Compare Auto Insurance – Dan Wesley is an American businessman and executive. An insurance and personal finance expert, he is known for creating web portals that connect people with resources to help them achieve their goals. As a mentor and leader to many, Dan strives to prepare himself and those around him for success. Experience Dean graduated in 2000 with a degree in nuclear medicine. Dan quit the drug but continued…

We strive to help you make the right insurance and legal decisions. Finding reliable and affordable insurance should be easy. It does not affect the content. We have our own opinions.

Contents

- Compare Auto Insurance

- Car Insurance Quote

- Compare Car Insurance Quotes For December 2023

- Between Two Auto Insurance Companies? Here’s How To Decide

- Best Home And Auto Insurance Bundles 2023

- Compare Car Insurance Quotes (2023 Updated)

- Compare All Car Insurance Sites:amazon.com:appstore For Android

- Get Potentially Lower Car Insurance Rates With Compare.com!

- Compare Auto Insurance Quotes (from $31/mo)

- How To Compare Auto Insurance Quotes By Brett Horowitz

- How To Compare Auto Insurance To Find Your Best Policy

- Compare Auto Insurance Quotes, Locally

- Compare Car Insurance Rates Side By Side In 2023

- Compare Car Insurance Quotes From 25+ Companies

- Gallery for Compare Auto Insurance

- Related posts:

Compare Auto Insurance

Publication Guide: We are a free online resource for anyone who wants to learn more about insurance. Our goal is to be your third-party resource for all things law and insurance. We update our website regularly, and all content is peer reviewed.

Car Insurance Quote

Not only is it mandatory in every state (the exception is New Hampshire), but it can save you a lot of money in repair costs, property damage and medical bills.

But when you’re looking for a good deal, how do you really compare what car insurance companies have to offer?

This helpful guide will teach you everything you need to know about comparing car insurance companies so you can get the best deal on coverage at the right price for you.

