How Much Is Contractor Insurance – The value of a builder’s risk policy (also known as construction course insurance) is based on the total value of your structure and other project factors. This includes the cost of all materials and labor, but does not include the cost of the land.

Small businesses pay an average of $105 per month, or about $1,259 per year, for manufacturer’s risk insurance.

Contents

- How Much Is Contractor Insurance

- The 7 Best Builders Risk Insurance Companies & Quotes

- How Much Does A Performance Bond Cost Seaman’s Insurance

- General Liability For General Contractors — Contractors Choice Insurance Services

- Roofers Contractors Insurance In Texas

- Contractor & Cleaning Insurance

- Professional Liability Insurance 2024

- How Much Does Business Insurance Cost?

- Questions To Ask A Contractor Before You Hire Them

- General Liability Insurance Cost

- Certificate Of Liability Insurance: What It Is, How To Get One

- Related posts:

How Much Is Contractor Insurance

Our figures are derived from the value of policies purchased by customers from major insurance companies. The median provides a good estimate of what your business is likely to pay because it does not include high and low rates.

The 7 Best Builders Risk Insurance Companies & Quotes

While small business customers pay an average of $105 per month for manufacturer’s risk insurance, 49% pay less than $100 and 26% pay between $100 and $200 per month.

The price depends on the construction project. The cost of the policy is usually between 1% and 4% of the total cost of the structure, including construction costs.

Builder’s risk insurance has broad coverage limits. The upper limit is higher, but it covers expensive claims. The average limit for consumers purchasing a manufacturer’s risk policy is $460,000, with no deductible.

A builder’s risk policy covers perils such as vandalism or theft of construction materials at the construction site, up to the policy limits. For example, this policy covers expenses if a natural disaster causes water damage to existing structures, or a fire destroys firewood in the workplace.

How Much Does A Performance Bond Cost Seaman’s Insurance

To protect your small business against all risks, you should consider purchasing additional insurance, such as general liability insurance for third-party financial protection against bodily injury and property damage; Business property insurance to cover damage to your business property; and professional liability insurance, to protect against work-related and employment-related claims.

For construction projects that require expensive construction materials or large labor costs, you need a manufacturer’s risk policy with higher limits. This will increase your money.

Many builders have multi-million dollar insurance policies that limit, for example, $10 million or more in damages per incident.

If you have equipment and materials to transport from one job site to another, you may need marine insurance for the equipment and materials on site or the contractor. These policies protect your equipment and other belongings during your trip, and are not the types of risks covered by the manufacturer’s risk insurance.

General Liability For General Contractors — Contractors Choice Insurance Services

Builder’s risk insurance sometimes provides different coverage limits for building classes and building types. For example, the plan may include a $5 million limit on physical systems and a $10 million limit on related systems.

In addition, the size of the building may affect your costs, because the cost of insurance for the risk of the builder may be lower than the insurance for a large commercial structure.

You can also add additional coverage and support, such as temporary structural coverage or debris removal after a loss.

It’s simple: The more employees you have, the greater the risk of accidents (for example, employee theft). For this reason, a company with many employees may pay more for a manufacturer’s risk policy than a few employees working on a small project.

Roofers Contractors Insurance In Texas

If an employee is injured on the job, builder’s liability insurance does not cover medical bills or legal expenses. Instead, you need workers’ compensation insurance.

The location of the construction project can play a big role in how much you pay. For example, workplaces in areas with high crime rates or high risk of natural disasters may pay higher rates than those in areas where these incidents occur.

For example, a small business owner in Florida or Texas may have a higher premium on a builder’s risk policy than someone doing a project in Colorado due to the risk of hurricanes or storm damage. other.

Although the appropriate builder’s rental fee can vary depending on the location of the project, it can still save you in the long run if there is damage to your building or building materials due to an internal disaster.

Contractor & Cleaning Insurance

An open risk policy is more expensive than a stated risk policy. Accident coverage protects against all losses, except for the exclusions listed in the policy. Accident insurance only protects against losses listed in the policy.

