Compare Insurance – Select FI has partnered with CardRatings to cover credit card products. Select FI and CardRatings may receive a commission from card issuers. The opinions, reviews, analysis and recommendations are solely those of the author and have not been reviewed, endorsed or approved by any of these entities. American Express is an advertiser. Publications.

No one particularly likes the idea of car insurance. It costs too much, you’ll never get all the coverage you want, and it’s a must. Even if you don’t want to take the time to understand auto insurance, it is important that you do. You need to understand what you are paying for, why you are paying for it and how it can help you in the event of an accident.

Contents

- Compare Insurance

- Side By Side Comparison Of Health Insurance Plans In 2021

- Google Results For

- Best Yoga Insurance Options

- Best Car Insurance By Occupation

- Here’s How To Compare Different Life Insurance Policies

- How To Compare Auto Insurance To Find Your Best Policy

- Shopping For Auto Insurance

- Compare Auto Insurance Quotes (save $245/mo)

- Compare Insurance Policy Online By Okbima

- Compare Car Insurance Quotes And Rates 2024

- How To Compare Life Insurance Types: Factors & Considerations

- Comparing Insurance Like Solutions In Defi

- Gallery for Compare Insurance

- Related posts:

Compare Insurance

Our guide is here to make things a little easier. We discuss the different types of car insurance, where to find it, how to read your policy and more.

Side By Side Comparison Of Health Insurance Plans In 2021

The most popular type of car insurance, comprehensive coverage covers you in the following situations:

As you can see, some major items are missing, such as coverage for collision damage and medical bills that you may incur as a result of an accident.

That’s because, even though it’s called “comprehensive,” comprehensive insurance doesn’t cover everything and you’ll need to add other types of insurance (see below) to your policy.

The cost of comprehensive insurance depends on many factors (age, driver’s license, your car, etc.). But, you can find the average for your state with insurance.com.

Google Results For

Liability coverage covers your costs if you cause an accident and pays the medical bills and other expenses incurred by the victim of your accident.

The cost of liability insurance, like any other car insurance, varies by many factors. But Policygenius found the average of all 50 states. Here are some:

Collision insurance is just what it sounds like – you are covered if your vehicle collides with another car or an object and you need to repair or replace your car.

This is the most expensive car insurance policy. If you look again at the graph in the excess insurance section, you will see several examples of the high cost of collision insurance.

Best Yoga Insurance Options

While comprehensive insurance averages just $80 in my state, collision averages $408 per year.

Uninsured/underinsured coverage is a supplement to your typical policy. It covers you if you get into an accident with someone who doesn’t have insurance or doesn’t have insurance to cover the damage to your vehicle.

Uninsured is definitely one of the cheaper car insurance supplements. ValuePenguin provides the average for the least expensive state (Mass.) and the most expensive state (Oklahoma):

Even Oklahoma, which has the highest number of uninsured drivers (hence the high costs), only charges $41 a year for the lower limit of coverage.

Best Car Insurance By Occupation

Gap insurance is for those who lease their car or those who have taken out a loan to pay off their car. If your car is totaled or stolen, loss insurance pays the difference (or gap) between what you owe and the value of your car. For example, let’s say you owe $10,000 on a car that’s worth $8,500. If your car is hit and the cost to repair the damage is $9,000, the insurance company considers your car “totaled” and pays you the value of the car, or $8,500. This leaves you on the hook for the $1,500 you still owe the finance company.

Gap insurance is one of the cheapest types of car insurance, usually costing just a few dollars a month! Worth considering if you owe more than your car is worth.

