Car Insurance Online – The offers on this page come from advertisers who pay us. This may affect which products we write about, but also what we write about them. Here is an explanation of how we make money.

In the past, the options for buying car insurance were very limited. You can make an in-person appointment at your local insurance company or contact an independent insurance agent to help you find the best policy. But the auto insurance landscape has changed significantly as more insurers make it easier and faster to buy auto insurance online.

Contents

- Car Insurance Online

- Best 3 Things To Know Before Getting A Car Insurance Quote Online

- Things To Know About Online Car Insurance Quotes

- How To Get Car Insurance Before You Buy A Car

- Car Insurance Purchase: Online Versus Agent

- Car Insurance Online Hi Res Stock Photography And Images

- Buying Car Insurance Online: How To Do It (2024 Tips)

- Check Your Car Insurance Online In Easy Steps!

- Can I Receive Florida Car Insurance Deals Online?

- Gallery for Car Insurance Online

- Related posts:

Car Insurance Online

Getting auto insurance quotes and getting your auto insurance policy online is convenient – and it saves you money. Read on to learn more about how buying a policy online affects the price, where to buy insurance online, and how to get the best car insurance.

Best 3 Things To Know Before Getting A Car Insurance Quote Online

Answer: Probably. When you search for auto insurance online, you can get and compare quotes from multiple providers to find the best auto insurance rates for your profile. Shopping online is also cheaper because you don’t pay agent commissions or other fees when you get your auto policy in person.

However, you can also miss out on potential savings if you don’t work with a knowledgeable personal insurance agent.

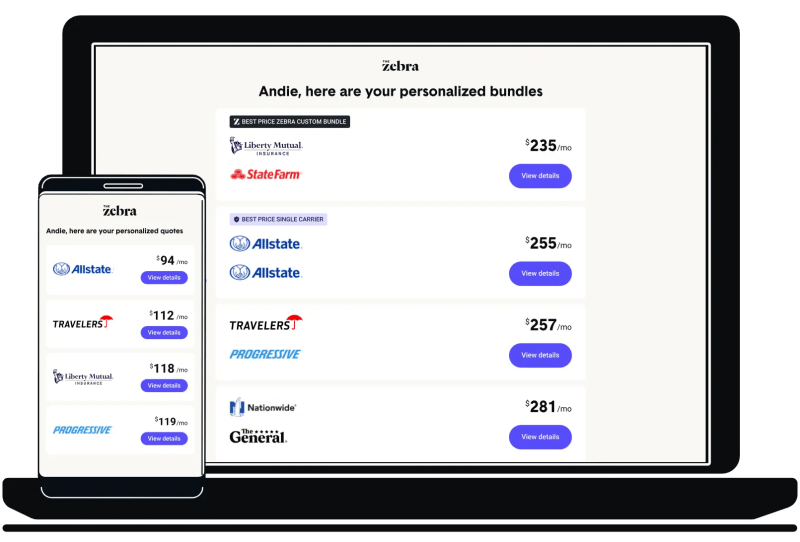

When it comes to buying car insurance online, you generally have two options: get a policy through the insurance company’s website or shop on an insurance comparison site. Each option has its pros and cons. For example, getting quotes from individual insurers can be more time-consuming and frustrating than using an insurance comparison site.

Although an insurance comparison site can save you time, you can only get quotes from a small selection of insurance companies instead of a complete list. This is because many comparison sites have business relationships with selected insurers. The comparison site pays when you buy a policy from one of their partners.

Things To Know About Online Car Insurance Quotes

Before you buy a new policy, think about what type of auto insurance you need. Learn about your state’s minimum car insurance requirements. Almost every state in the US requires minimum total liability insurance, but requirements vary. For example, drivers in Texas must have coverage for bodily injury liability and property damage liability. But even those in North Dakota require uninsured/underinsured motorist and personal injury coverage.

In addition to your state’s minimum insurance requirements, you should also consider your own needs and risk preferences. If you’re driving a new car or are particularly prone to accidents, you may want comprehensive coverage that includes liability, collision and comprehensive coverage. A comprehensive insurance policy offers more protection than minimum coverage, but keep in mind that your car insurance costs will be higher with full coverage. Some lenders may require full coverage if you bought your car.

Once you understand your state’s requirements and insurance requirements, it’s time to gather the information you need to get an auto insurance quote. Car insurance companies usually ask for personal information such as your name, address and driver’s license number. You must also provide information about your vehicle, including its year, make, model, vehicle identification number and driving history, such as recent accidents or speeding tickets.

The next step is to get and compare car insurance quotes online through an online comparison tool or individual insurance sites. Many popular insurers offer online quotes including GEICO, Nationwide, Progressive, USAA and more. Getting quotes from multiple insurers for the same coverage levels can provide valuable insight into the premiums you’ll pay, as costs vary by company.

