Motor Car Insurance Quote – At Just Quote Me we can provide car insurance for both business vehicles and personal vehicles. Whether you need personal car insurance or business car insurance or fleet insurance, we offer many options and opportunities to get your unique car insurance policy.

Car insurance usually includes a number of basic covers and may include covers for accidental damage, fire, theft and windscreen repair or replacement. Some car insurance policies include coverage for personal belongings left in the car, while others offer legal expenses coverage in the event of a claim and coverage for your vehicle if your car is damaged or stolen.

Contents

- Motor Car Insurance Quote

- Motor Insurance Quotes Hi Res Stock Photography And Images

- Cheapest Car Insurance Quotes In Rochester, Nh For 2023

- Doubts You Should Clarify About Motor Insurance Quotes

- Oriental Car Insurance: Secure Your Ride With Quickinsure

- Same Day Car Insurance: How To Get It Online Now (2023)

- What Is Comprehensive Insurance And What Does It Cover?

- Compare All Car Insurance Sites:amazon.co.uk:appstore For Android

- Car Insurance Cover & Quotes Uk

- Top 10 Cheapest Car (auto) Insurance Companies

- Commercial Motor Vehicle

- Gallery for Motor Car Insurance Quote

- Related posts:

Motor Car Insurance Quote

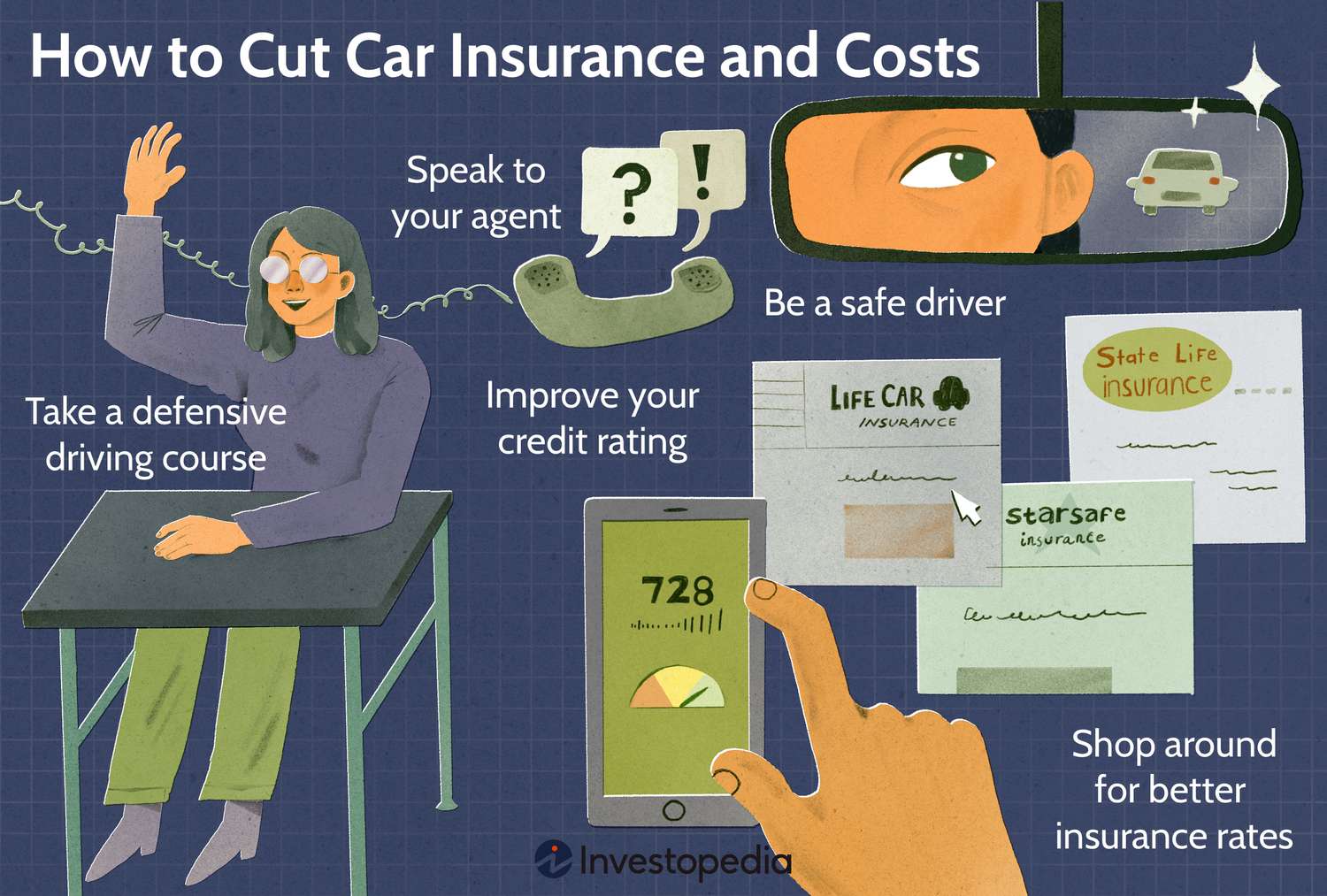

Getting the right level of car insurance to suit your needs isn’t always as simple as it first seems, so Just Quote Me is here to discuss your options and provide expert advice on the best car insurance rates and premiums for your car and situation. .

Motor Insurance Quotes Hi Res Stock Photography And Images

At Just Quote Me, we specialize in quality insurance quotes and offer quotes to suit every situation.

It is common for car insurance to be sold quickly and without paying enough attention to whether it is the right level of cover for the driver’s needs. Most insurance policies are sold on a blanket basis rather than tailored to the insurer, and for real peace of mind, there is a fee to find the right cover for your situation.

Just Quote Me brings together the skills of highly experienced insurance professionals with over 30 years of industry knowledge and experience, particularly in motor insurance. We are proud to cover national businesses including charities, wine bars, nightclubs and houses of worship.

As one of the most common types of insurance premiums, car insurance can be found in many different places, at different prices and coverage levels.

Cheapest Car Insurance Quotes In Rochester, Nh For 2023

