Car Insurance Prices – Comparing car insurance quotes online is one of the fastest and most efficient ways to make sure you are covered at the best rates.

Auto insurance is a broad category of auto insurance products that covers: cars, boats, cars, convertibles, SUVs,

Contents

- Car Insurance Prices

- Ford F 150 Car Insurance Cost In Houston [2022]

- Allstate Car Insurance Review 2023

- Why Are Auto Insurance Premiums Going Up And What Can I Do About It?

- Full Coverage Auto Insurance (2023)

- How Product, Labor And Legal Trends Are Driving Increased Vehicle Insurance Rates [infographic]

- How Much Does Car Insurance Cost?

- Compare Car Insurance Rates From $57/mo (december 2023)

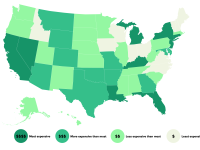

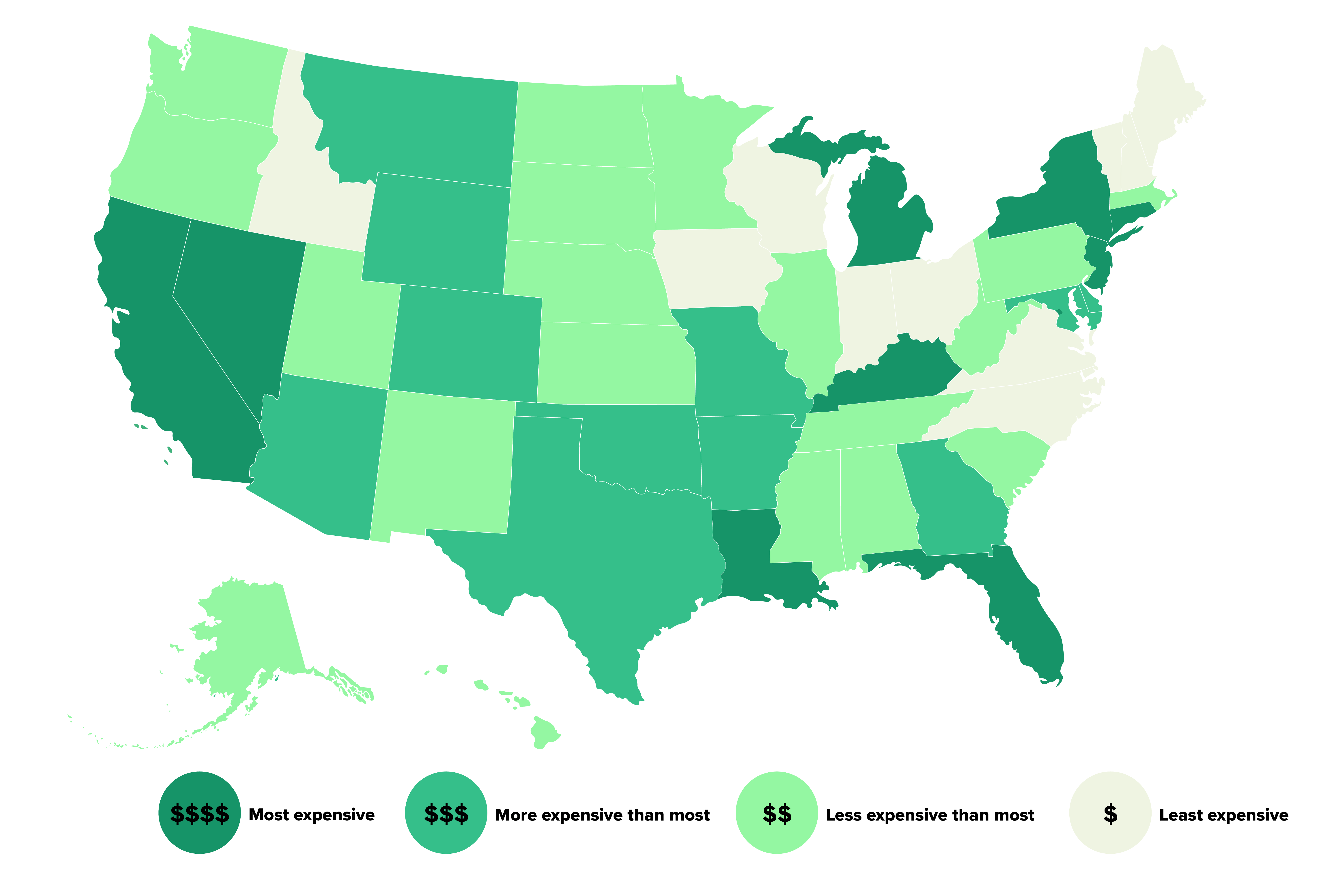

- The Average Cost Of Car Insurance In The Us, From Coast To Coast

- Gallery for Car Insurance Prices

- Related posts:

Car Insurance Prices

), and watercraft, to name a few. Choose the type of car insurance that best describes the car you want to insure and let us provide you with free quotes and information. Compare auto insurance rates and save policy from multiple carriers. In general, you have the option to set up and start your policy online, depending on your travel method and location.

Ford F 150 Car Insurance Cost In Houston [2022]

Car Insurance Stay Smart and Safe with Auto Insurance Motorcycle Insurance Ride Free with Affordable Motorcycle Insurance ATV Insurance Take Risks with ATV Insurance Snowmobile Insurance Hit the Snow Trails with Snowmobile Insurance RV Insurance Make the Road Feel Like Home with RV Insurance Boat Insurance Leave your worries at. coast with insurance boats

Most states require auto insurance for most vehicles. Whether you have a car, truck, classic/vintage car, convertible, SUV, or other four-wheel drive vehicle, it doesn’t matter how much you drive it! – you need a different type of car or car insurance. Although there is limited auto insurance coverage for cars, trucks, etc., you should consider the level of coverage that best suits your lifestyle and risks. To get the right auto insurance rate, you need to make sure that your auto insurance quote meets your needs. Our goal is to help you make insurance decisions with confidence. We have advertising links with other offers on this page. However, this does not constitute our editorial opinion or recommendation. The ratings and reviews of our reviews, tools, and all other content are based on objective analysis and our opinions are entirely our own.