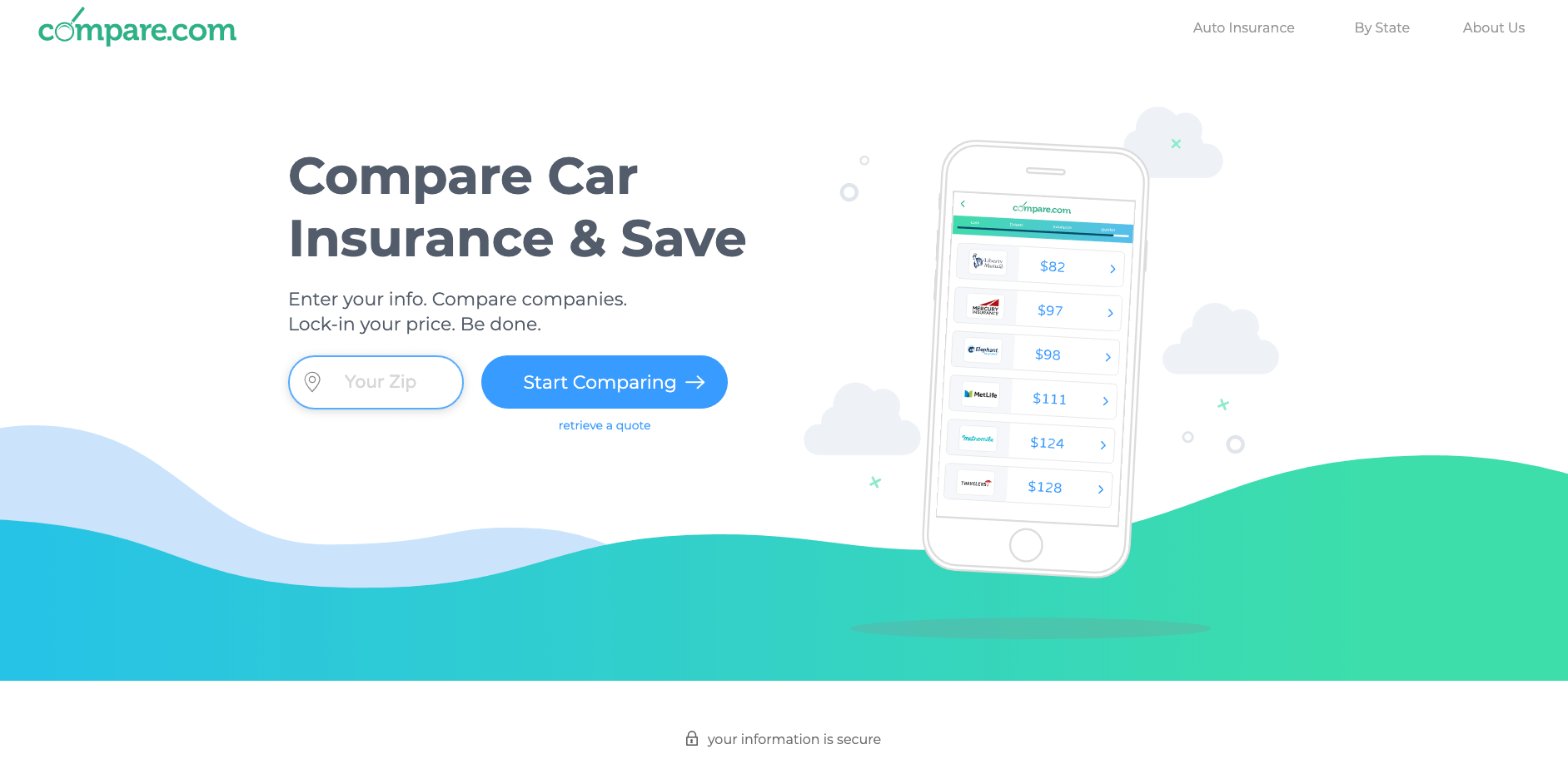

Many people choose to comparison shop to see who has the best prices and best service.

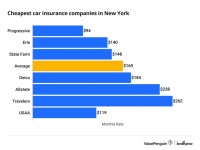

Compare Car Insurance Quotes For December 2023

The internet is doing well with consumer reviews of all major insurance companies across the country, and insurance carrier rates are very competitive.

That’s why it’s important to compare them so you can get the best deal for your situation.

For example, you may want the best coverage for a new car, or you have a young driver in your household and want to save money.

Fortunately, we have a detailed and comprehensive guide to the top auto insurance companies to make your decision easier!

Between Two Auto Insurance Companies? Here’s How To Decide

Perhaps the most important thing you need when comparing car insurance companies is a buyer’s guide to all car insurance carriers in your state.