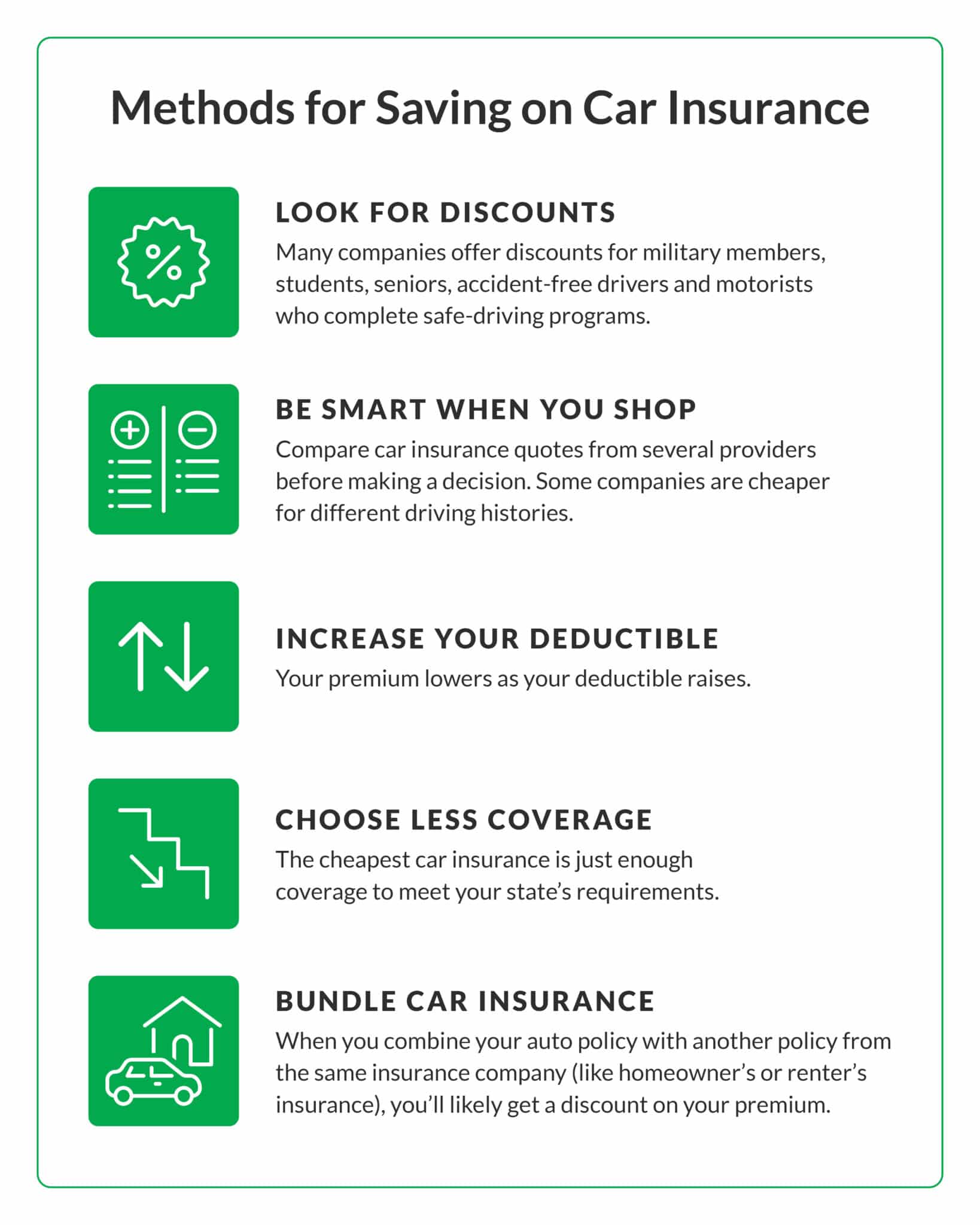

Your premium is how much you pay for each type of policy you choose (eg comprehensive, collision, liability, etc.). This is one of the most important factors when deciding on car insurance.

Reputable auto insurance companies often have similar premiums for comparable plans and vary by just a few dollars. That’s why we recommend you use an insurance aggregator that shows all your premiums in one place. Compare.com is our favorite (more on that below).

Here’s How To Compare Different Life Insurance Policies

Although some companies have higher premiums, if you are eligible for discounts, it may not matter much.

For example, I use Allstate, which is often more expensive than other car insurance. However, I qualify for six rebates that lower my monthly cost by about $30.

