Health Insurance Comparison – The company offers a comprehensive health insurance plan through its headquarters health and life insurance program, which provides medical, dental and life insurance coverage to eligible employees, retirees and their dependents. Eligibility for headquarter-administered health plans varies by location, but given the cost of health care in the United States, all eligible employees, retirees and their dependents can enroll in US-based plans. The benefits included in this plan include preventive care, inpatient and outpatient services, pharmacy, eye care and other benefits. Dental benefits include diagnostic and preventive, restorative and orthodontic treatment.

For health plans administered by headquarters, plan participants bear costs jointly through a cost-sharing agreement approved by the General Assembly. Please note that employees are encouraged to choose a plan based on benefits that suit their individual/family situation rather than prepayment. Also note that employees or retirees cannot be covered by a separate health insurance plan than their designated dependents. It is also not possible to cover only dependents.

Contents

- Health Insurance Comparison

- How To Compare Health Plans

- Health Insurance Plans: A Comparison

- Short Term Insurance Comparison

- Medicare Supplement Plans Comparison Chart

- State Level Trends In Employer Sponsored Health Insurance (esi), 2014 2018

- Us Based Plans

- New York City Retirees Brace For Switch To Medicare Advantage

- Ny State Of Health Insurance Plans Redesign — Rose Mervis

- Gallery for Health Insurance Comparison

- Related posts:

Health Insurance Comparison

Plans offered to new employees in the US are Aetna PPO, Empire Blue Cross PPO and Cigna Dental. Some employees may be enrolled in HIP, but as of July 1, 2013, New York City’s HIP health plan is closed to new enrollees (ie, employees or retirees). Currently covered enrollees can remain in the plan and accept changes that include eligible family members, but please note that a current enrollee who changes plans in states during the annual enrollment campaign cannot return to HIP. Plan. Detailed information about all schemes including HIP is available on their respective pages and in the information section below.

How To Compare Health Plans

The definition of US-based plans refers to plans that provide adequate coverage in the US and is different from the definition of a plan administered by headquarters because, for example, WWP is administered by headquarters but does not provide adequate coverage in the US – high health care costs. US-based health insurance plans that provide adequate coverage for any US employee and retiree and are currently open for enrollment: Aetna PPO, Empire Blue Cross PPO and Cigna Dental. Compare health plans, including medical insurance plans, if they cover CA

Protect your loved ones. Learn more about life insurance: Term vs Whole Life – What’s the Difference?

Compare and buy health insurance. Our Providers: BlueShield, Anthem Blue Cross, Kaiser, Oscar, Sutter Health, HealthNet, Cigna, VHP, Western Health Advantage, etc.

Find the right benefits package for your employees. Whether you are a small business owner with one employee or have over 100 employees – we can help

Health Insurance Plans: A Comparison

Individual dental insurance can be a daunting task. We can make it easy! Learn about dental PPO and HMO plans and compare the different options!

You booked your room six months in advance. They’ve packed everything you need on vacation, from straws to sunglasses. But even the most planned trips can be disrupted due to circumstances beyond your control. Learn how to protect yourself and your family during the holidays.

Vision insurance is designed to help cover routine vision care costs, such as regular eye exams, prescription glasses and contact lenses. Plans start at $15 per month and save up to $193 per year.

Get a side-by-side comparison of various health insurance plans available for 2023. Compare bronze, silver, gold and platinum plans and find information on health insurance companies: BlueShield of California, Kaiser, Oscar, HealthNet, VHP, Sutter Health, Cigna, Western Health Benefits and more.

Short Term Insurance Comparison

(All these questions are answered on our YouTube channel and other resources. Visit us on YouTube and subscribe to get this information)

Can I get a subsidized health plan through CoveredCA if my employer offers health insurance as an employee benefit?

Do I have to pay a penalty if I don’t have health insurance in 2018 or 2019? Do I need a Form 1095-A?

If you have any questions, please contact us by phone or email at any time. Visiting the office is by appointment only.

Medicare Supplement Plans Comparison Chart

Schedule a 15-minute one-on-one phone consultation. We spend most of our time working on the phone and we don’t want you to miss your important call. So instead of calling us and making an appointment, try something new! Schedule a phone consultation that works for both of us!

Insurance Center Helpline, Inc. An insurance agency located in the San Francisco Bay Area with clients throughout California. The agency was created in One goal in 2013 (changed in 2018) is to help the local community understand its health insurance options. We fully understand that purchasing health insurance can be a confusing, frustrating, and most importantly overwhelming process, especially with the recent changes to the Affordable Care Act (ACA). We’ll work with you one-on-one to learn how health insurance works—from buying a plan to understanding your plan’s benefits and how it can be used to pay for medical expenses. Ultimately, we hope to educate you about the current state of the market and provide you with the information you need to choose the insurance plan that best fits your financial and health needs.

