features similar to those offered by other insurance companies. Its many benefits support and protect those who serve our nation. These include discounts for storing a vehicle on a military base, keeping a vehicle in storage (such as when stationed overseas), and USAA Legacy membership.

USAA is known as a leader in customer service. 890 score in J.D. Power ranked it #1 in the 2022 US Auto Insurance Customer Satisfaction Survey (JD Power rates USAA but does not officially rate the company due to its exclusive customer base).

Car Insurance Vs. Car Warranty

Farmers ranks in the top half of JD Power’s 2022 US Auto Insurance Customer Satisfaction Survey. However, it is the second most expensive company in our review and only publishes a few available discounts. This includes discounts for having multiple Farmers policies and being a safe driver. The company offers a UBI program called Signal.

Farmers also offers new car trade-in coverage. If your vehicle is declared a total loss due to breakdown or theft, Farmers will pay to replace the vehicle with one of the same make and model. This optional feature applies to vehicles less than two years old and less than 24,000 miles.

On the other hand, if your new car is repairable, you can be sure that the dealer will pay for the OEM parts when the OEM parts are available.

Travelers is the eighth largest insurance company in the US, but it may be the best at electric vehicle (EV) and hybrid insurance. According to a recent study, Touring pays 36% less for EV insurance than other companies. It’s also the only company that offers discounts specifically for EVs and hybrids.

How Much Does Car Insurance Cost?

Of course, whether you drive an EV or hybrid or not, you’ll find a wide variety of discounts from Travelers. These include more passenger insurance, more vehicles on one policy, permanent insurance without delay, paying the full amount before the insurance start date and getting a quote.

We reviewed the top eight US insurance companies in 2022, according to data released by the NAIC. We’ve also collected authentic third-party ratings and reviews from various sources:

We reviewed each company’s website to determine the discounts offered, availability of UBI and other programs, and other features. Next, we created several “best of” categories and placed companies where we thought they would fit.

It can be difficult to determine which car insurance company is better than another. Another problem is the fact that American insurance companies spend billions of dollars on advertising. You can’t seem to make a difference without seeing another car insurance ad on your screen or billboard.

Oc] Car Insurance Prices Top Latest Cpi Report

Try to take an objective approach so that you can get the best insurance company for your needs. Here are some tips.

J.D. Over the years, Power has ranked among the nation’s top auto insurers based on customer service and satisfaction ratings. Abstracts of these studies can be easily found using an online search. Third-party insurance company reviews and ratings from organizations such as A.M.Best, Demotech, Crash Network, and NAIC.

Talk to people you trust – family, friends, co-workers, neighbors – and see if there are any companies they recommend (or not).

Insurance costs vary between companies, with some running into the hundreds of dollars a year. Make sure you get quotes from at least three or four companies so you can get the lowest premiums for the coverage you need.

Car Insurance Mistakes

Independent insurance agents are licensed professionals who can provide you with the policy you need at a price that fits your budget. These agents usually represent multiple companies (including smaller ones that cost less than larger insurance companies) so they can handle the buying process on your behalf.

You have many options for car insurance. But three-quarters of the coverage in the US is sold by a few large companies. Use our independent ratings and detailed third-party reviews to find out exactly what these companies have to offer.

Car insurance covers multiple coverages. Most states require liability coverage for injuries to other drivers or damage to the vehicle if you are found to be at fault in an accident. Some states require personal injury protection (PIP), which pays medical bills regardless of which driver is at fault. Comprehensive and collision charges, which help cover damage to your personal vehicle in specific circumstances, are usually required by the lender if you finance the vehicle.

The price of car insurance is influenced by various factors. This includes your age, gender, driving record, zip code and the year, make and model of your vehicle. Premiums also vary by insurance company, as each insurer must price a policy based on the unique needs of their business.

What Is Non Owner Car Insurance And Do You Need It?

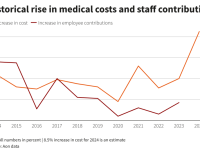

The cost of car insurance has increased in recent years. According to a recent study by Insurify, premiums are up 17% nationwide in the first half of 2023. This increase is due to higher costs for auto parts and maintenance workers.

All this is highlighted

Which insurance, which car insurance is cheaper, car insurance which, which car for cheap insurance, which car insurance reviews, which states require car insurance, which best car insurance, which cheap car insurance, which car insurance company, which cheapest car insurance, car insurance which is best, which car insurance is cheap