How To Get Car Insurance Before You Buy A Car

If you use a comparison site (many of which also have a mobile app), they’ll do the comparison for you and show you apples-to-apples policy options.

From here, you can select your coverage options and configure your policy online. For example, you can choose a higher deductible or set higher coverage limits to lower your monthly payments, giving you peace of mind.

You can consider additional add-ons to increase your coverage, such as medical bills, accident forgiveness or roadside assistance.

After customizing your policy to suit your needs, be sure to read the fine print before proceeding. Review the terms and conditions and understand what is covered versus possible exclusions. This will help you avoid unexpected surprises in case of an accident and your car is damaged or stolen. If anything in the fine print is surprising or interesting, talk to your insurance agent to discuss it before finalizing your policy. Once you’re comfortable enough to go ahead, you’ll need proof of insurance and ID cards – you can print them or save them on your phone.

Car Insurance Purchase: Online Versus Agent

If buying insurance online doesn’t seem like the best option for you, you can get a policy with an independent broker or agent. Independent brokers may provide quotes from multiple insurance companies, while captive agents work for a single insurance company. If you know exactly which insurer you want to work with, a captive agent may be the right choice.

As noted above, you may be required to pay sales commissions or other fees when you work with an insurance broker or agent. If you have questions about your auto policy or are looking for special add-ons, you’ll also benefit from personalized service. You can also access lesser-known discounts when you work with a knowledgeable broker or agent.

Getting car insurance is not a one time thing. Car insurance requirements can change over time, so it’s important to understand how to update your policy if necessary. If your driving record improves after taking a safe driving course, for example, you may be able to get a better rate on your auto insurance. Most insurers allow you to renew your policy whenever you want without waiting for the next renewal. If you want to upgrade your coverage, add a driver, or make other changes to your policy, you’ll usually need to talk to an insurance agent.

Since car insurance requirements can change, it makes sense to review your policy periodically. Car insurance policies are generally valid for six or 12 months and automatically renew at the end of that period. Your insurer should ideally contact you before your policy renewal date to review cover details or get free quotes on your new policy. Our goal is to help you make informed insurance decisions. We have an advertising relationship with some of the offers included on this page. However, this does not affect our editorial opinion or recommendations. Our reviews, tools and all other content ratings and lists are based on objective analysis and we fully own our opinions.

Car Insurance Online Hi Res Stock Photography And Images

Compare car insurance quotes so you can see which company offers coverage for the price you want to pay. Comparing car insurance can save you money.

Laura is an award-winning editor with content and communications expertise covering auto insurance and personal finance. He has written for several media outlets, including the USA Today Network. He most recently worked in the public sector at the Nevada Department of Transportation.

John is Editorial Director of Insurance.com and Insure.com. Prior to joining QueenStreet, John was a deputy editor at The Wall Street Journal and an editor and reporter for several other media outlets covering insurance, personal finance and technology.

Dr. Gao is Director of Principles of Risk & Insurance, where he teaches at Eastern Kentucky University.

Buying Car Insurance Online: How To Do It (2024 Tips)

Whether you’re looking to buy a new car or replace car insurance, comparing car insurance rates is the best way to find a great deal on car insurance.

Comparing car insurance quotes is a simple process that can save you hundreds of dollars each year. Our experts compare car insurance quotes to bring you this data-driven guide.

To compare car insurance rates, see how companies compare the three coverage levels in the chart below. Suggested Rates Average Annual Rates:

To compare car insurance rates, you first need to decide how much insurance you need and list information about your car, location and drivers. Also, remember the difference between comparing car insurance rates and comparing car insurance quotes:

Check Your Car Insurance Online In Easy Steps!

During your research, you’ll get quotes, but the exact amount you’ll pay for coverage — your rate — may be higher or lower after the insurance company completes its calculations.

Here are five steps you can take to compare car insurance quotes to find the best deal on car insurance:

If you’ve moved, want to know how much car insurance costs in your area, or are a new driver, our car insurance comparison tool can help you get an idea of what people in your area are paying average car insurance rates in each zip code.

Florida car insurance rates Enter zip for average rate by zip code. Then enter age, gender and coverage level for customized tariff.

Can I Receive Florida Car Insurance Deals Online?

State Minimum: Liability coverage is required to legally drive in your state; Some states require additional coverage, such as personal injury coverage,

Commercial car insurance online, new car insurance online, car insurance rate online, instant car insurance online, car insurance online michigan, online car insurance texas, car insurance quotes online, best online car insurance, buy car insurance online, find car insurance online, online car insurance, online car insurance companies