Insurance Center Helpline, Inc. What makes it special? We focus only on the needs of our customers. We are listening. We are talking. We select the health insurance product that best suits your individual, family or small business needs.

We understand that no two individuals, families or businesses are the same and the type and level of insurance coverage required will be unique. We help you find the best plan at the best price and the most comprehensive coverage.

State Level Trends In Employer Sponsored Health Insurance (esi), 2014 2018

We help you find a health insurance plan that gives you access to the best doctors, clinics and hospitals.

We work with insurance companies in California so you can shop and compare different options. We also work with CoveredCa and are happy to assist you with registration, renewals and troubleshooting.

If you have questions about health insurance, PPO, copays, coinsurance, deductibles, HSA, FSA, etc. or want to learn more about personal finance, discounts, great deals, etc., subscribe to our YouTube channel for training videos.

EU Cookie Law: We use cookies to provide personalized services to our users. By continuing to use this site, you consent to our cookies. Employer-provided health insurance is an important, if not mandatory, benefit for job seekers in the United States. According to a survey conducted by the Society for Human Resource Management, 46 percent of employees who have an employer-sponsored plan say it had a positive influence on their health insurance decision or choosing their current job. What’s more, 56% said whether or not they liked health insurance was a key factor in their decision to stay in their current job.

Us Based Plans

Even if you know you want to take advantage of your company’s healthcare offerings, you may feel a little lost when it comes to choosing the right insurance plan for you and your family. In this article, we break down some key points to consider to help you evaluate your options.

