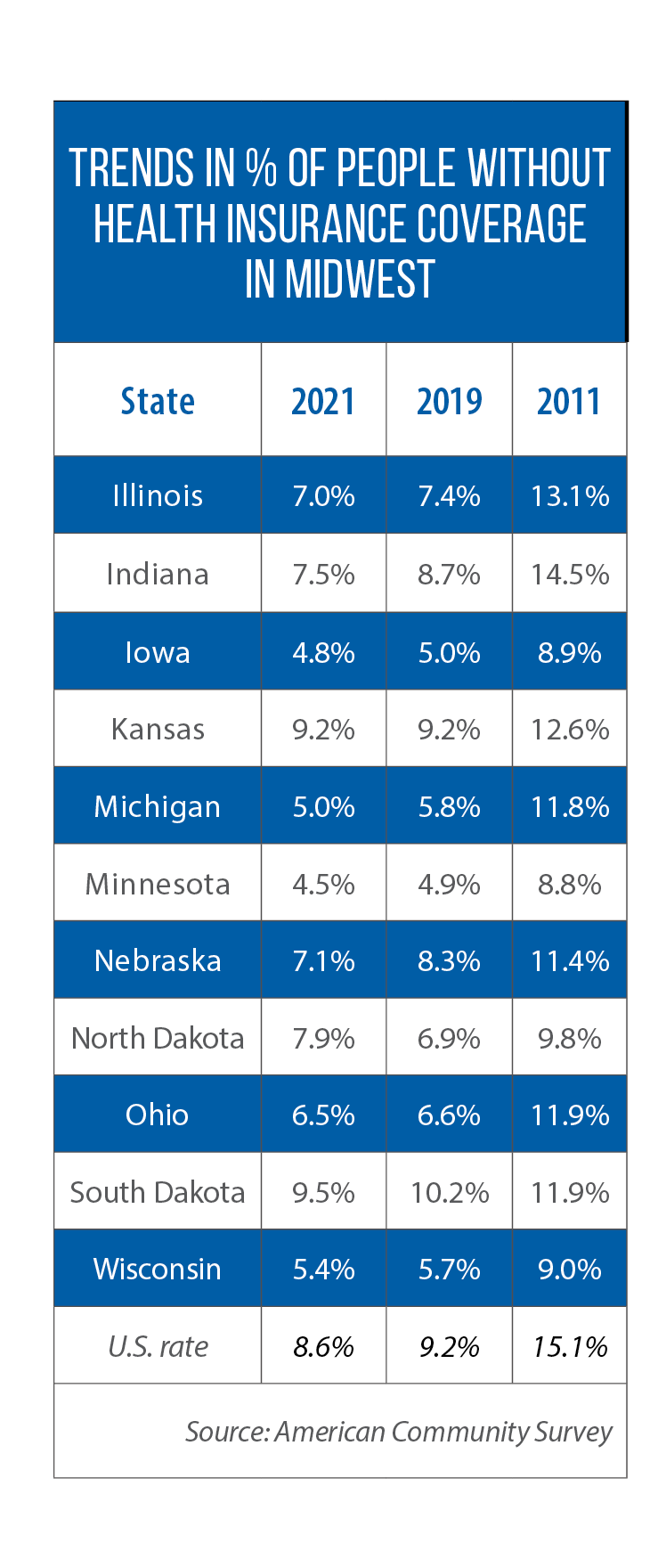

Health Insurance Coverage – Health insurance is a central goal for access to health services. Those with health insurance are more likely to have access to health care, a regular source of care, and a recent health visit than those without insurance (1-3).

In the year Decreased from 17.5% in 2009 to 11.0% in 2018 Uninsured Number of People Under 65 In 2019, 12.0% of people under 65 were uninsured. For more information on analyzing trends using NHIS data, see Featured Charts for Additional Analysis and Notes.

Contents

- Health Insurance Coverage

- Health Insurance Plans ‘too Complicated To Understand’

- Tufts Health Plan

- Single Payer Health Care Vs. Universal: Pros And Cons

- How To Get Self Employed Or Freelancer Health Insurance

- Us Health Insurance Coverage

- Health Insurance Coverage

- Achieving Universal Health Insurance Coverage In The United States: Addressing Market Failures Or Providing A Social Floor?

