Motor Insurance Quote – Add to favorites0 Free license Learn more Attribution required How to attribute? File type: Downloads: 1,535

Car insurance is an important part of owning a car because it helps protect the car owner against financial loss in the event of an accident, theft or damage. A car insurance quote is a key aspect of this protection. This article aims to explain what a car insurance quote is, why it is important, and its key components. We’ll also guide you through the process of making a car insurance quote and give you some practical advice. What is a car insurance quote? An auto insurance quote is an estimate provided by an insurance company that shows the rate you can pay for coverage. The quote is based on the information you provide about yourself, your vehicle and your driving history. The insurance company uses this information to assess the risk of insuring you and calculate the potential value of the policy. Remember that each insurance company has different methods of calculating risk and determining rates, which causes quotes to vary. Why is a car insurance quote important? Car insurance quotes are important for several reasons:

Contents

- Motor Insurance Quote

- Compare Car Insurance Quotes Images, Stock Photos, 3d Objects, & Vectors

- How Many Times One Can Claim For Car Insurance Policy In India?

- Tips Compare Car Insurance Quote Online By Nishantmehta333

- Comparing Automotive Insurance Quotes

- Factors That Affect Your Life Insurance Premium

- Cheap Car Insurance Quotes Images, Stock Photos, 3d Objects, & Vectors

- Gallery for Motor Insurance Quote

- Related posts:

Motor Insurance Quote

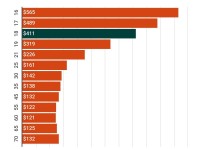

Budgeting: They can help you estimate how much you should spend on car insurance and help you with financial planning. Comparison: Quotes provide a basis for comparing different insurance providers. You can compare rates and coverage to find the best value for your needs. Risk Assessment: A quote helps you understand how insurance companies perceive your risk level. A higher price may mean you are considered a high-risk driver. Key elements of a car insurance quote A car insurance quote includes several key elements:

Compare Car Insurance Quotes Images, Stock Photos, 3d Objects, & Vectors

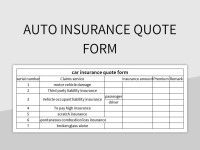

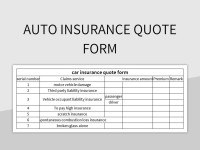

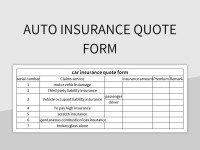

Personal information: This includes your age, gender, marital status and residential address. Driving record: Your driving history has a significant impact on your offer. Events such as accidents or violations can increase your rates. Vehicle Information: Your vehicle’s make, model, year, and safety features all play a role in determining your price. Coverage details: The coverage you choose, such as liability, comprehensive, collision, and the limits for each, will affect the price. Deductible Amount: The amount you choose to pay out of pocket in the event of an accident can also change the quote. How to get a car insurance quote? Most insurance companies offer online tools to prepare car insurance quotes:

Go to the insurer’s website: Go to the insurance company’s website and search for “get a quote” or a similar option. Submit personal information: Fill in the necessary information about yourself and your driving history. Enter vehicle information: Enter details about your vehicle, including its make, model, year and safety features. Choose your coverage: Choose the coverage and limits you want. Get your quote: The insurance company will calculate your quote based on the information you provide. Tips for Using a Printable Car Insurance Quote A printable car insurance quote can be a handy tool for comparison and negotiation. Here are some tips:

Compare multiple quotes: Collect and print quotes from different insurance companies for comparison. Check the details: Make sure all personal and vehicle information on the quote is accurate. Negotiate: Use printed quotes as a negotiating tool when speaking with insurance agents. Frequently Asked Questions Does getting a quote affect my credit score? No, getting a car insurance quote is a soft question and does not affect your credit score. How often should I receive a new offer? It’s good practice to get new quotes at least once a year or whenever there’s a significant change in your life, such as buying a new car or moving house. Why are my friend’s rates lower than mine? Car insurance rates depend on many factors, including driving history, type of car, location and age. Different people may have different rates even with the same insurance company. Additional Factors Affecting Car Insurance Prices There are several additional factors that can affect the price of car insurance:

