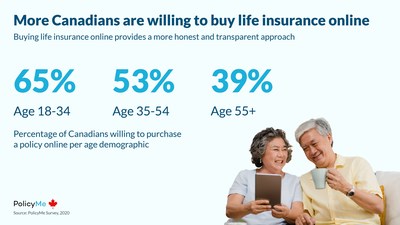

Buy Life Insurance Online – Although teens are less likely than the general population to have life insurance, a new study shows that nearly half of Gen Z and Millennial teens say they plan to buy life insurance this year. The way they say they want to shop shows that the insurance industry will have to be driven to meet the expectations of these consumers.

According to Life Happens’ 2023 Insurance Barometer Study, more young people say they’d rather buy life insurance online than work with a financial professional. Although interest in online shopping has grown over the past decade, for the first time online shopping is the top choice.

Contents

- Buy Life Insurance Online

- Experienced Independent Life Insurance Agent Vs. Life Insurance Call Center: 6 Things You Need To Know

- The Easiest Way To Get Life Insurance Quotes & Apply — Apple Insurance Solutions

- Aged Life Insurance Leads

- Instant Access: Get Online Life Insurance Quotes In Minutes By Top Whole Life

- How Long Does A Beneficiary Have To Claim On A Life Insurance Policy?

- Good Advice For Buying A Life Insurance Policies By Legalswamp7804

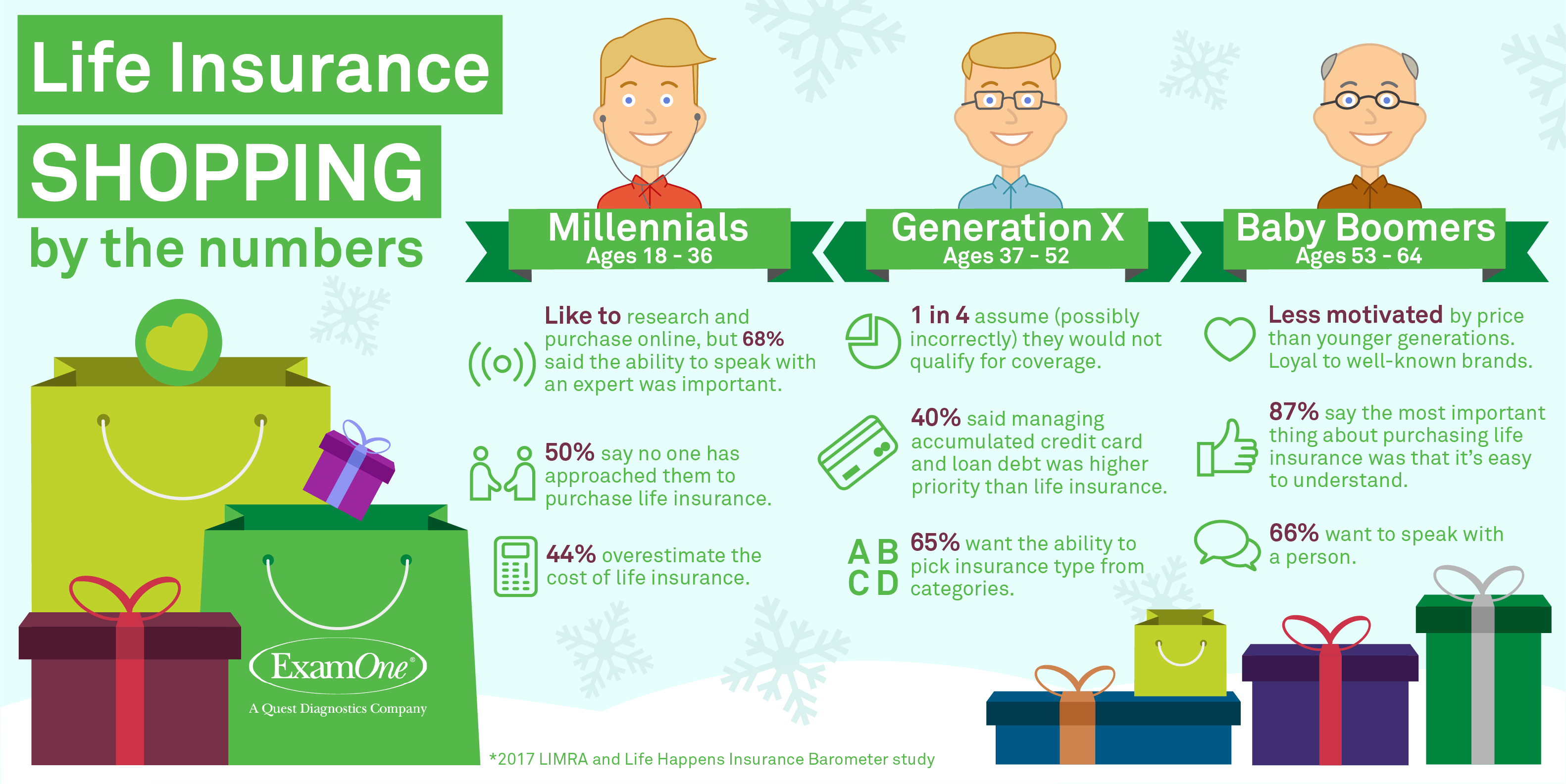

- Holiday Shopping For Life Insurance? The Purchasing Habits For 3 Generations Of Consumers

- Gallery for Buy Life Insurance Online

- Related posts:

Buy Life Insurance Online

While young consumers are drawn to the convenience and convenience of shopping online, they also recognize the value of working with financial professionals. Nearly half of Gen Z and Millennials say they expect to research life insurance online but work with a financial professional to ultimately purchase insurance. Why? For most people, buying life insurance is an important decision they don’t want to make. Four in 10 Gen Z and Millennials show little confidence in their knowledge of life insurance, and more than a quarter say they haven’t bought insurance because they didn’t know what to buy or how much. Working with financial professionals can help answer these questions and ensure they get the right life insurance for their needs and goals.

Experienced Independent Life Insurance Agent Vs. Life Insurance Call Center: 6 Things You Need To Know

Alison Salka, Ph.D. “It’s no wonder the younger generation lives online—the average young person reports spending at least five hours on their device every day,” said the senior vice president and head of research.

“While they want to research online, they realize they may not have specific knowledge about life insurance, so they want to talk to experts when making the final decision to buy insurance because “it includes the financial security of their loved ones.”

