Short Term Health Insurance – Advertiser Disclosure: The credit card and banking offers that appear on this site are from the credit card companies and banks from which the site receives compensation. This compensation may affect how and where products appear on this website, including, for example, the order in which they appear on category pages. does not include all banks, credit card companies or all available credit card offers, although every effort has been made to include a comprehensive list of offers regardless of compensation. Advertiser partners include American Express, Chase, U.S. Including Bank and Barclaycard.

In August 2018, the Trump administration announced new rules for short-term health insurance. It has extended the maximum coverage period for these barebones plans from 90 days to just under a year, with the option to extend the plans to as much as three years.

Contents

- Short Term Health Insurance

- Short Term Health Care Insurance: How Trump Let Insurance Providers Sell Bad Health Plans

- Short Term Health Plans In Ca

- Biden Wants To Roll Back Trump’s Expansion Of Short Term Health Insurance Plans

- Short Term Health Insurance • North Carolina

- Short Term Health Plans Skimp On Medical Payments

- How To Choose The Best Short Term Health Insurance Plans

- Short Term Health Insurance In Las Vegas

- Health Maintenance Organization (hmo): What It Is, Pros And Cons

- Gallery for Short Term Health Insurance

- Related posts:

Short Term Health Insurance

The White House claimed the measure would provide Americans with relief from high health insurance premiums. And it’s true: These plans can cost about 75% less than full health care plans. But they also offer less coverage, much less. They don’t cover basic care like checkups, and most only pay a certain amount per year, no matter how sick you get.

Short Term Health Care Insurance: How Trump Let Insurance Providers Sell Bad Health Plans

So make sure you have all the facts before you rush to replace your expensive health care plan with a cheap, short-term plan. Here’s an overview of how much short-term health insurance policies cost, what they cover, and how they compare to regular health insurance plans that meet the standards of the Affordable Care Act (ACA).

Short-term health insurance is intended as a stopgap solution to provide basic emergency coverage when you are between regular insurance plans. Because they are for short-term use only, they do not have to meet the ACA’s (aka Obamacare) requirements for “minimum essential coverage.”

As HealthInsurance.org explains, the ACA requires all regular health plans to cover certain medical costs, with no annual or lifetime limits. These basic health benefits include doctor visits, emergency services, hospitalization, maternity care, mental health care, prescription drugs, and laboratory tests.

However, short-term plans are an exception to this rule. They do not have to cover all essential benefits and can set limits on the amount they pay for the benefits they do cover. Short-term plans cost less than standard plans, partly because they cover so little.

Short Term Health Plans In Ca

Another reason they are cheaper is that they only provide temporary coverage. Even if you develop a serious and expensive illness, such as cancer, while on a short-term plan, the insurer must cover the cost of your care for only a few months before the plan expires. Even that is unlikely because people who choose a short-term plan are usually quite healthy.

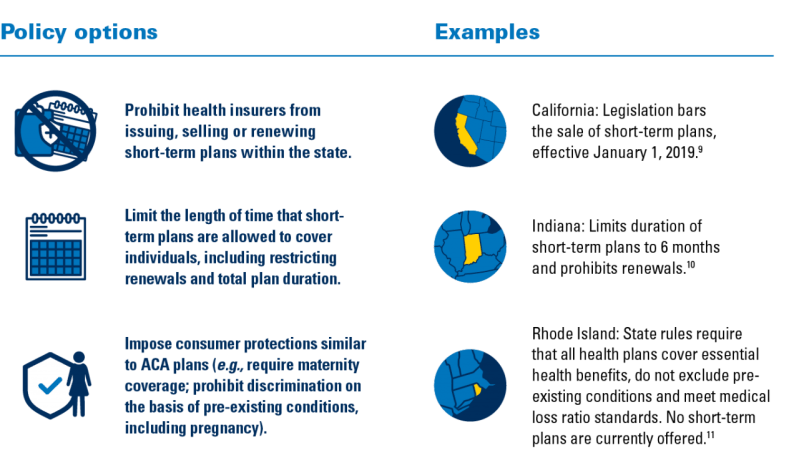

The rules for short-term coverage have changed several times in recent years. Before 2017, federal law defined short-term insurance as plans that provided coverage for less than one year. However, some individual states have imposed deadlines of six months or less.

A new Obama administration rule that went into effect in early 2017 required all new short-term plans to offer health insurance for no more than 90 days. The purpose of the change was to prevent people from relying on short-term plans as their primary source of care, as some people have done since Obamacare first went into effect.

However, some insurance companies have gotten around this rule by selling consumers up to four consecutive 90-day plans. This way, consumers only had to sign up once to receive up to 360 days of care.