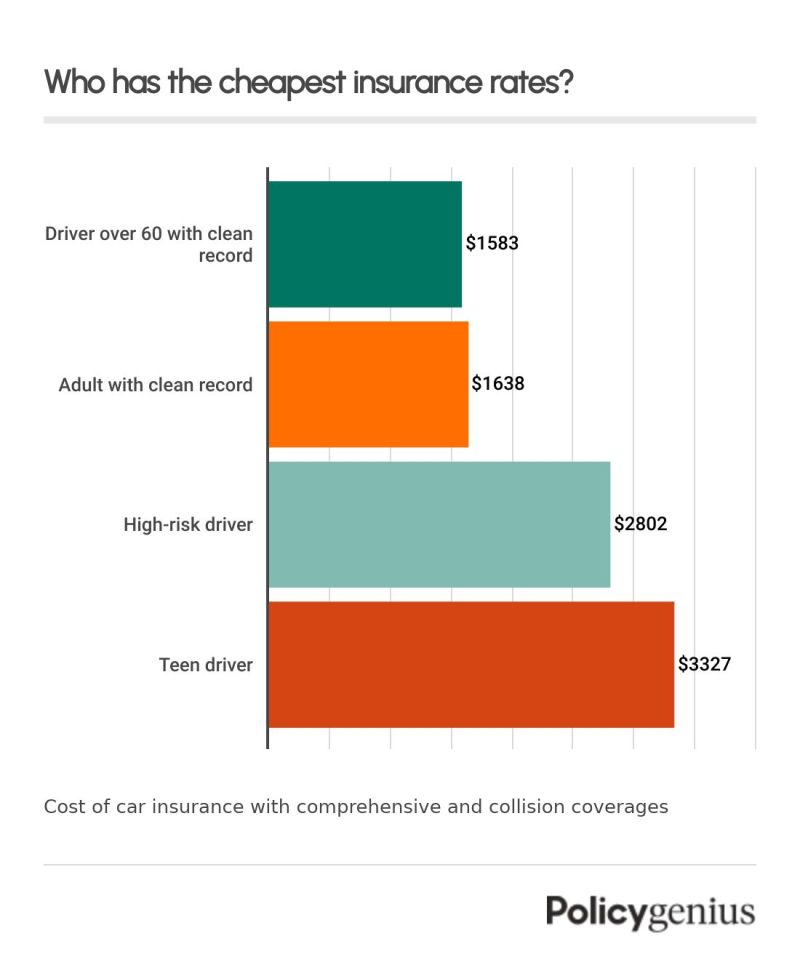

The cost of insurance depends in part on your age. Find out why age is estimated and at what age you can expect to pay more and less for your car insurance.

Laura is an award-winning editor with experience in auto insurance and financial content and communications. He has written for several media outlets, including the USA Today Network. He recently worked in the human resources department at the Nevada Department of Transportation.

Allstate Car Insurance Review 2023

John is a copywriter for the insurance companies Insurance.com and Insure.com. Prior to joining QuinStreet, John was a deputy editor at The Wall Street Journal and has been an editor and reporter for other media outlets, covering insurance, personal finance and technology.

Car insurance premiums depend on a variety of factors, with age being one of the most important factors. After all, young drivers ages 16 to 19 are about three times more likely to be involved in a fatal crash than drivers age 20 or older, according to the CDC.

The average cost of car insurance for people under the age of 25 is high. Teenagers and young drivers are less experienced behind the wheel and more likely to get into accidents, making them a bigger risk for car insurance companies. High risk equals high tech.

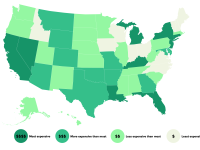

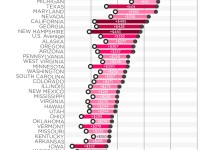

The editors calculated the average cost of car insurance for people aged 16 to 75 in each state. Here’s how much you can expect to pay for car insurance at any age.

Why Are Auto Insurance Premiums Going Up And What Can I Do About It?

California Car Insurance Rates by Zip Code Enter your zip code to see the average rate. Then enter your age, gender and coverage level for your personal account.

State Minimum: Required liability insurance to legally drive in your state; Some states require additional coverage, such as personal injury protection, uninsured motorist, insured motorist. Liability 50/100/50 only: $50,000 per person/maximum $100,000 per personal injury accident; $50,000 for property damage. Liability covers injuries/damages you cause to others. Comprehensive Coverage 100/300/100: $100,000 per person/maximum $300,000 per risk of personal injury; $100,000 for property damage; Comprehensive and Collision Insurance with a $500 Deductible. Liability covers injuries/damages you cause to others. Full compensation for your car damage in a collision.

Commissioned Quadrant Information Services to provide a report on average auto insurance rates for the 2017 Honda Accord for nearly every zip code in the United States. We calculated the rates using data from six major mobile phone companies. The average results are based on the monthly insurance for a 30-year-old male driver with the minimum state requirement. Average individual rates are based on the driver’s age and gender for the following coverage levels: small liability, 50/100/50 liability and 100/300/100 with a $500 deductible for comprehensive and collision coverage. These speculative drivers have a clean record and good credit history. Average prices are given for comparison. Your personal rating depends on your personal belongings and vehicle.

In the charts below, you will see the average auto insurance rates by age for the following coverage packages:

Full Coverage Auto Insurance (2023)

As you will see in the table below of car insurance rates by age, drivers in their 40s, 50s, and 60s have the lowest rates. Average car insurance premiums for teenagers are high, but decrease as they reach their twenties.

Once you turn 20, your rates start to drop, but you’ll still pay more than most drivers until you’re 26. The charts below show the average cost of car insurance by age for a standard package of coverage if your teenagers are in the rearview mirror.

