Personal Health Insurance – Customers should explore the many hidden benefits in private health insurance plans to avail the benefits during the policy period. For customers, these benefits are hidden in plain sight, and most don’t notice these benefits in the first place. Insurance brokers fail to explain these benefits when selling private health insurance policies to customers, resulting in customers missing out on these benefits. Private health insurance has many advantages and if used properly, it can bring good benefits to the customers.

A convalescent benefit is a payment made to an insured customer while recovering from an accident, illness or disease. Convalescence benefits are usually paid in one go if the hospital stay exceeds a certain number of days. The recovery benefit will be paid only once during the policy period. However, due to lack of awareness, many customers refuse to take advantage of these benefits during their hospital stay. If he was hospitalized, he would not work, a certain amount would be deducted from his income, and he would be compensated to a certain extent by convalescence benefits. In addition to the loss of income for the insured, there will be fewer visits to the insured in the hospital, and a certain amount of expenses will be incurred. These costs can be covered under the convalescence benefits of your private health insurance plan.

Contents

- Personal Health Insurance

- Should You Buy Individual Health Insurance Over A Corporate Group Health Insurance Plan?

- Amazon.in: Buy Goqii Insure+ 5 Lakhs Health Insurance With Smart Vital Lite (grey) And 3 Months Personal Coaching Online At Low Prices In India

- Choose The Right Personal Health Insurance Plan

- Personal Health Insurance For Government Employees: Things You Should Know!

- Gallery for Personal Health Insurance

- Related posts:

Personal Health Insurance

Home hospital treatment is done from your home. In case of any illness, disease or accident, treatment can be done from home and the cost of treatment will be borne by the insurance company. Certain expenses such as hospital, doctor and nursing expenses for inpatient treatment at home will be covered by the private health insurance plan. It is important to note that it is not the policyholder’s discretion but the attending physician’s determination of residential hospitalization. There are two options for a physician to prescribe home treatment to an insured member.

Should You Buy Individual Health Insurance Over A Corporate Group Health Insurance Plan?

Another hidden advantage of private health insurance is that you can get an annual medical check-up if no claim has been made during the previous policy period. Few users know about this feature and users will not use this feature. Annual health check-up is available only if no claims are made during the year. When you get health insurance, the diagnoses you get at your doctor’s office are different. The policyholder can undergo an annual health check-up at any network hospital or diagnostic center of the insurance company, and the report will be shared between the policyholder and the insurance company. Annual health check-ups allow clients to understand their health and take preventative measures to improve it. These reports allow the insurance company to estimate future losses and maintain reserves. A medical examination includes various health tests, such as blood tests and urinalysis.

Another lesser-known benefit of private health insurance is the reinstatement of the sum assured once the sum assured is over. In case the Basic Sum Assured is exhausted, it will be rolled over once during the policy period up to the previous limit. There is an option to use the insured or reimbursed amount for future rehabilitation. It is important to note that the guaranteed compensation is available only for new illnesses and not for existing claims or pre-existing illnesses. With a floating family policy, the amount reimbursed is available to a new member who has not claimed before, but a member who has claimed before cannot claim again for the same illness. For example, if you are diagnosed with kidney failure and run out of coverage during your treatment, the insurance company will return your coverage to the base level. If kidney failure is re-diagnosed during the same policy period, the reimbursement cannot be used. But if your family members are hospitalized for kidney or other diseases, you can use the compensation guaranteed.

Insurance companies also offer add-ons so that customers can enjoy unlimited recovery options, which means unlimited coverage of the sum assured.

Another lesser-known benefit of private health insurance plans is that they offer free consultations to their customers. Insureds can get free telephone consultations with doctors working for the insurance company about their illnesses, diseases and treatments. Some private health insurance plans offer unlimited phone consultations to their customers. A second opinion can be obtained from any doctor in the car and the insurance company collects the payment. If you are not happy with your current treatment and want to explore other options, a second opinion can be helpful. Free phone consultation will save customers time and energy. In case of any specific disease, you can get advice from home. Online teleconsultations have gained momentum in the age of COVID and remain popular among people.

Amazon.in: Buy Goqii Insure+ 5 Lakhs Health Insurance With Smart Vital Lite (grey) And 3 Months Personal Coaching Online At Low Prices In India

Medical Daily Cash Benefit is another hidden benefit of your health insurance plan. If the insured is hospitalized for a certain period of time during the insurance period, the daily medical allowance will be paid to the insured. A certain amount is paid per day for the total number of days of hospitalization, excluding the first 3 days of hospitalization. A maximum of 10 days is usually paid, excluding the first 3 days of hospitalization. The daily medical allowance must be reimbursed by the insurance company. Daily Medical Allowance is intended to provide certain amount of cash benefit to the insured, and the patient will incur certain expenses for food and other necessities when visiting family members. Daily medical benefits are sometimes provided as a cover and additional premium. With the add-on, customers can select a hospital daily cash benefit limit, and if installed, the limit will be pre-set.

For more information on the hidden benefits of health insurance plans, contact our health insurance experts at Insurance Brokerage.

Individual health insurance, health insurance, health insurance policy, hidden benefits of private health insurance, insurance company, benefits of private health insurance

Namaste. I am Abhinay Nedunuru, Member of Insurance Institute of India with passion to make insurance simple and understandable. I write about insurance and investments. I especially enjoy teaching and training in the insurance industry. I am currently doing my PhD in Management at IIM. A private health insurance plan is a plan where the insured pays premiums to cover the financial costs of hospitalization. Unlike auto insurance policies, health insurance policies can be difficult to change every year, so choosing the right personal health insurance plan is important. Therefore, the following tips will help you choose the right personal health insurance plan.

