Where To Buy Life Insurance – Buying life insurance online is great. By 2022, Google’s fastest search for “life insurance” will exceed 1.2

Findings Add this to TV ads, spam emails, texts and emails, and it’s easy to see why consumers are overwhelmed with choices when buying life insurance online. There are so many options and so many to compare.

Contents

- Where To Buy Life Insurance

- How To Use Life Insurance To Buy A House: The Key Steps

- Benefits Of Buying Life Insurance Online

- Do I Need Life Insurance? If So, What Kind Should I Buy?

- What Is Bank Owned Life Insurance (boli) And How Does It Work?

- September Is Life Insurance Awareness Month

- Top 5 Reasons Why Not To Buy Life Insurance As A College Savings Plan

- Why Clients Buy Life Insurance

- Can Life Insurance Give You Peace Of Mind?

- Related posts:

Where To Buy Life Insurance

Today we are going to cut through all the marketing hype and give you a completely unbiased guide to buying life insurance online. By the end of this chapter, you will know how to buy life insurance online, what to look for when comparing life insurance policies, and what to expect when applying.

How To Use Life Insurance To Buy A House: The Key Steps

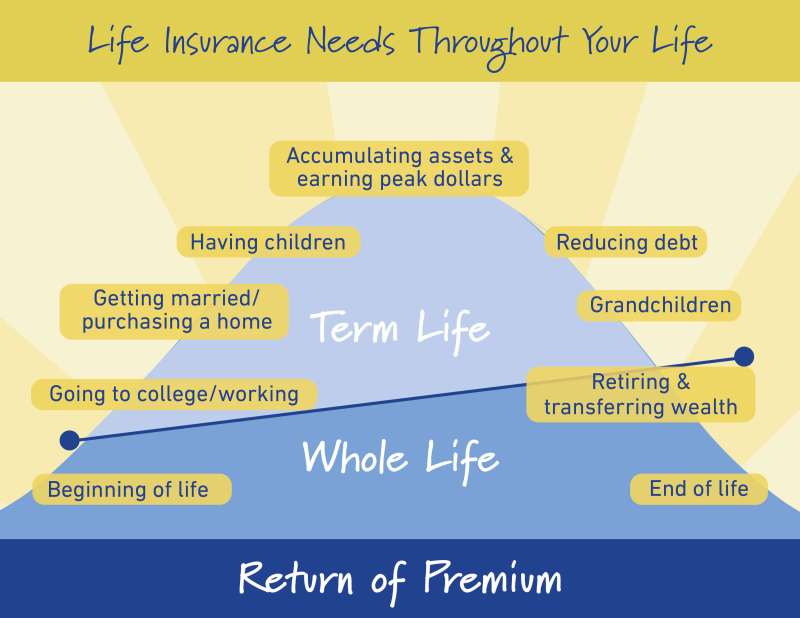

Ignore any commercial, postal or spam emails you receive. There are only two main types of life insurance:

ALL life insurance policies that you can buy online fall into these categories. Some of them have bells and whistles, or you can call them “end of life insurance”, “whole life insurance” or “accidental death benefit”. But if there’s one thing you know on the internet today, we’ll repeat it: all life insurance falls into one of these categories.

Whole life insurance is sometimes called “permanent life insurance.” And “global” policies fall under this umbrella as well as “youth” or child life insurance offered by companies like Gerber.

If you buy a whole life plan at age 25, you will continue to pay the same amount at age 75.

Benefits Of Buying Life Insurance Online

The bottom line is that whole life policies create financial value. The insurance will deposit a portion of your premium each month on your behalf. It takes several years of premium payments for this remaining amount to turn into a substantial amount of money. However, you can withdraw the money later to help pay for emergencies. It’s just that you have to pay them off quickly or you’ll end up paying interest.

The lifetime value of money can be a big deal. For example, imagine your new built-in refrigerator dies five days before your due date. You can take some money out of your life insurance premium, buy a new refrigerator and groceries, and pay it off on payday-free.

And if you don’t need insurance, you can take it or sell it to a lifetime settlement broker.

Term life insurance policies work a little differently. You enter into a contract with the insurer, but it is only for a certain period of time. That time can be five, ten, or even thirty years. But when that period is over, if you still need life insurance, you sign a new policy. Your premium increases (significantly) as you get older and have less money.

Do I Need Life Insurance? If So, What Kind Should I Buy?

The advantage of term policies is that they offer a large amount of coverage for a low premium. A 40-year-old in good health would pay $30 for $100,000 of insurance over the next 10 years, or $30 for $15,000 for the rest of his life.