Our unique position as an independent broker means we can compete with other car insurance brokers and direct market insurers in terms of prices and services.

We use technologies such as cookies to store and/or access device information to provide the best possible experience. Consent to these technologies will allow us to process information such as browsing on this site or unique credentials. Opting out or opting out may adversely affect certain features and functionality.

Technical maintenance or access is strictly necessary to enable the use of a particular service expressly requested by the subscriber or user or to disseminate communications by electronic means.

Technical maintenance or access is required for the legitimate purpose of maintaining preferences not requested by the subscriber or user.

Doubts You Should Clarify About Motor Insurance Quotes

A technical collection or log used for statistical purposes only. A technical collection or log used only for anonymous statistical purposes. Without a call, voluntary compliance by your Internet service provider, or additional records by a third party, information stored or received solely for this purpose cannot generally be used to identify you.

Technical storage or login is required to create a user profile to send advertisements or track on one or more websites for similar marketing purposes. Car insurance is required for all vehicles plying on Indian roads and every owner/driver must have active car insurance. The primary function of an insurance policy is to provide a financial safety net in the event of accidental injury, death or injury to a third party.

In addition to third-party liability, personal injury coverage includes bodily injury or loss of the insured vehicle in the event of a natural or man-made disaster. This plan makes driving on country roads stress-free and safe. It is recommended to purchase a comprehensive car insurance policy to cover everything.

Anyone who wants to drive on Indian roads needs a third party liability policy. A comprehensive plan can also be considered if insurance is required for damage to the insured vehicle. As the number of cars increases, accidents have become more common, which makes it important for everyone to have the best car insurance policy that protects them from financial ruin. Some of the benefits of buying a car insurance policy are:

Oriental Car Insurance: Secure Your Ride With Quickinsure

Most of the car insurance companies in India have done business online using advanced technology. There are advantages to buying car insurance online, let’s take a look at them.