There are several things you can do to keep your builder’s insurance premium within your construction budget.

Insuring your small business doesn’t have to cost a fortune. At , we help you find affordable insurance that meets your small business needs, through one online application. This way you can get peace of mind without breaking the bank.

Is the #1 independent agency offering online small business insurance. We help business owners compare quotes from top providers, purchase policies, and manage different types of coverage online.

Professional Liability Insurance 2024

By filling out a simple online application today, you can compare free quotes on builder’s risk insurance and other types of insurance from America’s top insurance companies. Insurance agents are available to help answer questions and provide guidance on your insurance needs.

Once you find the right policy for your small business, you can start getting coverage in less than 24 hours and get your small business insurance certificate.

Insurance premiums vary depending on the policy purchased by the company. See an overview of small business insurance prices or research the prices of different types of policies. The cost of general insurance varies depending on a number of factors in your business. Your industry directly affects your premium, your location, your policy limits, and more.

Small businesses pay an average of $42 per month, or about $500 per year, for general insurance.

How Much Does Business Insurance Cost?

Our figures are derived from the value of policies purchased by customers from major insurance companies. The median provides a good estimate of what your business is likely to pay because it does not include high and low rates.

Welcome here! Public liability insurance is essential if you open your business to the public, manage consumer property, or rent or own commercial property.

While small business customers pay an average of $42 per month for general liability insurance, 29% pay less than $30 and 41% pay between $30 and $60 per month.

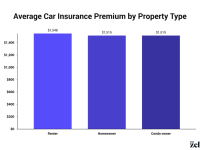

If you need car insurance that covers a lot of damage, you will have to pay more. The same applies to commercial insurance policies. If you want a policy that covers accidents and expensive lawsuits, expect to pay more than basic insurance.

Questions To Ask A Contractor Before You Hire Them

General liability insurance with limits of $1 million / $2 million is the most popular option for small businesses. These include:

Most consumers (91%) choose policies with $1 million / $2 million limits. Five percent of our customers choose policies with limits of $2 million / $4 million, the next most popular option.

When purchasing a policy, it’s a good idea to make sure your deductible is something you can afford. If you can’t pay the emergency fee, your insurance will not make a liability claim. The average deductible that customers choose for insurance coverage is generally $500.

The right amount of insurance depends on the needs of your business. You need insurance that will cover possible lawsuits, but don’t buy more than you need. Consult with a licensed contractor if you are not sure what limits are appropriate for your business.

General Liability Insurance Cost

The location of your business can play a big role in how much you pay. For example, businesses in areas with high traffic or high traffic rates may pay higher rates than those in lower areas.

Insurance prices can also vary slightly depending on your state. For example, small business owners in Virginia pay an average of $36 per month for general insurance, while Colorado businesses have an average of $49 per month.

Although general liability is offered to many small businesses, most states require by law that small business owners carry workers’ compensation if they have employees, and commercial auto insurance. if they have a company car.

An analysis of general liability insurance costs reveals that your industry has the greatest impact on small business premiums. In general, insurance companies pay higher premiums for high-risk industries, while low-risk industries enjoy lower premiums.

Certificate Of Liability Insurance: What It Is, How To Get One

For example, brick-and-mortar retailers face more risk than IT consultants who work from a home office. The chart below shows how the type of business affects how much you pay for general liability insurance.

Depending on the industry you work in, such as construction or cannabis, your state may require you to carry general insurance. In other businesses, such as real estate, insurance, or health care, you may need professional liability insurance (also known as liability insurance) before you can get a license. path.

Construction, landscaping, and landscaping companies have the highest rates because they do most of the work.

How much does general contractor insurance cost, how much is contractor liability insurance, how much does liability insurance cost for a contractor, how much is general contractor liability insurance, how much is a contractor license, what is contractor insurance, how much is a general contractor, how much does contractor liability insurance cost, how much is general contractor insurance, how much is a contractor, how much insurance does a general contractor need, how much is it to hire a contractor