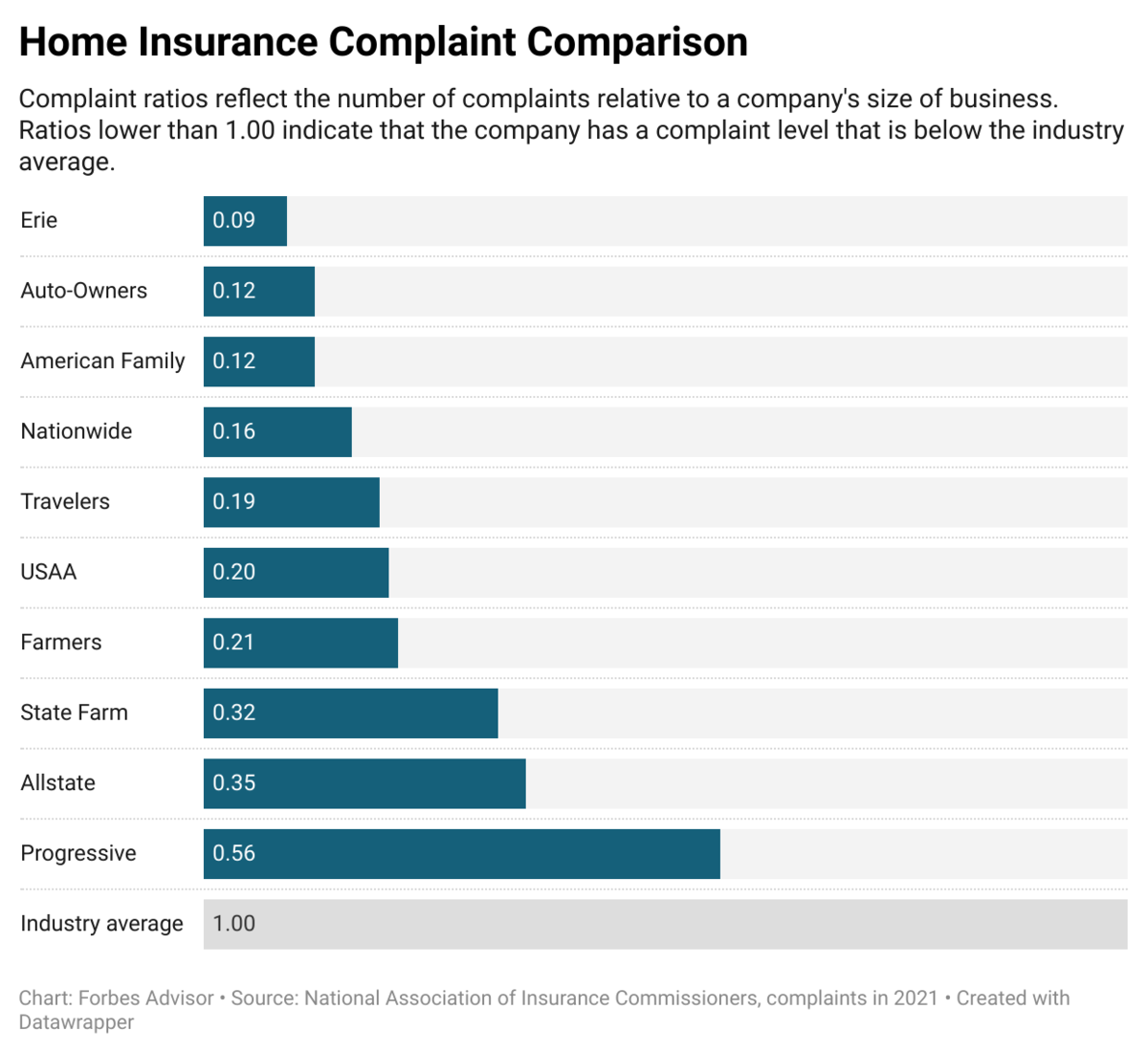

You can find this guide on the State Insurance Commission website. You can compare things like customer complaint rates, financial ratings and more.

Of course, you want to know that a company is financially stable so that it can pay claims quickly.

This will give you a clear indication of what kind of surprises you might encounter if you contact support or need to file a claim.

Best Home And Auto Insurance Bundles 2023

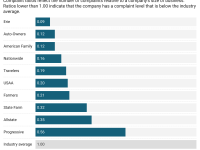

To review the company complaint in detail, visit the National Association of Insurance Commissioners (NAIC) website. Then type in the name of the company (or companies) you are thinking of going to, and then you will see various reports.

The difference with this particular approach is that you see a more balanced customer complaint rate than the company’s market share.

In short, this prevents larger and better-known insurance companies from being unfairly singled out because they have more customers who are likely to file complaints.

Anything less than that and you risk putting your insurance in the hands of a company that may not be as strong or financially sound as it seems.

Compare Car Insurance Quotes (2023 Updated)

For example, looking at a company’s S&P (standard and poor) rating can tell you about its financial ability to meet its insurance obligations, such as paying claims on time.

This rating system has 10 different lower levels and the highest possible rating is the highest AAA rating.

Most states already have minimum requirements such as bodily injury (both single and multiple), property damage, etc. These values vary from state to state.

According to Edmunds.com, they start at $10,000 (bodily injury liability) / $20,000 (bodily injury liability for all parties) / $10,000 (property damage liability) in Florida at $50,000 / $100,000 / $25,000 each. can do

Compare All Car Insurance Sites:amazon.com:appstore For Android

Keep in mind that this is just the beginning. Often, the state minimum is not enough to cover costs such as rising medical expenses and the cost of vehicle repairs.

You need to consider the value of the property that needs protection, and how much protection it needs. For example, if your car is fully paid off and it’s an old car, you may not need collision coverage.