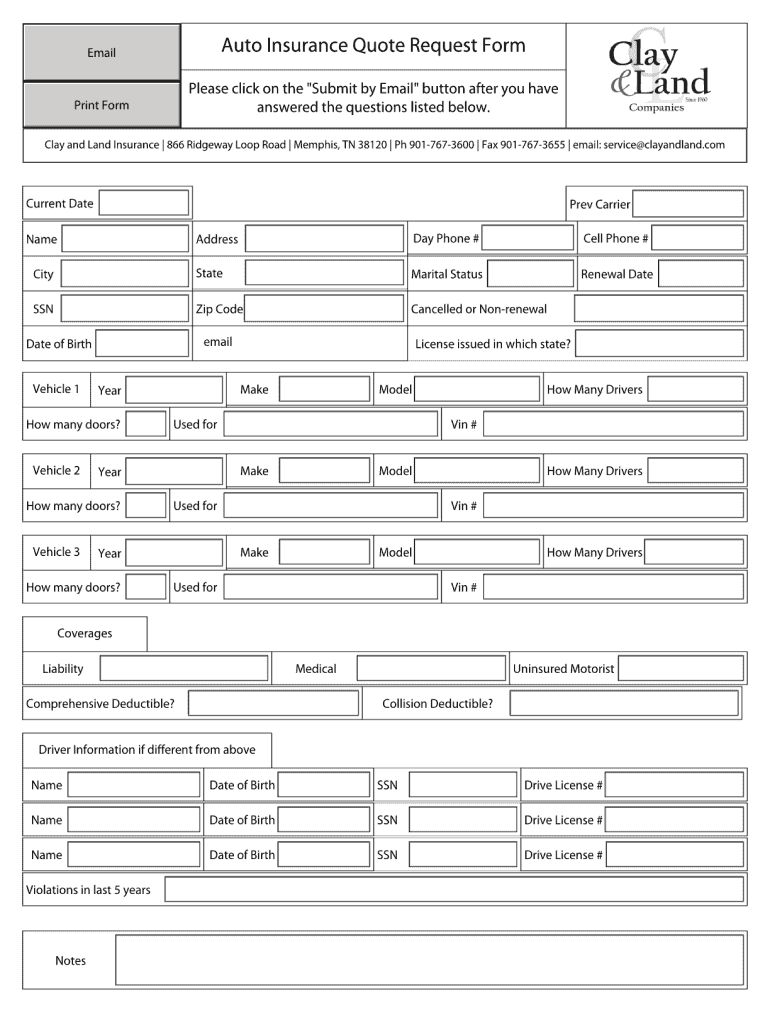

Buying car insurance online takes less time because you can fill out the paperwork whenever you want. You can buy and upgrade any space you want.

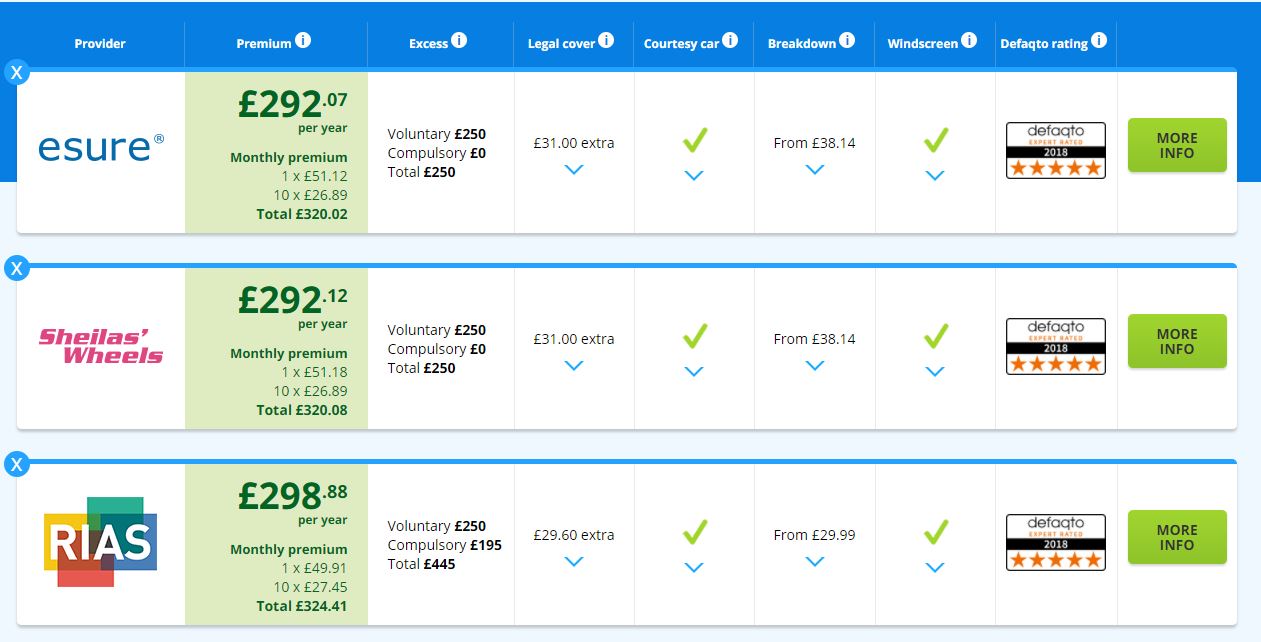

Since you can compare car insurance policies online, you can choose the cheapest car insurance at the lowest possible premium.