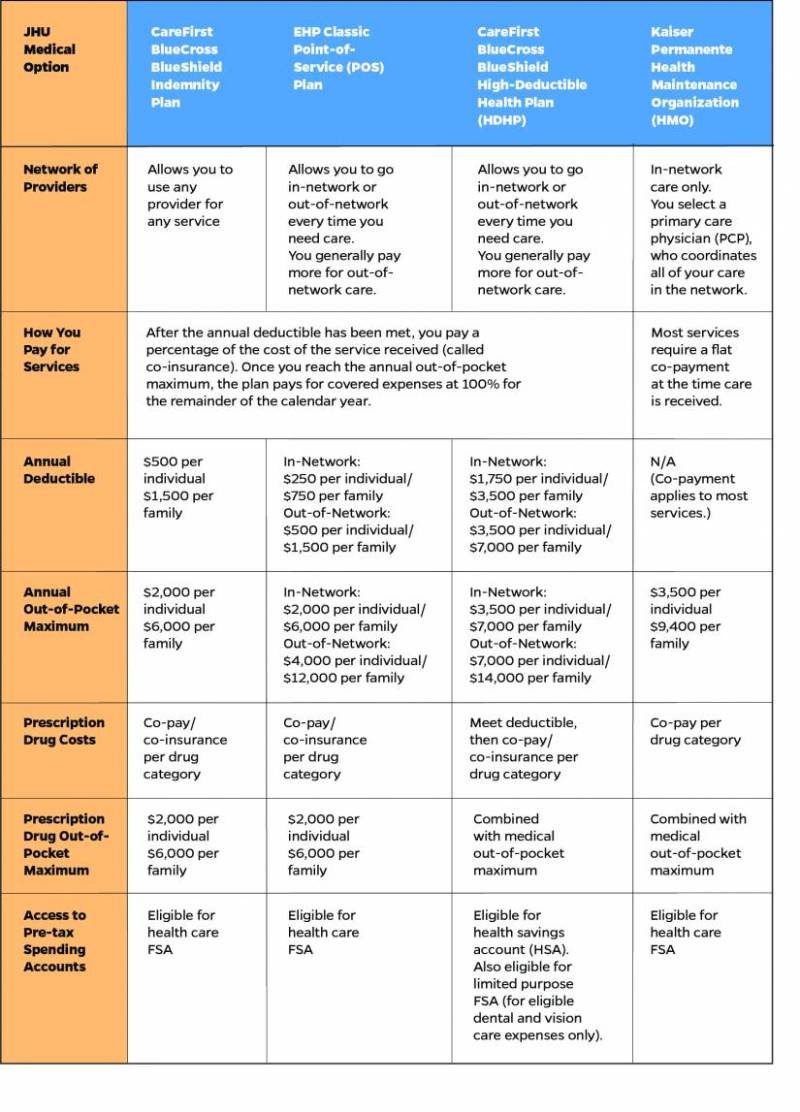

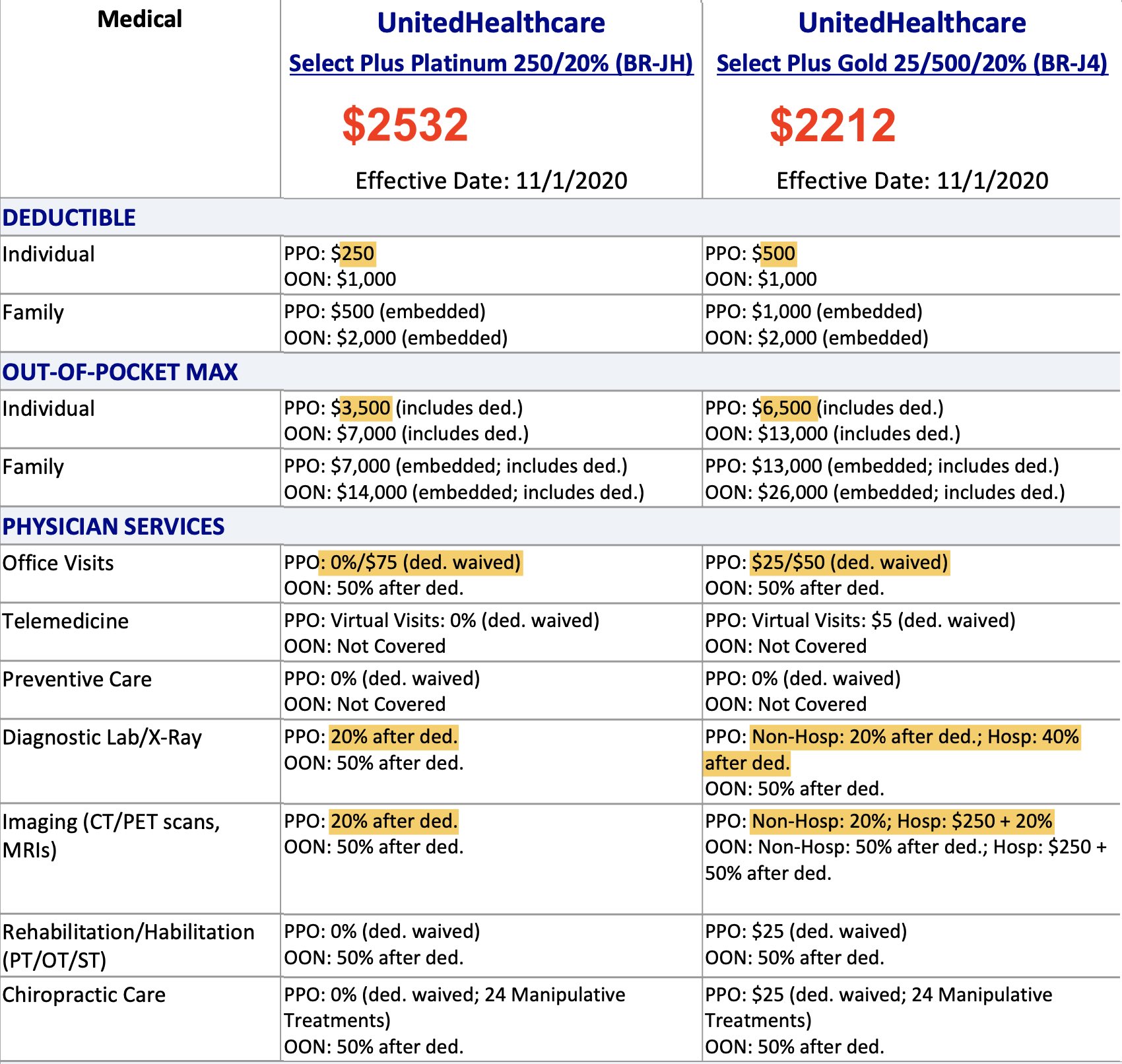

One of the main differences between plan types is whether they offer out-of-network coverage.

In short, a network is a group of health care providers—doctors, hospitals, laboratories, etc.—contracted with an insurance company to provide services to members of that health plan. To be part of the network, these facilities and physicians must meet certain eligibility criteria and agree to receive a reduced payment for services covered under the health plan.

Out-of-network providers do not have a contract with your health plan and may charge you the full cost of their services.

New York City Retirees Brace For Switch To Medicare Advantage

Another important difference is whether the plan requires you to have a referral from your primary care physician (PCP) to see a specialist.

Fortunately, HealthCare.gov offers an excellent glossary! Here are some of the most important ones you’ll want to know.