- Private Health Insurance For Individuals And Families

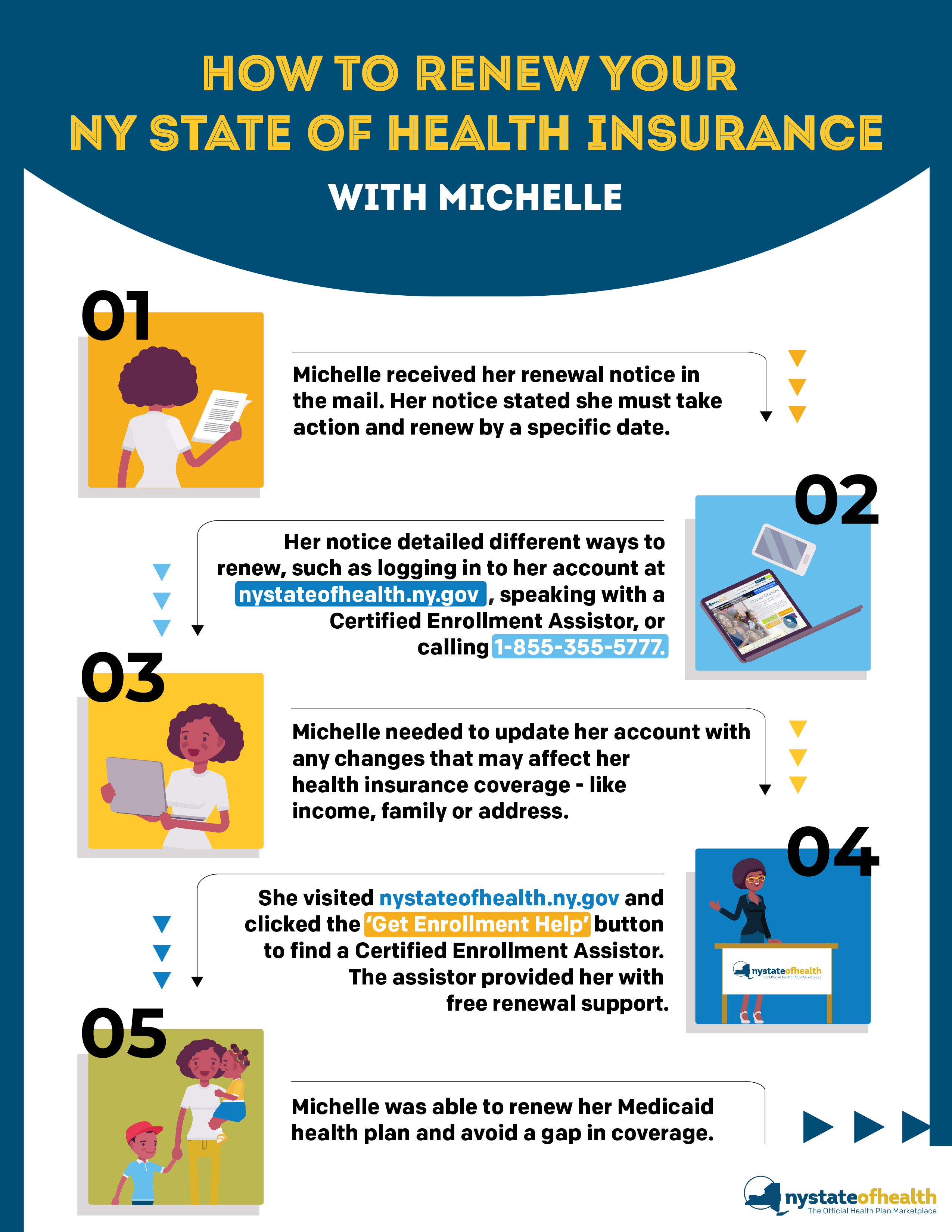

- How To Renew Your Ny State Of Health Insurance Infographic

- What Would The 2020 Candidates’ Proposals Mean For Health Care Coverage?

- Gallery for Health Insurance Coverage

- Related posts:

Health Insurance Coverage

Source: National Center for Health Statistics, National Health Interview Survey. See sources and definitions, National Health Interview Survey (NHIS) and

Health Insurance Plans ‘too Complicated To Understand’

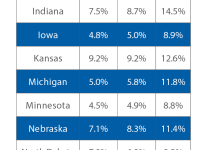

For people under age 65, Medicaid increased from 16.1 percent in 2009 to 21.1 percent in 2016 and then decreased to 20.2 percent in 2018.

Source: National Center for Health Statistics, National Health Interview Survey. See sources and definitions, National Health Interview Survey (NHIS) and

The percentage of people under the age of 65 who had private health insurance dropped from 63.3 percent in 2009 to 61.8 percent in 2011 and then increased to 65.3 percent in 2018. In 2019, 64.3 percent of people under the age of 65 were covered by private health insurance.

