Student Health Insurance – ISI is the leader in reliable and affordable international student insurance plans with a five-star customer service rating. Find your schedule below:

International Student Insurance is the leading online destination for international student health insurance and international student travel insurance. Not only are our plans comprehensive, they are available for any budget and are specifically designed to provide health insurance for international students.

Contents

- Student Health Insurance

- California Student Health Insurance Options

- Student Health Insurance Overview

- Insurance & Billing

- Student Health Insurance Overview At Hsc Fort Worth, Texas

- Student Health Advantage Travel Medical Insurance

- Health Care & Insurance

- Aetna Student Health Insurance

- Faq’s About Student Health Insurance

- Student Health Insurance

- Updates To Student Health Insurance

- International Student Health Insurance In The Usa

- Gallery for Student Health Insurance

- Related posts:

Student Health Insurance

Comprehensive yet affordable international student health insurance plans are designed to meet visa requirements and provide essential cover for schools such as mental health, sports and maternity. With different plans and tiers offered, we have a plan for every international student budget and need.

California Student Health Insurance Options

For international travelers worldwide, travel medical plans offer instant coverage of up to $5 million for travel outside your country for 5 days to one year. With your choice of deductibles and plan levels, travel health insurance is very flexible to suit the needs of travelers and students.

We offer international major medical plans for expats, families and students who need long-term and more permanent cover. Once purchased, you can renew these benefit-rich plans annually for as long as you qualify.

ISI offers a variety of international student insurance options to meet school and country requirements, including F (with OPT), M, or J visas, as well as for study abroad students. Our commitment to excellent customer service and support sets us apart and ensures that our clients always have the information they need to make informed decisions.

Learn more about international insurance plans in our “Explaining Insurance” help center; Full of helpful articles to guide you in choosing an insurance plan.

Student Health Insurance Overview

Learn more about our plan options and free school resources, including videos, presentations, insurance best practice guides and more.

Do you want to offer international insurance and travel insurance to your clients around the world? Learn more about becoming an insurance producer. We have sent an email to your email address with a confirmation link. Click on the confirmation link to complete the registration process.

Unless college students have pre-existing health conditions, few give much thought to their health care and health insurance. After all, when you’re young and in good health, it doesn’t seem like much to worry about.

Unfortunately, college students are just as (if not more) susceptible to illness, injury, and infection as adults. Poor diet, lack of sleep and unhealthy habits such as excessive drinking and smoking put many at increased health risk. And accidents, sports injuries and sexually transmitted diseases do not discriminate by age, sex or race.

Insurance & Billing

That’s why it’s important for young adults to take their health care seriously and make sure they have the right type of insurance to protect them.

More than 5% of students (~1 million) remain uninsured in the US, with the highest rates reported in Texas and North Dakota. If you want to be safe and have adequate coverage, you need to research your insurance options and choose the one that works best for you.

That’s easier said than done considering how confusing and overwhelming the US insurance system is. So check out this comprehensive guide to learn the basics of student health insurance.

While health insurance can definitely put a dent in your or your parents’ budget, it’s a valuable investment to help you avoid financial trouble should unexpected health problems arise.

Student Health Insurance Overview At Hsc Fort Worth, Texas

Health care costs in the United States are notoriously high, and a simple broken bone after a football game can cost thousands of dollars. More complex health problems naturally come with higher costs, so it’s no surprise that medical expenses are one of the top reasons families and individuals file for bankruptcy.

But perhaps the most important reason to get health insurance as a student is that it gives you peace of mind that you’re covered when push comes to shove.

Having more than a million uninsured college students is far from ideal, but before 2010 and the introduction of the Affordable Care Act (ACA) — commonly referred to as Obamacare — the number was much higher.

Originally, the act was designed to expand access to insurance, improve consumer protection, reduce health care costs, increase quality of care, and emphasize the importance of preventive medicine.

Student Health Advantage Travel Medical Insurance

The law included an expansion of dependent coverage that required plans to include coverage for children up to age 26 and college students. A direct result of this has been a significant increase in the number of uninsured students across the United States, which has doubled since the implementation of the ACA.

Additionally, thanks to the Affordable Care Act, we’ve seen a significant increase in employment for college students and a significant reduction in the racial coverage gap.