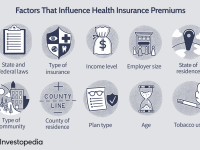

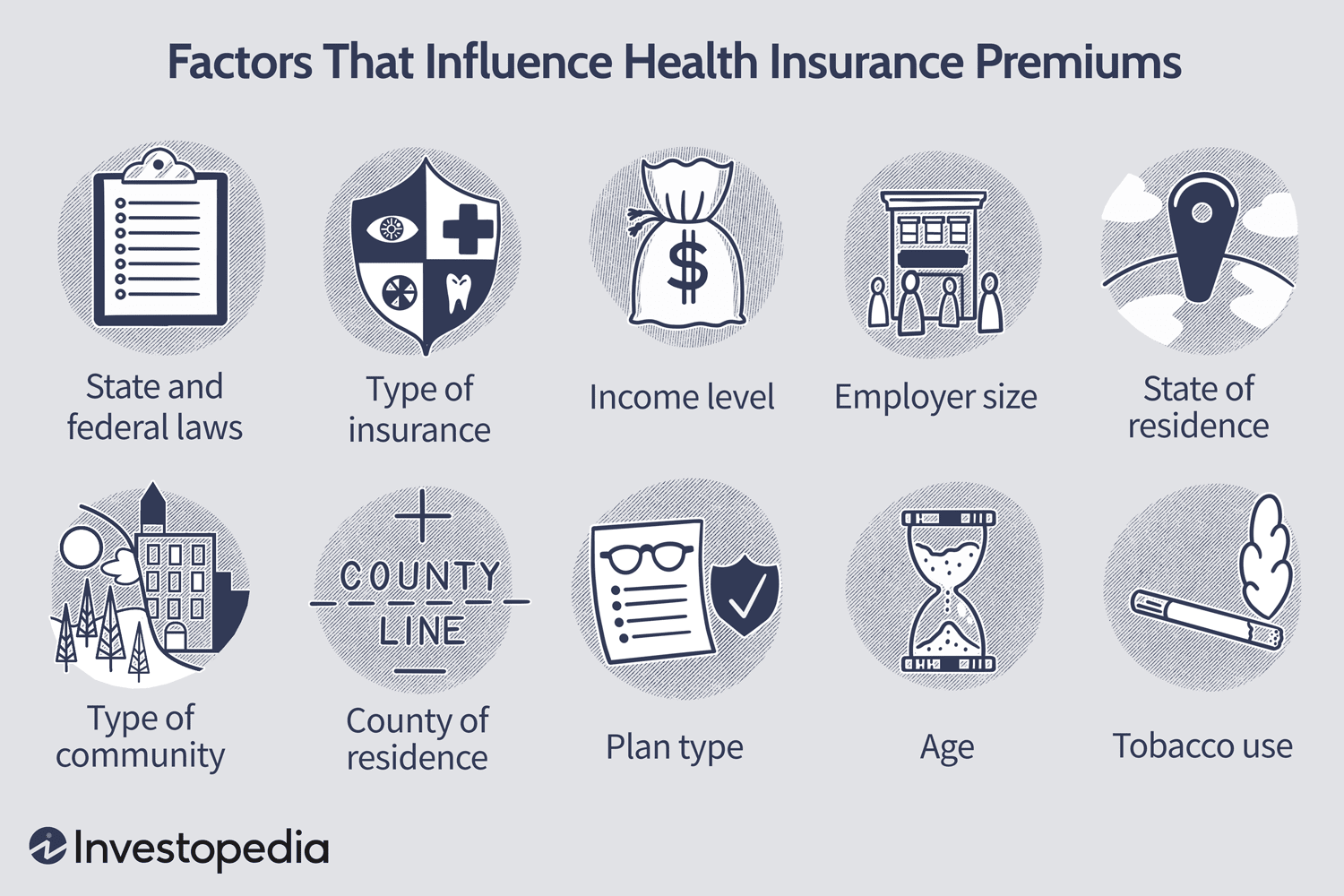

This is the amount you pay for health insurance each month. Your employer may cover part or all of your pay each month.

Keep in mind that lower premiums don’t necessarily mean bigger savings. Depending on your medical needs, paying a little more each month can result in a better plan and significant savings on doctor visits.

Ny State Of Health Insurance Plans Redesign — Rose Mervis

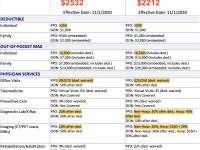

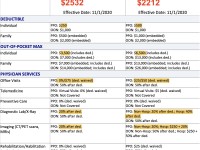

Your deductible is the amount you pay for covered health care services before your insurance plan starts paying. For example, with a $3,000 deductible, you pay the first $3,000 for covered services.

After you pay your deductible, you usually pay only the copay or deductible for covered services, and your insurance company pays the rest.

Your maximum, or out-of-pocket limit, is the maximum amount you must pay for covered services in a plan year. After deducting this amount for out-of-network care and services for co-pays, deductibles, and co-pays, your health plan

Health insurance comparison tool, overseas health insurance comparison, health insurance comparison india, dog health insurance comparison, private health insurance comparison, health insurance price comparison, medical health insurance comparison, pet health insurance comparison, federal health insurance comparison, australian health insurance comparison, health insurance comparison nz, opm health insurance comparison