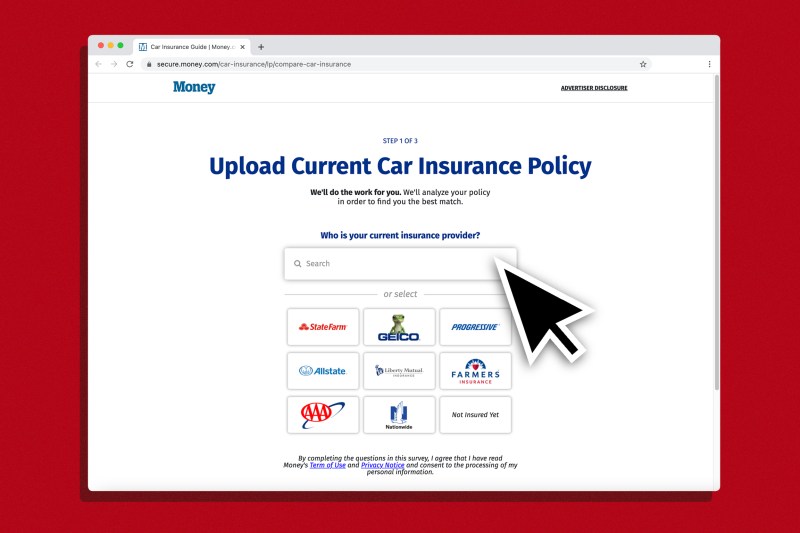

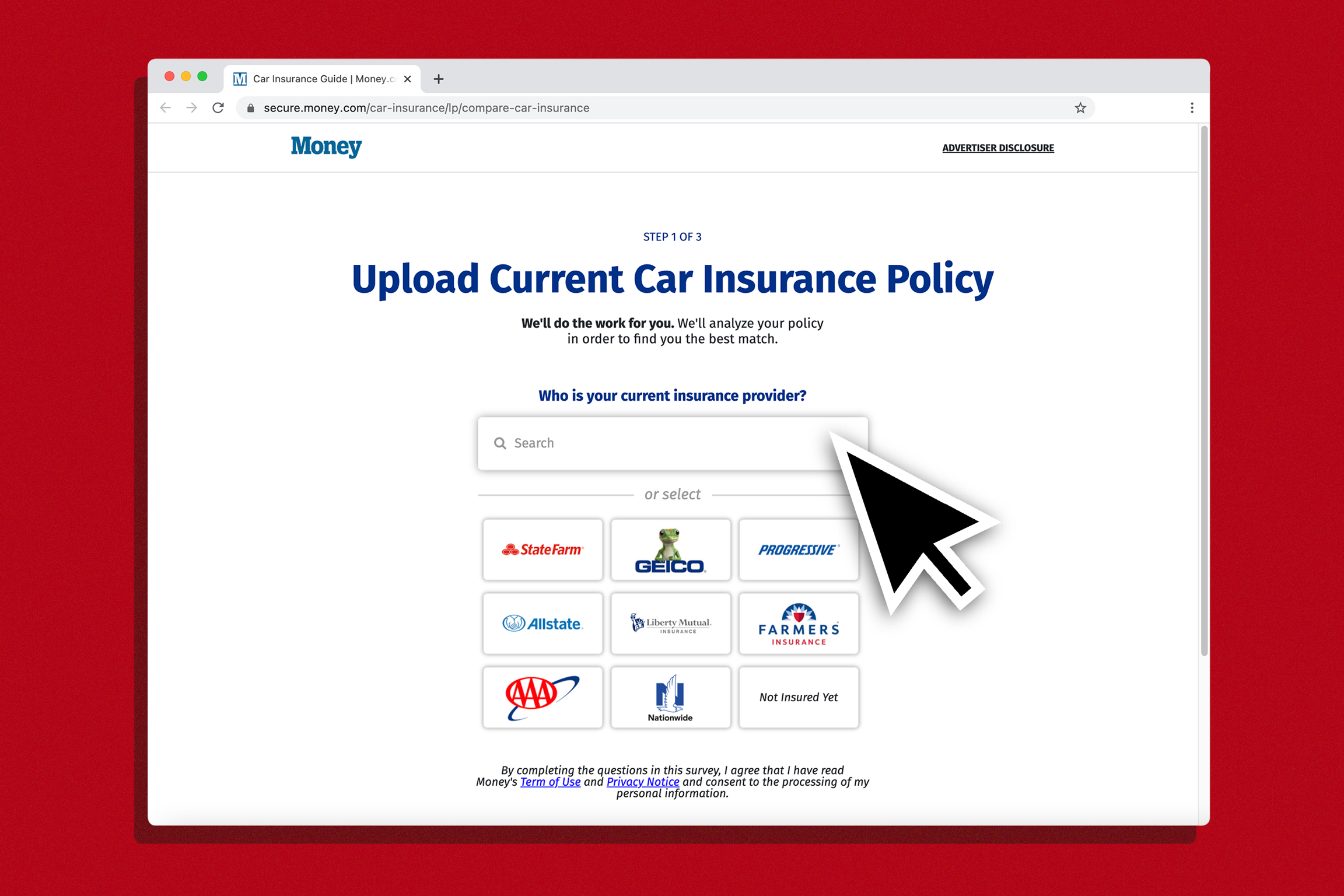

Once you have this information, it’s time to get started. Most likely, you will speak with an agent in person, either on the phone or online (or both).