Unlike previous generations, studies show that young people are more likely to turn to social media such as YouTube, TikTok and Instagram rather than financial company websites for advice and financial information. For them, social networks are like the Internet. According to the study, 81% of Gen Z and 75% of Millennials turn to social media for discussion, advice and information on financial topics, compared to just 48% of Gen X users and 27% of Baby Boomers. As a result, it is becoming increasingly important for life insurance providers and financial professionals to effectively use social media to engage, educate and sell to young consumers.

“The industry needs to know that it’s not just a platform we’re using for change, we need to refine our message and image to reflect the reality of these diverse, racial and national generations,” said John Carroll. “More races than previous generations.” Senior Vice President, President of Life & Annuities and LOMA. “We also need to address the challenge of combining the digital experience with getting people’s advice to meet these young people who have the information and advice they want and need.”

The Easiest Way To Get Life Insurance Quotes & Apply — Apple Insurance Solutions

Research continues to highlight the importance of Family Assistance Mission’s mission to improve the future financial security of Americans by bridging the life insurance gap in the United States. With over 100 million uninsured and uninsured American adults, it’s important that the creative industries meet the needs of consumers, especially teenagers, wherever they are.

1 Daily time spent with selected media in the US in the first quarter of 2020 by Nielson age group (in minutes). Have you stopped buying life insurance? That could be a mistake. Life insurance provides vital protection and the sooner you get it the better. Buying life insurance doesn’t have to be difficult. Now you can even buy life insurance online.

First, your life insurance rate can increase as you age and develop new health problems. If you are young and healthy, you can find the best rates for an affordable life insurance policy. But what if you stop buying a life insurance policy and develop medical conditions in the meantime? Your insurance rate may increase. You may also be denied life insurance. Buying life insurance sooner rather than later is the best way to avoid this possibility – and not. There’s no time like the present.