Biden Wants To Roll Back Trump’s Expansion Of Short Term Health Insurance Plans

In October 2017, then-President Donald Trump signed an executive order directing federal agencies to review these rules. Under the new rules, which came into effect on October 2, 2018, a short-term policy can have a term of up to 364 days and can be extended for up to three years. However, states are still allowed to place stricter restrictions on these plans if they wish.

Why would anyone choose short-term health insurance considering its disadvantages? There are several factors that can make it attractive.

The main advantage of short-term insurance is the price. Short-term health plans are much cheaper than ACA-compliant plans that provide comprehensive coverage.

To compare the two, HealthInsurance.org looked at healthcare costs for a 45-year-old living in Wyoming with an income of $12,000 per year. Because this is below the poverty line, this person is not eligible for premium subsidies. They also couldn’t get Medicaid because Wyoming chose not to expand its Medicaid program.

Short Term Health Insurance • North Carolina

The site found that the cheapest ACA-compliant plan this person could get on the state health insurance marketplace would cost $593 per month – almost 60% of their total income. Additionally, they would have an $8,550 deductible.

However, someone can purchase short-term health insurance for just over $100 per month. That would still be a $1,000 monthly budget, but at least it would be possible.

On the other hand, a short-term plan would have even higher out-of-pocket costs. The deductible would be about $10,000 and the deductible would be $20,000. So even with insurance, a person’s annual health care costs can ultimately exceed their total income.

Short-term policies vary in coverage. Instead of paying for all the basic health benefits, you can choose a plan that covers only the types of care you think you are likely to need.

Short Term Health Plans Skimp On Medical Payments

Most short-term health plans only cover emergency care, surgeries, hospitalizations, and outpatient care such as lab work. However, with a little effort, you may be able to find a plan that includes some preventative measures or prescription medications.

Some short-term plans also promise to let you choose your doctor and other health care providers, such as hospitals, without restrictions. However, these types of plans often cost you more out of pocket.

Because the insurer does not contract with any providers, they have not agreed to accept the insurance rates as payment in full. If the insurer pays out less than the full reimbursement, it may charge you the difference.

You can apply for short-term health insurance at any time of the year. ACA-compliant plans, on the other hand, only allow you to sign up during the annual open enrollment period at the end of the year or a special enrollment period due to a qualifying event, such as job loss.

How To Choose The Best Short Term Health Insurance Plans

Enrolling in a short-term health plan is simple: just answer a few yes or no questions about your health history. Once you sign up, your policy can take effect the next day. And if you know how long you want coverage, you can sometimes make just one upfront payment for the entire policy, instead of paying monthly.

For many health care buyers, short-term insurance seems like an incredible bargain. Price is one of the most important factors when choosing a health plan, and these short-term plans are much cheaper than any regular plan. However, if you look beyond the price and consider its true value, you can see that these cheap plans don’t give you much bang for your buck.

The biggest problem with short-term insurance is that it simply doesn’t provide much coverage. In particular, there are several types of medical conditions and care that these plans rarely cover.

Short-term insurance only covers you for new health problems that arise while you have the policy. Most plans don’t cover pre-existing conditions, meaning health problems you had at the time you signed up. In some cases, this includes conditions that were not yet diagnosed when you purchased the policy.

Short Term Health Insurance In Las Vegas

If you develop a chronic health problem while on a short-term plan, the problem will be considered a pre-existing condition when it comes time to renew your plan. You may not be able to renew the plan at all, and even if you can, it will no longer cover your new “pre-existing” condition.

Short-term plans are intended to provide coverage for emergency situations only. Most do not cover routine care, including office visits, preventive care, or maternity care.

However, there are some exceptions to this rule. Karen Pollitz, a health insurance expert interviewed by CNBC, says some short-term plans are now being dressed up to look more like regular plans by covering a limited number of doctor or hospital visits.

Short-term plans rarely include coverage for mental health conditions, such as depression and anxiety. CNBC tells the story of a woman who bought short-term health insurance after dropping out of college and ended up paying $600 a month out of pocket — about half her take-home pay — for therapy and medication.

Health Maintenance Organization (hmo): What It Is, Pros And Cons

Most short-term health plans only pay for prescription drugs if you get them while you are in the hospital. Even if you leave the hospital with a prescription for the same medicine you will take at home, the short-term plan will not pay you to fill the prescription.

Some short-term plans list prescription drug coverage as one of their benefits. But if you look closely, you’ll see that they only offer a prescription discount card.

Short-term

Short term health insurance wisconsin, humana short term health insurance, short term health insurance kentucky, private short term health insurance, short term health insurance tennessee, short term health insurance missouri, short term health insurance indiana, short term health insurance nebraska, short term health insurance oklahoma, short term health insurance alabama, short term family health insurance, short term health insurance georgia