For a 20-year-old man, the cost is $1,159 a year; for a female driver, a single policy can average $158,000 per year under international law. Here is a breakdown of insurance prices for different levels of coverage:

For a 21-year-old male, the average cost is $917 per year, but for a female driver, that policy can be $850 per year under the state’s universal law. The table below provides a breakdown of insurance costs for different levels of coverage:

How Product, Labor And Legal Trends Are Driving Increased Vehicle Insurance Rates [infographic]

For a 22-year-old male, the average cost is $819 per year, while for a female driver, that policy can be $769 per year under universal law.

For a 23-year-old male, the average premium is $755 per year, but for a female driver, that policy can be as high as $777 per year under the state’s universal law. The table below provides a breakdown of insurance costs for different levels of coverage:

For a 24-year-old male, the average cost is $705 per year, while for a female driver, that policy could be $660 per year under the universal law. Here is a breakdown of insurance prices for different levels of coverage:

Prices between women and men are about the same at age 25: $612 per year for men and $605 per year for women, according to the government’s statistics. Here is a breakdown of insurance prices for different levels of coverage:

How Much Does Car Insurance Cost?

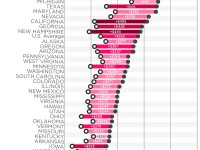

Refer to the table below to see the average auto insurance price by age and state for full coverage. Enter your location in the search box to see how much you can expect.

Select your location below to see average auto insurance rates by age for a full coverage policy.

Age is just one factor that car insurance companies look at when deciding how much you will pay. Gender is another factor, although some states do not allow gender to be used as a factor in reading standards—California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania.

Each of the rates, along with the type of coverage, deductibles, and premiums you choose, will affect the amount you will pay on your car insurance.

Compare Car Insurance Rates From $57/mo (december 2023)

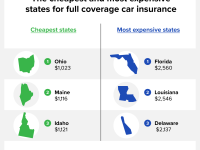

Regardless of your age and gender, you can save hundreds of dollars when you compare car insurance companies and find the one that offers you the best rates. Our guide to the best cheap car insurance for seniors shows how much drivers aged 65, 75 and 85 can save.

Car/Home package discounts saved an average of 13%, and for young drivers, student-on-the-go discounts saved an average of 16%. A good student discount saves drivers an average of 14%, while the marital discount is 8%.

Older drivers can also reduce their premiums. Drivers over the age of 65 who take a driver refresher course can save an average of 4%.

Provided Quadrant Information Services to study auto insurance rates for the 2022 Honda Accord LX at several levels of coverage for a driver with a clean driving record in all zip codes in each state.