Source: National Center for Health Statistics, National Health Interview Survey. See sources and definitions, National Health Interview Survey (NHIS) and

Tufts Health Plan

In the year In 2009–2019, Hispanics under the age of 65 were more likely to be uninsured than other race and Hispanic origin groups. So you want to pull the trigger on getting health insurance, but you have one important question on your mind:

You’ve probably heard many stories of people paying an arm and a leg for their policies, and you want to make sure the same thing doesn’t happen to you.

To give you peace of mind, we go over health insurance costs from every angle. That way, you can get a good idea of how big a bill you can expect—if you’re just 26 and off your parents’ plan, you’re in your 30s and self-employed, or you’re just looking for other options besides your employer’s plan.

Is it. Sure, you might be able to get by paying regular medical expenses yourself, but without insurance you can’t take on any major injuries without having your appendix removed or a cancer diagnosis.

Single Payer Health Care Vs. Universal: Pros And Cons

The average monthly premium (the amount you pay your insurance company each month) in the U.S. for an individual health insurance plan purchased from HealthCare.govmarketplace is $456, although the price you pay depends on your age, income, location, and tobacco use.1 If you’re 40 and married with two children The average cost of a family plan is $1,483 (without government funding).2

If you or your spouse work for a company or organization that offers a group plan for employer-sponsored health insurance for group members, you may not pay as much as a marketplace plan. In the year In 2022, people using company health benefits paid $111 per month for an individual policy and $509 for a family policy.3

Private health insurance refers to both marketplace plans and employer-sponsored plans—basically any health insurance plan that isn’t provided by the government (like Medicare or Medicaid). So the average monthly costs we just looked at — $456 for a marketplace policy and $111 for an employer-sponsored policy — are also the average costs of private health insurance.

Although $456 is the average monthly health insurance premium for adults with a Marketplace plan in the U.S., the amount you pay can vary quite a bit.

How To Get Self Employed Or Freelancer Health Insurance

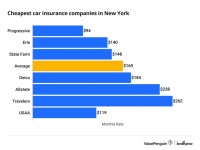

The cost depends on the state you live in, your age, the level of insurance you choose, and some other factors we’ll discuss later.

For now, let’s look at the average cost of health insurance in the marketplace by state, age, and plan level.

Another factor that affects how much you pay for health insurance is your age. As you get older, your health insurance premiums go up.

See how much you can expect insurance costs to increase over your lifetime. These numbers are based on average marketplace silver plan premiums for an adult who does not use tobacco, earns $60,000, and has no dependents.

Us Health Insurance Coverage

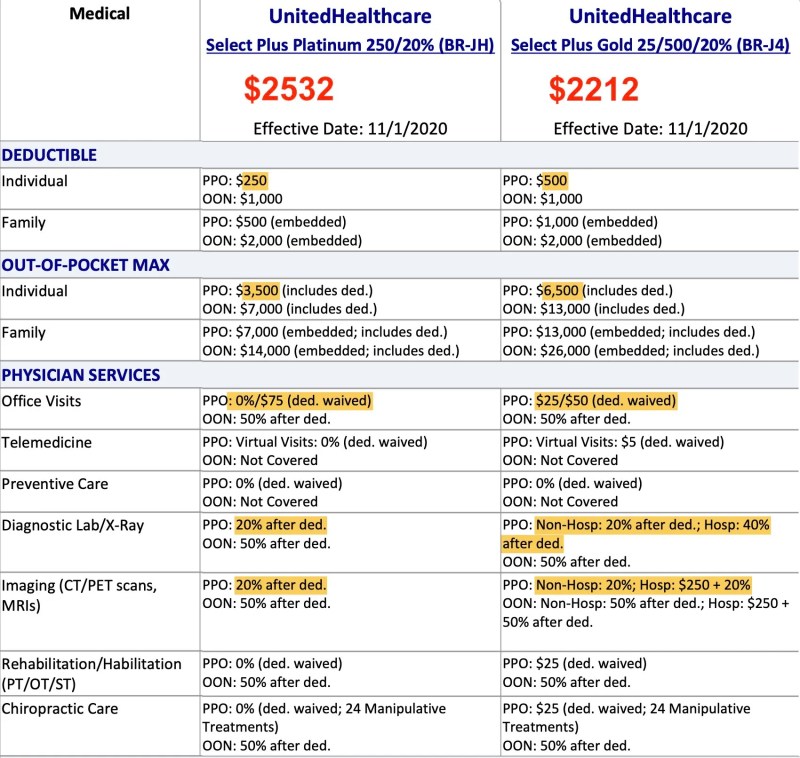

There are five different levels of coverage when it comes to health care marketplace plans – Catastrophic, Bronze, Silver, Gold and Platinum. These tiers give you different options on how much your plan will pay and how much you will pay