Second, an expected death can destroy a family. When a family loses a breadwinner, they can suffer financial ruin from their grief. With life insurance, you can ensure that your loved ones are financially secure no matter what. And since we don’t know what tomorrow will bring, it is wise to buy insurance. Life today.

Aged Life Insurance Leads

Life insurance typically involves two main financial transactions: insurance premiums and mortgage payments. The policyholder pays the insurance premium, which represents the cost of holding the life insurance policy. Insureds also name as many possible beneficiaries or beneficiaries of the policy as possible. If the insured dies when this policy takes effect, the death benefit is paid to the beneficiary.

Term life insurance is written to cover a predetermined period of time. The term can be short – for example, five years – or long – for example, twenty or thirty years. A lump sum policy can provide affordable life insurance and can provide protection until a number of milestones are reached, for example, until the mortgage is paid off or until a couple’s children are grown.

Permanent life insurance works differently. Permanent life insurance can extend the insured’s life as long as the policy is maintained. Like term life insurance, permanent life insurance provides death benefits. Unlike life insurance, permanent life insurance can also receive cash value.

There are different types of permanent life insurance, including whole life insurance and universal life insurance. Life insurance policies can also be customized by using riders or phrases on the life insurance policy that add some benefits.

Instant Access: Get Online Life Insurance Quotes In Minutes By Top Whole Life

Traditionally, you must answer questions about your medical history and undergo a medical examination before you can purchase life insurance from a life insurance company. However, this is not always necessary.

You can also buy a life insurance policy without a health check. You can also purchase a non-medical exam life policy with an accelerated warranty that eliminates the need for lengthy medical exams using access to modern databases.

Are you buying a term life insurance policy or a permanent life insurance policy? Term life insurance is usually cheaper than permanent life insurance. If you are looking for affordable life insurance for a limited number of years, consider purchasing term insurance.

How much life insurance do you need? The death benefit you choose will affect your rate. For example, if you want a life insurance policy for only $10,000 to cover final and funeral expenses, you will pay less if you want a life insurance policy with a $1,000,000 death benefit.

How Long Does A Beneficiary Have To Claim On A Life Insurance Policy?

What is your age and health? Life insurance rates tend to go up as you get older. Health problems and high-risk behaviors, such as smoking, can also increase your rate.

According to LIMRA’s Life Insurance Barometer study, many people underestimate the value of over-the-counter life insurance. A healthy 30-year-old may pay $160 a year for a life insurance policy, but 44% of millennials think the policy will cost around $1,000.

You may be overestimating the cost of life insurance. To see how much you can pay for life insurance, you can get a life insurance quote online.

Before you buy life insurance online, you should determine how much life insurance you need. Don’t just pick numbers that are good for you. Calculate your actual needs.

Good Advice For Buying A Life Insurance Policies By Legalswamp7804

For example, do you need life insurance to replace lost income? If so, you can multiply your annual salary by the number of years you want your life insurance policy to cover. Using this method, if you wanted life insurance to replace 10 years of income of $50,000 per year, you would need a $500,000 policy.

You can also determine your life insurance needs by calculating your expected costs. These costs can include mortgage and other bills, child care and school fees. Adding up these costs will help you figure out how much life insurance you really need.

Also, consider your other assets. If your family has other savings, you probably don’t need a lot of life insurance.

Once you’ve determined your life insurance needs—for example, what kind of policy you want and how much you need—you can get a life insurance quote online. This will allow you to see what life insurance rates the life insurance company is offering. You may need to answer some questions about yourself, your zip code and your health before you get a life insurance quote. Many insurance companies and insurance brokers offer online life insurance quotes.

Holiday Shopping For Life Insurance? The Purchasing Habits For 3 Generations Of Consumers

If you are interested in purchasing A

Life insurance online buy, buy life insurance online now, buy life insurance online canada, buy life insurance policy online, buy universal life insurance online, buy permanent life insurance online, buy term life insurance online, buy globe life insurance online, buy life insurance online instantly, buy life insurance leads online, buy whole life insurance online, buy cheap life insurance online