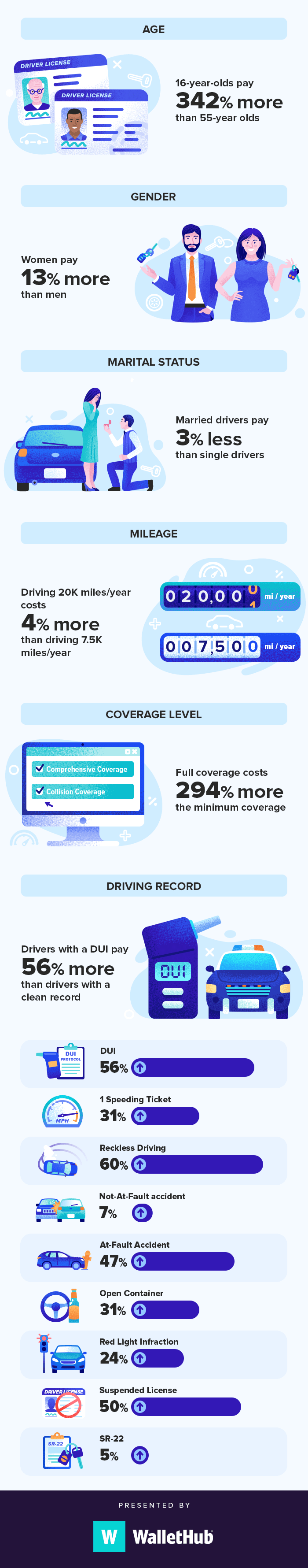

You’ve probably heard that it’s wise not to judge a book by its cover – but insurance carriers do. They must carefully evaluate and judge the risk based on many factors – otherwise they will not stay in business for long.

Get Potentially Lower Car Insurance Rates With Compare.com!

That being said, it’s a good idea to ask your staff some basic questions when you get:

When you receive a quote from an insurer, you will also be given a risk assessment. There are various factors that make up how much you “risk” the business – such as, your potential claims.

There are all kinds of factors that go into assessing risk, including your age, gender, criminal record, criminal record, credit history and even where you live.

For example, if you are elderly and live in an area where car theft is common, you will pay more than someone who is 30 years old and lives in the area.

Compare Auto Insurance Quotes (from $31/mo)

For example, if a friend borrows your car to get pizza and hits another car, are you liable?

What if you are a pizza delivery driver and you use your car for work – if you have an accident, are you jealous?

Each insurance company – and each state – handles these situations differently, so be sure to ask your agent for details.

Also, don’t forget to ask what happens if you borrow someone else’s car and it breaks down, or there is a break in the rental car.

How To Compare Auto Insurance Quotes By Brett Horowitz

Your deductible is the amount you have to pay if you have an accident and file a claim, before the insurance starts.

Depending on the insurance plan you choose, your deductible can range from $100 to $1,000+. Generally, a higher deductible means you will pay less for your insurance policy, while a higher premium means a lower deductible in the event of an accident.

Insurance companies want your business, because many of them offer a variety of payment options to make your payments easier.

Some companies allow you to pay for six months. Others give you a discount if you pay your entire annual premium at once.

How To Compare Auto Insurance To Find Your Best Policy

Others may charge additional monthly payments for additional convenience. Again, each company handles this differently, so it’s always wise to ask.

If you’re looking at a nice new car, make sure you can afford the payments and insurance – because your insurance can go up, sometimes it really does!

OEM stands for Original Equipment Manufacturer, and many people don’t think to ask their representatives this question.

But it’s good to know, because OEM parts are like your car.

Compare Auto Insurance Quotes, Locally

Another type of part is the “aftermarket” part, which is made without a specific type of vehicle, not the make and model.

Aftermarket parts are more expensive and contractors often use them because they save money, but contractors don’t always use aftermarket parts. Some things manage through claims – to make matters even more confusing!

Some insurers also prefer to “mix and match” – use OEM parts for critical safety items such as airbags, but aftermarket parts for cosmetic items such as windshields.

Sometimes, being able to drive down the street and face to face can help reduce anxiety better than chatting on the internet. If they have a local office, ask if they can provide you with an annual insurance review. This means that agents review your services and help you determine if you’re paying for coverage you don’t need, and make sure you do need coverage.

Compare Car Insurance Rates Side By Side In 2023

In the midst of an accident, it’s hard to think carefully and make sure you have all the relevant information your employees need to file a claim.

Many insurance companies have “list” apps or websites where you can file a claim and reach an agent as soon as an accident occurs.

Being able to do this anytime day or night is a real life – and money saver!

When it comes to an apples-to-apples comparison between car insurance companies, you don’t just want to look at their financial stability, but also their customer records.

Compare Car Insurance Quotes From 25+ Companies

In terms of coverage offered, what do the different plans offer and at what cost?

You should also look at the company’s claim history to see how it has changed

Compare auto insurance plans, auto insurance compare, compare auto insurance companies, compare auto insurance nj, compare auto insurance price, compare auto insurance quote, compare auto insurance online, auto insurance compare quotes, compare auto insurance rates, auto insurance quotes online compare, compare cheap auto insurance, compare auto and home insurance