Therefore, to make the best decision when buying life insurance online, you need to have a good understanding of your budget and how much life insurance you need. And remember, there is no law that prevents you from having one document or one type of law. Most people have term and lifetime policies.

Wait wait Before we get into buying life insurance online, a good answer is this: The first place you need to find new life insurance is the insurance you use. You can get a deductible on your home, rental or auto policy with additional new life insurance. In the insurance business, we call this “collaboration.” With the right discount on your home and car, new life insurance can even pay for itself.

In other words, if you save $75 a month to buy an $80 life insurance premium, you’ll only spend $5 more on life insurance. With the help of packages, you can have more.

What Is Bank Owned Life Insurance (boli) And How Does It Work?

And, if your family uses two or more insurers (Geico for auto and Allstate for home), get life insurance quotes from both of them. You can get two life insurance policies, two sets of discounts, and spend less on total life insurance.

But you probably did it before. Maybe you’re not happy with the rates or coverage your insurance company is offering and you’re ready to search for life insurance online. let’s go there

Now that you know the difference between term and whole life policies, your research time will be cut in half. Visit your favorite search engine, search and add more features according to your budget. Or just try this:

Depending on the search engine and your query, you can get millions of results. Each of them needs to fill out an application. And each application can lead to a ton of spam emails and lots of calls from agents. So don’t fill out 10 forms just yet. Start small.

September Is Life Insurance Awareness Month

Most insurance companies want you to complete a physical before they will insure you. This is especially true for the larger life rules. Although this may seem difficult, it is not a big deal. Life insurance companies agree with medical professionals and laboratories throughout the country. They even send a lab technician to your door to check your blood pressure and see you. Here’s what you need to know:

Life insurance medical tests are fragile. Insurers just want to know that you are healthy enough to be covered. If the technician comes to your house and finds out that you are on hospice, they will not shut you down. Can you blame them? They will write a big check if you pass, and they don’t want to write that check quickly.

If you are young and especially healthy, these hoops are worth jumping through. You get better coverage for your monthly premium.

However, if you are old, you don’t have to deal with a physical problem, or you have a health problem, you can buy life insurance without a doctor’s examination. These are always term plans and you will pay less for them.

Top 5 Reasons Why Not To Buy Life Insurance As A College Savings Plan

If you’re looking to buy life insurance online without a medical exam, look no further. Link: “buy life insurance without a medical exam.” Your options are endless. Fill out an application or two. They will get back to you soon. You can buy life insurance online with a credit card and application.

The second most important thing you will learn today is this: Be honest with your life insurance application. Life insurance companies can access your medical records, call your doctors, send a technician to give you an answer, and more. They may also share this information with other insurance companies.

So, even if you are tempted to misrepresent your age or health, don’t do it. They get the facts and see your behavior as a “moral hazard”. Not representing your age or health on your insurance application affecting your future auto insurance rates? It is possible!

In our age of technology, all insurance companies share information. Once you are exposed as a moral hazard (the person who lied to the insurance companies), companies A, B, C, and D can find out. So tell the truth. Whether you are unhealthy or a smoker or 88 years old, there is a life insurance company looking for your business.

Why Clients Buy Life Insurance

If you are planning to buy life insurance online yourself, you can easily answer many of the application questions. Common questions include:

From the perspective of a licensed insurance agent, problems with any life insurance claim often begin with the beneficiary’s knowledge. You need to have the right information about the partners you are working with. This means:

Also, be prepared to choose a second beneficiary. The life insurance company needs to know the second person or organization that accepts your death. This happens when your primary sponsor dies or becomes unavailable.

In summary, you will need your personal information, the information of the first sponsor, and the contact information of the second sponsor.

Can Life Insurance Give You Peace Of Mind?

A life insurance contract is the longest contract you can sign. We are not about writing papers; We mean that whole life insurance can last for 90 years or more. This is three times more than a 30-year loan. When buying life insurance online, you need to trust the reliability of the company.

Many consumers do not know that life insurance companies are rated by five different agencies. Honestly, this is another blog for another day. Note that all insurance companies advertise an excellent “A+” rating, but four other consumer protection agencies may not rate it as high. Don’t settle for the cheapest life insurance you find online, make sure the company is reliable

Where to buy liability insurance, where to buy life insurance near me, best life insurance to buy, where to buy whole life insurance, where to buy life insurance policy, where to buy indexed universal life insurance, where to buy term life insurance, where to buy cash value life insurance, where to buy business insurance, where to buy universal life insurance, where to buy life insurance online, where to get life insurance