Choose The Right Personal Health Insurance Plan

The most important thing to consider when opting for a private health insurance plan is the sum assured required. Sum Assured is the total liability of the insurance provider in case of hospitalization during the policy period. Unlike a car insurance policy, the amount of medical insurance will not be the same even after the claim is filed. For auto insurance, the maximum liability per claim is the total sum insured under the policy. However, for individual health insurance, the insurance company’s maximum liability per claim will decrease after each claim made during the policy period.

For example, Mr. A is covered by a health insurance plan with a sum assured of Rs 5 lakh, he is hospitalized for a heart attack and the hospital bill is Rs 3 lakh. After the claim is paid, Mr. A’s guarantee will be reduced proportionately to the amount of the claim paid, from Rs.5 Lakhs – Rs.3 Lakhs to Rs.2 Lakhs. Therefore, additional claim for Mr. A would be Rs.2 lakhs. 5 lakhs of Sum Assured at any point in the year of Rs.A chamber should opt for the unlimited recharge/recharge facility which comes as an add-on and the Sum Assured will remain the same throughout the policy. era.

Therefore, it is important to determine the sum assured or coverage required under a private health insurance policy. A decision needs to be made based on many factors such as medical inflation, family health issues, pre-existing conditions, and other health insurance support.

Claim payout ratio or loss incurred ratio is an indicator of an insurance company’s ability to settle claims and understand its goals. The claims payout ratio is the ratio of claims received to the number of claims received, while the claims generated ratio is the amount of claims paid to the amount of premiums received. A higher claim payout ratio means the insurance company is paying more

Personal Health Insurance For Government Employees: Things You Should Know!

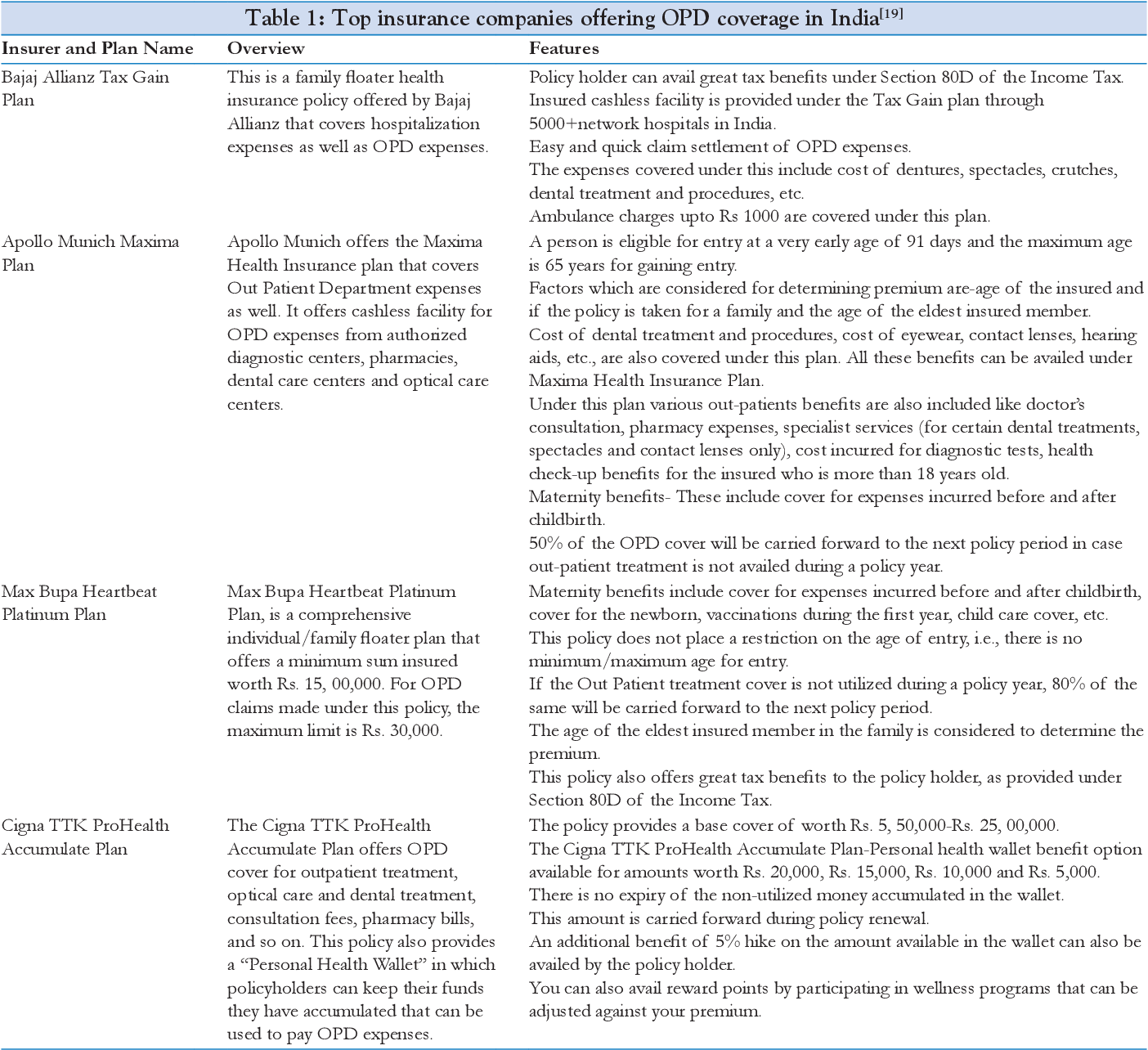

Personal health insurance georgia, get personal health insurance, personal health insurance policy, buy personal health insurance, personal health care insurance, cigna personal health insurance, florida personal health insurance, purchasing personal health insurance, personal family health insurance, personal health insurance texas, personal health insurance ohio, affordable personal health insurance