How Much Is Car Insurance A Month – The cost of fully insured car insurance depends on the company you choose, where you live and other factors. Find out more about comprehensive cover, what you can expect to pay and how to keep costs down.

By Nupur Gambhir Managing Editor Nupur Gambhir is a content editor and licensed life, health and disability expert. He has extensive experience in bringing brands to life and has created award-winning campaigns for the travel and technology sectors. His expertise has been featured in media outlets including Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym, and End of Life Planning Services. Read the full resume

Contents

- How Much Is Car Insurance A Month

- Average Cost Of Car Insurance In May 2024

- Car Insurance Under $50 A Month

- Best Car Insurance Companies (may 2024)

- America’s Car Insurance Crisis Is Getting Worse

- How Much Is Car Insurance In Massachusetts? (2024)

- Car Insurance Rates By State (2024)

- Cheap Car Insurance And Average Costs For 16 Year Olds

- Month Vs. 12 Month Car Insurance

- Cheapest Sr 22 Insurance In Virginia

- Best Car Insurance Companies Of May 2024

- Related posts:

How Much Is Car Insurance A Month

?strip=all)

Reviewed by: Leslie Kasperowicz Managing Editor Leslie Kasperowicz is an expert with four years of direct agency experience and more than a decade of creating educational content to help buyers make confident and informed decisions. Read the full fact-checked bio

Average Cost Of Car Insurance In May 2024

At, we are committed to providing timely, accurate and professional information that consumers need to make informed decisions. All of our content is written and reviewed by professionals and industry experts. Our team carefully reviews our rate data to ensure we only provide reliable and up-to-date prices. We adhere to the highest editorial standards. Our content is based entirely on objective research and data collection. We maintain strict editorial independence to ensure unbiased industry coverage.

Complete auto coverage provides a high level of protection for you and your vehicle. The national average cost of full auto coverage is $1, $895 per year, or $158 per month.

The term “comprehensive coverage” varies from location to location, and its exact definition depends on your state’s legal requirements. A fully covered car usually includes:

The cost of fully insured car insurance varies and depends on many factors. Find out which states charge the highest and lowest for fully insured cars, and which insurance companies offer the best prices.

Car Insurance Under $50 A Month

According to the latest figures, the average price of a fully insured car is $1,895 per year, or about $158 per month. This is based on 100/300/100 coverage ($100,000 per person, $300,000 per injury incident, $100,000 property damage.) The average state minimum coverage cost is $502 and coverage is approx.

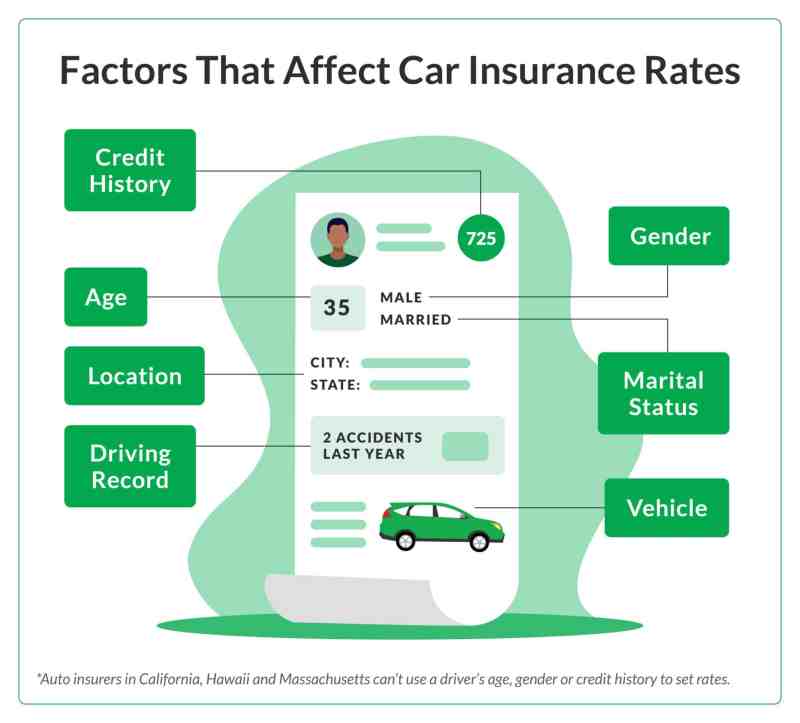

Car rates are very driver-specific: your age, driving record, credit history and number of locations, as well as the type of car you drive. The rate varies by hundreds or thousands of dollars from company to company. That’s why we always recommend comparing quotes as the first step to saving money.

According to data from Yili offers the best full coverage auto insurance policies. The insurance company received an overall score of 4.67. Car owners and passengers follow closely behind with scores of 4.65 and 4.62 respectively.

Below is a complete list of the top companies with comprehensive coverage based on price, NAIC complaint rates, customer satisfaction and AM Best’s financial ratings. An overall score is calculated using these factors and scored out of five.