Before embarking on the first appropriate health care plan, it’s important to evaluate your options and analyze what you’re signing up for. There are a few key things you need to consider:

As mentioned earlier, college enrollees can remain on their parents’ insurance under the ACA even if they are not listed as a tax dependent.

Health Care & Insurance

Your parent must add you to their plan during the open enrollment period to apply for parental coverage.

At most colleges, new college students are usually automatically enrolled in a student health insurance plan, although you should check with your administration. Coverage will depend on the institution, but most will be ACA compliant.

As previously mentioned, most colleges automatically enroll new students in a student health insurance plan. To know more about the application process, you must contact your chosen college.

If you don’t qualify for a parent plan or student insurance, you can buy an individual plan in the state where you live on the health insurance market.

Aetna Student Health Insurance

You can apply by registering at HealthCare.gov. You will need to provide proof of income and other personal information.

For those earning less than 133% of the federal poverty level, Medicaid may be the best option. With the ACA’s expansion of Medicaid, you can get free/low-cost insurance that covers a full range of medical services.

You can apply for this type of health insurance through the ACA Marketplace or your local Medicaid agency. Eligibility requirements may vary by state.

It is usually easier to switch between different types of student-friendly health insurance than it is to switch from student insurance to another plan. Health insurance arrangements are generally considered more complicated for recent graduates and students with exceptional status, such as those with disabilities or international exchange students. However, you still have several viable insurance options:

Faq’s About Student Health Insurance

The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows some graduates to continue using their parents’ insurance for 36 months after their 26th birthday.

It’s not an ideal option, but it can protect you until you find a better plan. Your parent must tell their insurance company that you want to apply for a COBRA extension within 60 days after turning 26.

Catastrophe insurance offers coverage for medical emergencies that result in extremely high costs (long hospitalizations, expensive surgeries, and the like).

Short term insurance offers coverage from 30 days to 12 months. This is usually reserved for those who switch between insurance types.

Student Health Insurance

While the health insurance system can be confusing, whether you’re a student or not, managing your health care costs is essential. To stay safe and ensure that a medical emergency does not escape you, you should try to follow the following tips:

Workplace coverage isn’t always the best choice, and neither is parental insurance. To ensure you are getting the best value for your money, you should analyze all your insurance options, compare their prices and consider any deductibles you may be liable for.

Billing errors are always possible and unfortunately some providers make them on purpose Always ask for an itemized bill that specifies all charges and check your bill thoroughly.

As with any other product, brand-name prescriptions usually cost more than generic prescriptions. Check with your healthcare provider about generic prescriptions that you may be able to use for your condition.

Updates To Student Health Insurance

Over-the-counter medications can sometimes be significantly cheaper than prescriptions. Talk to your doctor about the best over-the-counter options.

It never hurts to save for a specific purpose, so creating a special health savings account would be in your best interest. This will help you cover any deductibles you may be liable for and help you get proper treatment for services your insurance doesn’t cover.

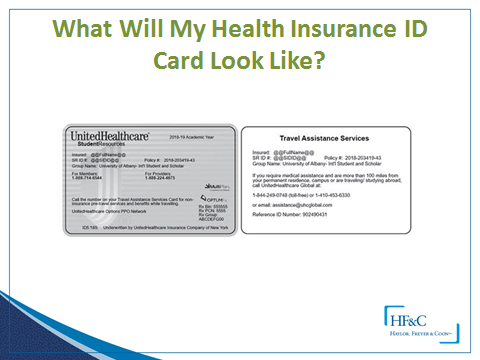

To learn more about the best insurance plans for students and recent graduates, you can check out the following additional resources: Georgia Tech is proud to offer insurance to enrolled undergraduate and graduate students and their eligible dependents who have not already done so. This plan includes comprehensive covered benefits (medical, dental, vision, prescriptions and worldwide travel) for 2022-2023 administered by United Care Student Resources (UHCSR).

The chart below was created by SGA students to help all students better understand the SHIP registration process.

International Student Health Insurance In The Usa

Compulsory group students must have insurance while studying at Georgia Institute of Technology. You must log in

Uh student health insurance, student health insurance germany, student health insurance georgetown, student health insurance plans, buy student health insurance, international student health insurance, florida student health insurance, health student insurance, health insurance for student, kaiser student health insurance, f1 student health insurance, student abroad health insurance