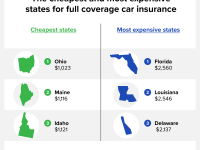

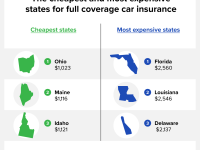

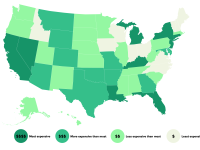

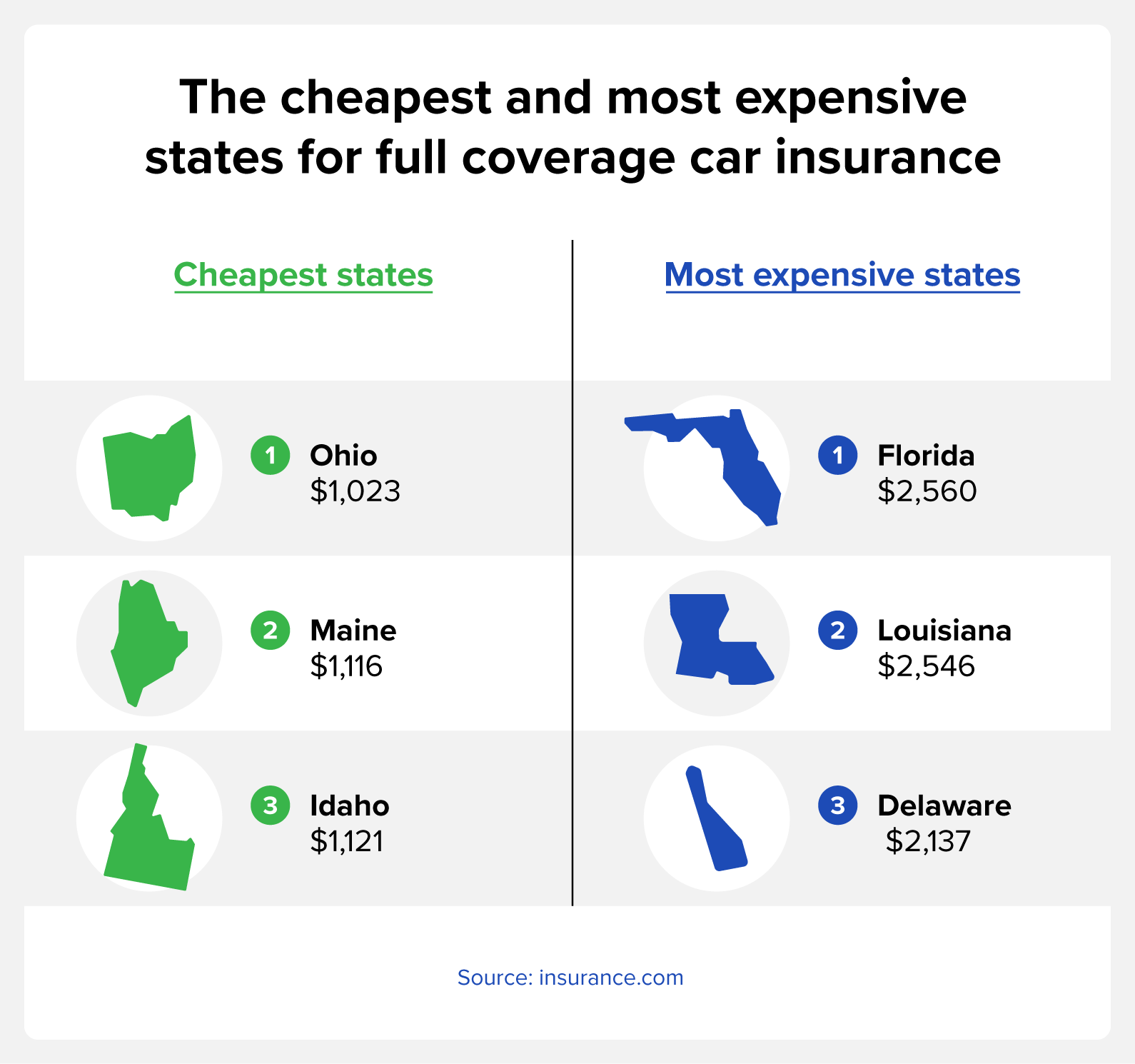

The Average Cost Of Car Insurance In The Us, From Coast To Coast

Leslie Kasperovich is an insurance educator and content writer with nearly 20 years of experience, first working directly in the insurance industry at Farmers Insurance and then as a writer, analyst and insurance buying coach writing for sites such as ExpertInsuranceReviews.com and InsuranceHotline. com and content management, now in .

Nupur Gambhir is a content editor and licensed life, health and disability insurance professional. He has extensive experience bringing brands to life and has created award-winning travel and technology campaigns. His insurance expertise has been featured in Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym and End of Life Planning Services.

✓ Thank you, your message has been received. Our team of auto insurance experts usually respond to questions within five business days. Please note that due to the number of questions we receive, not all can be answered. Due to a technical error, please try again later.

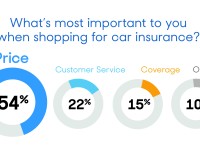

Check car insurance prices, state farm car insurance prices, low car insurance prices, cheapest car insurance prices, compare car insurance prices online, compare car insurance prices, usaa car insurance prices, best prices for car insurance, affordable car insurance prices, car insurance best prices, car insurance prices texas, cheap car insurance compare prices