Similar to a health insurance deductible, a car insurance deductible is how much you pay after an accident. The insurance company pays the rest.

Unlike health insurance, however, you cannot reach a withdrawal limit where the insurance still pays everything. Every time you make a claim, you have to pay a deductible.

How To Compare Auto Insurance To Find Your Best Policy

Deductibles typically come with comprehensive and collision insurance. If you increase your sales, you will reduce your monthly payment. This also means that you pay more in the event of an accident.

Many people get comprehensive car insurance and think it covers every eventuality. Then, after an accident, they find out they have to pay for a new car and medical bills out of pocket. It’s frustrating and not something you want to deal with while recovering from an accident.

Compare.com is an insurance aggregator that shows you all your rates in one place. It should be your first stop when looking for insurance because it really doesn’t get much easier than Compare.com.

All you have to do is enter your zip code. You can then choose to get a quote or simply view a list of all insurance companies in your area.

Shopping For Auto Insurance

Compare.com is completely free, so there’s no harm in using it to see if you can save on car insurance.

Policygenius works the same way as Compare.com. You answer a few basic questions and you get offers from different companies in one place.

In my experience Compare works much better than Policygenius. I actually received offers from Compare, whereas Policygenius said they would email me my offers and never did.

Insurify is another insurance aggregator that shows you all your quotes in one place. They also show all your eligible discounts in one place, making it easier to compare apples to apples.

Compare Auto Insurance Quotes (save $245/mo)

Allstate is a big name in auto insurance. They pride themselves on being part of their communities and often have local representatives you can talk to face to face. I use Allstate and have known my rep since I was 17 and got my first insurance.

Allstate is often one of the more expensive insurance companies, but their discounts more than make up for it.

Everyone knows GEICO for their commercials. However, they are one of the most expensive car insurance companies, even though they market themselves as low-cost.

Where they shine is their packages (combine different types of insurance – home, car – into one package). You will qualify for a much lower rate if you have multiple types of insurance through GEICO

Compare Insurance Policy Online By Okbima

Plus, if you want an insurance company that makes it incredibly easy to use the website and app, GEICO is for you.

Metromile is for those who don’t drive that often. It’s pay-per-mile insurance with a low rate starting at just $29. You will pay according to the mileage.

How to change car insurance company Step 1: Check your own policy to determine what you actually have

This is the hardest step of the whole process. To help describe how to read your policy, I’ll use my own Allstate policy as an example.

Compare Car Insurance Quotes And Rates 2024

: I have a strange policy because I am between cars. To keep my homeowners insurance covered, I need a replacement policy after I sell my car. As a result, my representative suggested that I get a policy for cars that sit in the garage most of the year.

Let’s start with Premium. A premium is how much you pay for the policy you choose. Allstate allows me to choose whether to pay in full or monthly.

Again, since I have weird insurance now, it doesn’t matter which one I choose because it’s only a few cents. But in the past, the full payment discount was significant—almost $100.

The policy period is how long you have your policy. Your policy usually lasts for one year. If you look in the right column of my policy, you will see exactly how long my policy lasts.

How To Compare Life Insurance Types: Factors & Considerations

This is the fun part of your policy This is where you also want to do a great comparison when choosing a car insurance company. Most car insurance companies are straightforward with the discounts they offer; I’m lucky enough to work with a company that automatically applies any discounts they find.

Now we get into the nitty-gritty of politics. I have the minimum policy, so mine is not the best example, but I work with what I have.

Allstate makes it easy to see what coverage I have. I only had liability insurance which included:

This is for a liability policy, which means it is only for the other car involved in the accident. I should have purchased additional insurance to cover my own vehicle.

Comparing Insurance Like Solutions In Defi

What you need is up to you. If you know what you are looking for, that

Compare dog insurance plans, compare life insurance plans, compare life insurance companies, compare dog insurance, compare cat insurance, compare life insurance policy, compare medicare supplement insurance, compare life insurance rates, compare pet insurance, auto insurance quotes compare, compare life insurance policies, compare home insurance quote