Best Car Insurance Companies (may 2024)

The average cost of fully covered car coverage in the United States is $1,895 per year, or $158 per month. It has 100/300/100 liability limits and a $500 deductible. These are averages, and many factors affect automatic rates, so your rates will vary.

Maine is the cheapest state for comprehensive auto insurance, with an annual premium of $1,175, and the three cheapest states for this level of coverage are:

On the other hand, Louisiana is the most expensive state for a fully insured car, with an annual premium of $2,883. The three most expensive states for comprehensive coverage are:

*Drivers in New Hampshire do not need a car, but most drivers do and we list the must-haves if you choose to have insurance.

America’s Car Insurance Crisis Is Getting Worse

Offers the best deals on full coverage cars across the country. The average premium is $129 per month, or $1,548 per year. USAA offers affordable coverage to those who qualify.

A comprehensive auto policy includes not only mandatory state coverage such as liability coverage (and personal injury coverage or other coverage in some states), but also comprehensive collision coverage that protects your car.

Generally, liability coverage protects others from damages you cause, while comprehensive coverage also protects your vehicle.

There is no specific definition of auto that is fully covered for you depending on your situation and the coverage you need. While liability plus comprehensive and collision coverage is what people call comprehensive coverage, you can add more to your policy, including:

How Much Is Car Insurance In Massachusetts? (2024)

The main difference between liability and comprehensive auto coverage is that comprehensive coverage protects your car no matter what is at fault.

Comprehensive coverage covers at-fault accidents and damage to other people and your vehicle. It does not cover injuries you suffer in an at-fault accident unless personal injury coverage is included (required in some states, optional in others).

Remember, “broad coverage” is not a formal term; Your comprehensive coverage policy may not include all available coverage. Review all of your coverage options to make sure you understand what is and isn’t covered, and add any additional coverage you may need.

Although most states have laws requiring you to carry liability insurance (and no-fault health insurance in some states), you are not required by law to carry full coverage.

Car Insurance Rates By State (2024)

However, if you owe money on the vehicle, your lender will require you to purchase collision and comprehensive coverage to protect its investment. After paying off the loan, buying composites and collisions is your choice.

Use an online car calculator to get personalized advice on what type of car insurance you should buy and what deductibles you should consider.

The best way to find the cheapest full roof car is to shop around and compare quotes. Companies assess risk differently, which can lead to big differences in premium quotes. In addition to shopping around, here are some tips for buying a cheap full roof car:

While there is no specific time when you can or should choose comprehensive coverage, there are a few ways to make the decision.

Cheap Car Insurance And Average Costs For 16 Year Olds

First, if your loan is paid off and you are willing to cover the cost of repairs or replacement after an accident, you may want to waive comprehensive and collision coverage.

Car values decrease every year, as do insurance premiums. At some point, most drivers will choose to accept the risk and bear their collision and higher premiums because they are unlikely to find a reliable alternative to compensate them.

Consider the amount you pay for additional coverage and the value of your car. It may be wise to keep extra money aside. If you don’t have an accident, it stays in your pocket. If you do, hopefully you’ve saved enough money to pay for it.

Trust Quadrant Data Services to provide 2023 comprehensive insurance coverage with 100/300/100 coverage and a $500 deductible. Rates come from many companies in zip codes across the country. Rates are based on a 40-year-old male driver driving a 2023 Honda Accord LX material updated to 2024.

Month Vs. 12 Month Car Insurance

There is no difference in the cost of comprehensive insurance for new and used cars. In other words, the answer to the question “How much does comprehensive insurance cost for a used car?” It’s the same: it depends.

According to statistics, the average price of a fully insured car in 2023 will be $1,895. This will vary based on several factors. The price of a car is more important than a new or used car.

The monthly cost of a full coverage policy varies, but based on the national annual average, the monthly cost is $158.

In almost all cases, the answer to this question is yes. If you finance a vehicle, your lender will require you to purchase a minimum of comprehensive insurance to protect your investment in the vehicle. / year

Cheapest Sr 22 Insurance In Virginia

How Much Does Car Insurance Cost for a 16-Year-Old: Average Monthly/Annual Car Insurance Costs for 16-Year-Old Male and Female Drivers

17 How Much Does Car Insurance Cost for a 17-Year-Old: Average Monthly/Annual Car Insurance Cost for a 17-Year-Old Driver

The average cost of car insurance is an important factor that every driver should consider, and is discussed on this page. We provide up-to-date information on the average cost of car insurance in the United States in 2021 based on our research and various (and not so common) questions, issues about the average monthly and annual cost of car insurance. and respond to concerns. the United States.

It is important to note that although these rates reflect the average cost of car insurance, car insurance rates vary and depend on many factors, including how clean your driving record is, your credit How good is the score and the type of vehicle, the amount of car insurance.

Best Car Insurance Companies Of May 2024

How much is boat insurance per month, how much is cat insurance per month, how much is full coverage car insurance a month, how much is life insurance per month, how much is dog insurance per month, how much is sr22 insurance per month, how much is pet insurance a month, how much is homeowners insurance per month, how much is state farm car insurance per month, about how much is car insurance per month, how much is car insurance for a teenager a month, how much is car insurance per month