How Much Is Cheap Car Insurance – Cat Protection found Acuity to have the best cheap car insurance with an average premium of about $36 per month. The average Texan pays $87 a month for auto insurance, or $1,044 a year, while the average Texan with a premium policy pays just $432 a year, saving about $612 a year.

While it may be tempting to go straight to the “cheapest” insurance company for insurance, what you pay for car insurance depends on literally thousands of factors, from your zip code and age to the type of insurance you buy and the car you drive. .

Contents

- How Much Is Cheap Car Insurance

- Cheapest Car Insurance In Texas Today

- Best Cheap Car Insurance Companies In 2024

- Very Cheap Car Insurance No Deposit

- Best Cheap Car Insurance In Washington

- That Dirt Cheap Car Insurance Quote Can Wind Up Costing You

- Cheap Car Insurance In Flushing, N.y. (2024 Rates)

- The Cheapest (and Best) Full Coverage Car Insurance Of 2024

- Looking For Cheap Car Insurance? Way.com Has A Few Tips To Share

- Related posts:

How Much Is Cheap Car Insurance

:max_bytes(150000):strip_icc()/Primary-Image-how-to-find-cheap-car-insurance-for-17-year-olds-7371132-694bb8925ba2419098a54f398cf34513.jpg?strip=all)

That being said, one of the most frustrating parts of buying car insurance is that it is almost impossible to find out how much it will cost without getting a quote.

Cheapest Car Insurance In Texas Today

At Coverage Cat, we use data collected from millions of real auto insurance quotes to steer you in the right direction.

Get quotes from smaller companies. Whether you drive a Ford F-150 or a Toyota Camry, smaller companies like Mercury, Clearcover and Elephant Texans offer the best insurance rates. Acuity, Gainsco and Dairyland are also good choices for lower Texas auto insurance premiums.

If you’d rather skip sending a quote request to each of these companies, get a quote from us – we’ll find your best policy for dozens of insurance companies. We’re hassle-free, we don’t make phone calls, we send a minimum of emails – and we can save you time (and usually money).

We’ve crunched the data and written this guide to help people who want to make smart money decisions based on real data and sound advice (not conventional wisdom).

Best Cheap Car Insurance Companies In 2024

Finding the best deal on your Texas auto insurance isn’t easy because rates and eligibility can vary greatly from person to person, and insurance companies don’t show you the difference in costs.

For a deeper dive into how we arrived at our recommendations, read: our methodology, why you should trust us, and our editorial note.

Please note: This information, which reflects insurance rates offered to other drivers, may or may not be particularly relevant to you. The information provided here is intended to give you an estimate of your own potential premium and is not a quote.

I’m Max Cho, licensed insurance agent and founder/CEO of Coverage Cat. I started navigating insurance and effectively finding out how to use and buy it more than 15 years ago, when I was missing two teeth after an accident. This experience inspired me to found Coverage Cat as a way for people to discover transparent cost data about their insurance and make better decisions based on that information. I want to help all Americans avoid overpaying for expensive insurance they don’t need and get the right coverage at the right price.

Very Cheap Car Insurance No Deposit

Before starting Coverage Cat and becoming a licensed insurance agent, I spent the last ten years in quantitative roles at Google, Two Sigma, and Microsoft.

For this guide, we created a unique database of tens of thousands of auto insurance quotes from public data. When you try our insurance system, we use this data set and more to match Coverage Cat users with the best insurance for their needs.

To determine our top picks, Coverage Cat generated over 76,000 quotes for Texas drivers. In this data set, we represent drivers aged 16 to 70 who have driven vehicles up to 15 years of age and of various types.

Using thousands of quotes, we can better understand the available data and use the data model to provide the median of randomly generated Texas drivers.

Best Cheap Car Insurance In Washington

For our insurance price comparison, we chose to exclude carriers with fewer than 1,000 quotes to avoid unbalanced comparisons. Internally, we use this data set and more to match Coverage Cat users with the best policies for their needs.

Our data is continuously modified and presented to you in real time. The specific numbers in this article may differ slightly from the latest data in the tables above.

Coverage Cat found that Progressive has the lowest premiums for young TX drivers in their 20s-30s, with premiums around $108/month. Insurance rates can be significantly higher for younger drivers, especially those under the age of 25, due to the higher risk of accidents. Central Texas in their 20s and 30s pay $248 a month ($2,976 a year) for car insurance, and buying a cheaper progressive policy can save you an impressive $1,680 a year.