Credit score: In many states, insurers use credit scores to predict the likelihood of a claim. A lower score may lead to a higher price. Driving experience: New drivers or drivers with less experience usually have higher insurance rates. Claim history: If you’ve made several claims in the past, insurers may consider you a high-risk driver and raise your rates. Conclusion Understanding car insurance rates is very important for every driver. Quotes not only estimate your potential insurance costs, but also provide insight into how insurers assess your level of risk. By understanding the key elements of an auto insurance quote and the process of obtaining one, you can make more informed decisions about your insurance coverage. Note that it is useful to compare and negotiate quotes from different insurers to get the best deal.

How Many Times One Can Claim For Car Insurance Policy In India?

Creating professional templates takes a lot of time and effort, but all we need from you is an attribution link. Follow the instructions below for the appropriate attribute. Insurance is an important part of modern life. By purchasing an insurance policy, you are taking steps to manage your risks. For example, driving a car means the risk of an accident. Likewise, owning a home can affect damage to your home or even being sued by someone injured on your property. When you pay for insurance, you’re also giving the company a little money to help cover important expenses when they happen. The insurance company gets paid even if you never file a claim, and you know that they will (usually) cover your larger costs if you do.

There are many types of insurance, so it’s important to shop around for a good deal. Getting insurance quotes from multiple companies is a great way to save money. Some types of insurance are required by law, such as motorist insurance, while others are optional, such as life insurance. Meanwhile, renter’s insurance and homeowner’s insurance may be required by landlords or loan companies even if they are not required by law.