Auto insurance renewal is also a major issue. You can renew your car insurance policy online quickly and without any hassle.

Same Day Car Insurance: How To Get It Online Now (2023)

With significant technological advancements, you can shop, upgrade, compare, and more. The next important thing in the insurance industry is online insurance so that you can have a satisfactory insurance experience.

Motor insurance can be broadly classified into three categories and depending on your needs, you can choose the car insurance online plan that suits your needs.

Car insurance is a must buy policy when buying a car. Accidents happen while driving, so having insurance eases the stress of getting into an accident. Car insurance protects against loss, damage and loss to a third party. Compare several auto insurance policies to get the insurance that best suits your needs.

Two-wheeler insurance protects the insured against losses related to motorcycles and scooters if the covered vehicle is damaged or stolen. The insurance policy also covers third party loss, injury or accidental death. It is advisable to evaluate multiple insurance policies before choosing a similar one for car insurance.

What Is Comprehensive Insurance And What Does It Cover?

Commercial vehicle insurance is a special type of auto insurance because it covers damage and loss to a commercial vehicle in the event of an accident. Most businesses need commercial vehicle insurance, including those that use tractors, pickup trucks, school buses, trucks, and other vehicles. Also, the Motor Vehicles Act, 1988 only provides liability insurance for commercial vehicles plying on the roads of the country.

You can choose the auto insurance policy you want according to your needs. Once you do, car insurance offers two types of coverage.

A third party auto insurance policy protects an individual against financial damages if the vehicle involved in an accident causes property damage, bodily injury, or death to a third party. A third party includes a person and a vehicle. If someone wants to drive on Indian roads, he must have car insurance because you need to have car insurance in India.

When you take comprehensive car insurance, you are fully covered in case of loss or damage. When comparing third party car insurance with comprehensive car insurance, it is clear that it is the best choice in all aspects.

Compare All Car Insurance Sites:amazon.co.uk:appstore For Android

Buying car insurance in India is mandatory by the Indian government, but that is not the only reason why you should buy car insurance. Let’s look at some of the reasons why you should buy auto insurance.

A third party insurance policy is legally required to cover the vehicle. Violating the law can have serious consequences, including fines or jail time.

Paying out of pocket for repairs can be expensive. Comprehensive coverage improves coverage and provides financial assistance for the repair of a damaged vehicle.

Traveling by road is not an easy task. Being faced with an accident can be very stressful. Car insurance protects you from the legal and financial hurdles of an unfortunate situation.

Car Insurance Cover & Quotes Uk

The type of car insurance policy chosen will determine the coverage limit of the car insurance policy. The components of third party and comprehensive motor insurance are listed below.

Exceptions apply to situations where the insurer does not want a claim. Learn more about it below.

Additional car insurance can be purchased along with the insurance policy to increase the insurance benefits. Pay extra to get extra. Below is a list of the most popular auto insurance add-ons.

With this add-on, the auto insurance company will settle the claim regardless of the wear and tear cost. Consequently, without this payment, you will be charged more after the claim.

Top 10 Cheapest Car (auto) Insurance Companies

If you encounter a situation on the road and need help with this extra coverage, you can get roadside assistance from your car insurance company, including towing services.

With this extra cover, the heart of your vehicle, the engine, is sealed. This is one of the most important additions to car insurance.

In India, PA cover is required in addition to third party car insurance policy. This additional insurance provides financial protection in case of death or permanent disability while driving.

To avoid submitting the questionnaire

Commercial Motor Vehicle

Motor scooter insurance quote, cheap motor insurance quote, motor insurance quote comparison, tesco motor insurance quote, motor home insurance quote, motor cycle insurance quote, motor insurance quote ireland, get motor insurance quote, commercial motor insurance quote, motor bike insurance quote, motor insurance online quote, motor insurance quote