Coverage Cat found that Progressive has the lowest rates for TX drivers in their 60s-70s with premiums around $75/month. While auto insurance rates drop after age 30, they may begin to rise again for older drivers due to increased risk. However, in Texas, we found that the average Texan between the ages of 60-70 pays $105 per month for auto insurance. But the range of these prices was wide, and the cheapest policy saved the median Texan aged 60-70 $ 1,788 / year compared to the most expensive policy.

That Dirt Cheap Car Insurance Quote Can Wind Up Costing You

For new cars, Coverage Cat found that Clearcover and Progressive had the best low-cost car insurance, with premiums around $151 per month. Newer cars are usually more expensive than older cars to insure because the cost to repair or replace these cars is higher than older cars. The most expensive insurance company for new drivers in Texas costs about $3,276 per year, meaning customers with Progressive and Clearcover can save $1,464 per year on premiums.

Coverage Cat found that for older cars, Clearcover & Progressive has the best cheap car insurance with premiums around $124/month for a 5-year-old car and $80/month for a 10-year-old car. As cars age and deteriorate, insurance companies pay less for repairs or replacements, so it’s important to review your insurance needs, including whether to purchase comprehensive or collision coverage.

For female drivers in Texas, the lowest average monthly premium available on Progressive was $94/month. Coverage Cat found that female drivers in Texas pay slightly more than male drivers, with an average payment of $118 per month. While that’s only $1 a month (or $12 a year) more than drivers in Texas, the difference was as much as $288 a year for some carriers.

For male drivers in Texas, the best cheap auto insurance policy was at Progressive for $94 per month. The median price for male drivers was only slightly higher at $117/month, but the most expensive carrier (Allstate) cost $1,644 more per year than Progressive.

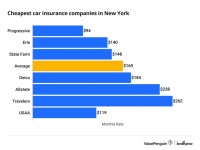

Cheap Car Insurance In Flushing, N.y. (2024 Rates)

Tip: You may also need car insurance if you rent or lease cars on a regular basis, as it may be cheaper and safer to have non-owner’s insurance to cover your liability.

If you do not have a clean driving record, your insurance rates will be higher than what is suggested here, regardless of the insurance company you choose. Expect a 20-25% increase for moving violations and distracted driving; 25-30% increase for open vessels, speed and cause an accident; and a 50-70% increase for driving without a license, DUI or speeding.

If it’s been more than three years since you lost your good record, it’s time to buy new car insurance.

Answer: Auto insurance in Texas is more expensive than the national average. The National Association of Insurance Commissioners (NAIC) estimates that drivers in Texas paid 14% more in premiums than drivers nationwide. A 2019 NAIC database report estimated that the average monthly auto insurance was $100 in the United States and $114 in Texas.

The Cheapest (and Best) Full Coverage Car Insurance Of 2024

A: According to Coverage Cat, Acuity has the best cheap auto insurance in Texas with premiums around $36/month, which is lower than the average price of $87/month. However, depending on your insurance needs, your insurance may be cheaper (and better) with another company.

A: Although Coverage Cat found that premiums were lower overall for Acuity drivers, switching companies does not guarantee savings. We recommend that you shop for insurance at least every two years, get multiple quotes, and re-evaluate your insurance needs each time.

If that seems complicated, try Coverage Cat. We optimize your insurance to meet your needs at the best price.

The content of this article is based solely on the opinions and recommendations of the author. It has not been seen, paid for, ordered or otherwise approved by any of our partners (insurance companies).

Cat’s coverage analysis used insurance rate information from our own data set. These prices are public and should be used for informational purposes only. Your own quotes may vary.

I’m Max, Founder and CEO of Coverage Cat. Insurance has been a big part of my life since I lost two front teeth in an accident and had to fend for myself to replace them. I have previously worked at Google, Microsoft and Two Sigma.

Cover Cat, Inc. is a licensed insurance broker (or producer). In California, Coverage Cat does business under the name Coverage Cat Insurance Services. The Cat Coverage license number is listed here. Coverage Cat maintains policies with several insurance companies, each of which is an affiliate of Coverage Cat. Andrew Hurst Andrew Hurst Senior Editor and Licensed Auto Insurance Expert Andrew Hurst is Senior Editor and Licensed Auto Insurance Expert at . His work has also appeared in the New York Times, The Wall Street Journal, Forbes, USA Today,

How much is allstate car insurance, how cheap is car insurance, how much is car insurance in maryland, how much is car insurance a year, how much is comprehensive car insurance, how much is average car insurance, how much is state farm car insurance, how much is my car insurance, how much is cheap insurance, how much is car insurance, how much is full coverage car insurance, how much is commercial car insurance