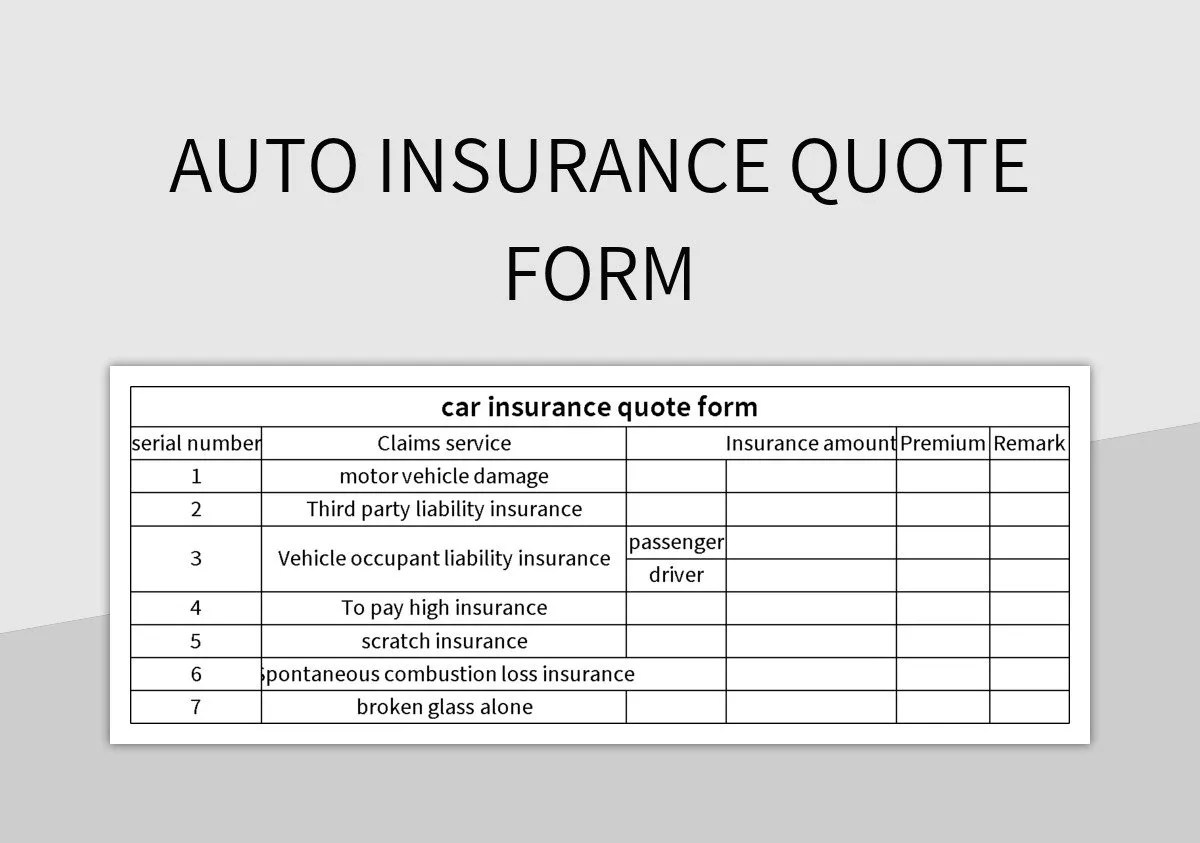

The insurance quote is based on the policy you are looking for and the information you provide. Here is your quote

Detected when your information changes, such as a lower credit score. However, an insurance quote is simply an estimate of the premium or monthly rate you will pay for your insurance.

Tips Compare Car Insurance Quote Online By Nishantmehta333

An insurance quote template is a form used by insurance companies to logically organize the information you need about your quote.

. Although different companies use slightly different templates, each company must inform potential customers about their rates and coverage. By arranging the quote a

By using a template, a company can quickly reuse the form to offer individual insurance quotes by entering specific information for that person or group without having to create each one from scratch. These templates save time and man-hours and help streamline the process of communicating information to hundreds or thousands of people

There are many types of insurance. Some types of insurance are industry-specific, such as small business insurance or niche policies for certain situations, such as travel or car insurance. Typically, insurance companies cover liability, personal property, property of others, etc. offers many options. Below is a short list of the most common types of insurance that people need.

Comparing Automotive Insurance Quotes

If you own and drive a car, most places require car insurance. Car insurance quotes cover six main types of car insurance which include:

Pro Tip: Each state has different requirements for drivers. Always check the minimum insurance rates in your area before looking for coverage.

If you are unable to work permanently, disability insurance covers your needs. Although there are different types of coverage and whether it is purchased individually or designed to cover an entire group of people, it can be a lifesaver if you are injured and don’t recover quickly.

Pro Tip: You can’t use disability insurance to file a claim for a preexisting condition, but having a disabling condition doesn’t prevent you from getting disability insurance to cover potential future problems.

Factors That Affect Your Life Insurance Premium

Home insurance is optional, but any homeowner can tell you it’s a smart idea because homes eventually need repairs. Here are some types of cover quotes you may need:

Pro Tip: Vacant property insurance is available, as are many places where you plan to build a home or hunting and camping area.

Health insurance is a complex system where each company only covers agreed upon medical needs. There may be additional charges for doctor and hospital visits, and there is a deductible you must pay out of pocket before the insurance company covers the rest of the bill.

Pro Tip: Employers often offer insurance, but that doesn’t mean it’s the best deal. Shop around to see who offers the best coverage and rates for you.

Cheap Car Insurance Quotes Images, Stock Photos, 3d Objects, & Vectors

Long-term care generally refers to adults who need regular or even daily care. By the time you reach age 65, your chance of long-term care increases to 70%. The longer you wait to buy this type of insurance, the higher the premiums will be because

Commercial motor vehicle insurance quote, motor vehicle insurance quote, commercial motor insurance quote, commercial motor insurance quote online, motor insurance quick quote, motor cycle insurance quote, motor bike insurance quote, get motor insurance quote, motor insurance online quote, motor home insurance quote, business motor insurance quote, get motor insurance quote online