Two of the least common plans among these options are Catastrophic and Platinum, as both are on the extreme end. Catastrophic plans are the cheapest and offer the least coverage – they have the highest out-of-pocket costs. With platinum insurance, the insurance company pays 90% of the health costs, but this means that they are very expensive plans.

Many people go for the metal layer in bronze, silver or gold. Bronze plans give you lower monthly premiums but higher costs. Silver offers lower deductibles (the amount you have to pay before the insurance company kicks in) and out-of-pocket costs than bronze, but you pay more in monthly premiums. Gold plans have higher monthly premiums, but lower deductibles, coinsurance and out-of-pocket costs.

Here’s a look at the average cost of health insurance for an individual based on monthly premiums for bronze, silver and gold plans:

Health Insurance Coverage

Wondering how much health insurance costs for a family of four? Well, the answer depends on the age of both the parents

Figures are based on households with a household income of $100,000 who do not use tobacco or receive financial assistance.7

Now that we’ve crunched the numbers on how much you should pay for health insurance, let’s look at the factors that affect health insurance costs.

Generally, a handful of economic factors, such as inflation or current market conditions, affect health insurance costs across the United States. For example, when inflation increases and the cost of goods and services across the country increases, so does the cost of health insurance.

Achieving Universal Health Insurance Coverage In The United States: Addressing Market Failures Or Providing A Social Floor?

With Ramsey Trusted Partner Health Trust Financial in your corner, you’ll have peace of mind knowing you have the right health insurance that won’t break the bank.

Let’s start with five factors that insurance companies are legally allowed to consider when deciding how much to pay for a Marketplace plan.

If it’s not on this list, insurance companies aren’t allowed to factor it in when deciding how much to pay for a policy. It includes your gender, medical history (pre-existing conditions) and current health. 9

While these are the only factors that insurance companies can base their rates on, there are other factors that affect health insurance costs that are beyond the provider’s control. The two biggest ones are:

Private Health Insurance For Individuals And Families

Shopping for health insurance can sometimes feel like being in the grocery store for the same products for hours – less fun and

More expensive than grain! But comparing plans can save you money. That’s because the type of plan you choose affects your health insurance costs.

He definitely feels it. And it’s true that health care costs have increased dramatically over the past decade. By 2023, the average person will pay 67% more in premiums than in 2014. But compared to 2019, the price is really

Just go to the websites of the major health insurance companies in your area and see what plans they offer. However, there are many reasons. Choosing the right health insurance plan for you or your family is a daunting task, and you probably have better things to do with your time than sifting through endless health insurance quotes.

How To Renew Your Ny State Of Health Insurance Infographic

That’s why we recommend our friends at Health Trust Financial for your health insurance needs. They’re RamseyTrusted and will connect you with an agent who can handle your situation and compare the best rates to get the coverage you need. They will help you understand the marketplace or even what your employer has to offer. And the best part? It’s free to connect! It is a new resource for everyone affected by childhood cancer – patients and their parents, family members and friends.

Most health services in the United States are paid for by health insurance. An individual or family contracts with a health insurance company to cover health expenses.

When covered by a policy, the policyholder pays a fixed amount or premium to the health insurance company at regular intervals. In return, the insurer agrees to pay a pre-agreed portion of the costs when health care becomes necessary.

While every insurance plan is different, most health plans have three main components: benefits, networks, and costs.

What Would The 2020 Candidates’ Proposals Mean For Health Care Coverage?

Costs vary depending on your health plan and the type of health care or prescription you receive. To learn more about health insurance costs, read about common health insurance terms.

You can buy health insurance directly from the insurance company. Or you can shop at health insurance marketplaces run by the state or federal government. The cost and number of plans varies by state. Find more details on the marketplace by state.

Employer-based coverage,

Full coverage health insurance, best health insurance coverage, immediate health insurance coverage, cheap health insurance coverage, health insurance worldwide coverage, indiana health insurance coverage, find health insurance coverage, health insurance national coverage, group health insurance coverage, affordable health insurance coverage, utah health insurance coverage, health care insurance coverage