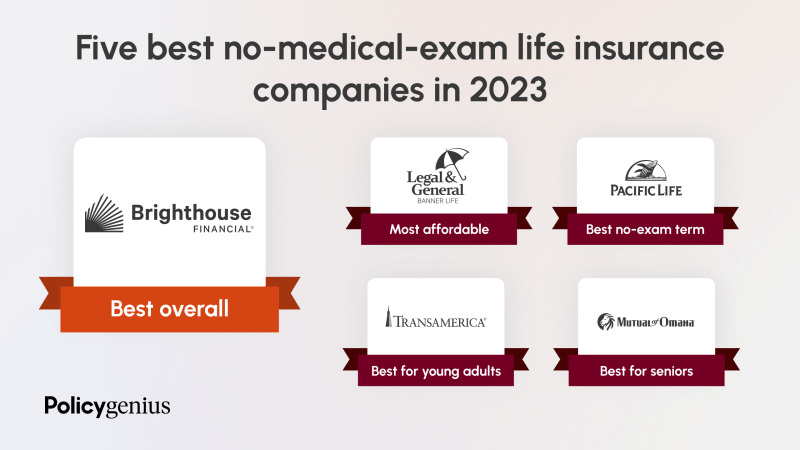

Best Term Life Insurance – No-medical-exam life insurance is ideal for people who want to skip the medical test and get insurance sooner, or people who won’t be approved for traditional life insurance for health reasons.

We analyzed the best life insurance companies in the market based on their policies, prices, policy options, customer satisfaction, and financial strength, to identify the best insurance for you. Depending on your needs and personal circumstances, these companies will approve you without medical examination and offer you the best price.

Contents

- Best Term Life Insurance

- Term Life Insurance: The Best Choice For Most People

- Solved Universal Life Insurance Combines Elements From Term

- Policy: Decoding Term Life Insurance Policies: Everything You Need To Know

- The Best Term Life Insurance Companies For 2021 + Rates

- Best Life Insurance For Seniors In 2020: Top 5 Companies

- Life Insurance For Seniors

- Which Is Better

- Best Term Life Insurance Companies & Coverage Options

- Year Term Life Insurance With No Exam (see Rates)

- Gallery for Best Term Life Insurance

- Related posts:

Best Term Life Insurance

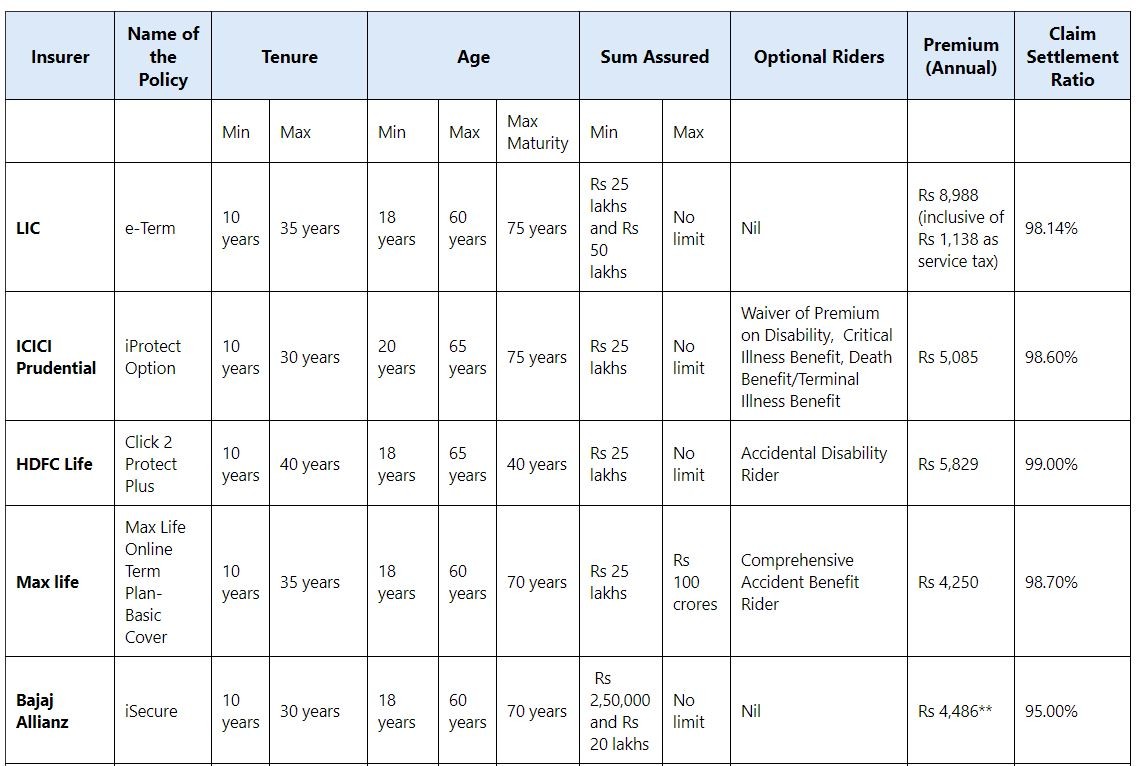

Our recommendations are based on internal and external expert analysis, as well as the Life Insurance Price Index, which uses real-time data from life insurance companies to determine price trends. When reviewing a life insurance company, our editorial team uses a proprietary scorecard with five factors – cost, policy details, financial strength, transparency, and customer experience – to assign an unbiased rating between one and five stars. for the. These ratings are also considered part of the company’s recommendations. We are not paid for our reviews.

Term Life Insurance: The Best Choice For Most People

Our reviews and recommendations can help you find reliable insurance for your family’s financial security, but the best life insurance company for you depends on many factors. A licensed agent can assist you throughout the application process to ensure you get the right insurance for your circumstances at the most competitive price.

The property appraisal process considers many factors, including customer satisfaction, cost, financial strength, and policy coverage. See the “Methods” section for more details.

EMBest is an international credit rating agency that rates the financial strength of insurance companies from A++ (Superior) to D (Poor).

Using a combination of internal and external benchmark data, we rank each insurance company’s premiums from least expensive ($) to least expensive ($$$$$).

Solved Universal Life Insurance Combines Elements From Term

Brighthouse Financial offers competitive rates, comprehensive coverage, and application decisions in less than 24 hours, making it a great choice for people who want to get life insurance without a medical exam.

Brighthouse Financial offers a fast decision application process that can help you get up to $3 million in life insurance without a medical exam.

If you have a common medical condition such as anxiety, high blood pressure, ADHD, or even sleep apnea, you are likely to get better rates from Brighthouse Financial than other insurers.

Legal & General America, which also does business for Banner Life and William Penn, has some of the longest terms — up to 40 years — and the most competitive life insurance rates available, even for people with a history of medical conditions. have

Policy: Decoding Term Life Insurance Policies: Everything You Need To Know

Legal & General America, which also does business with Banner Life and William Penn, offers affordable policy options with some competitors regardless of your health profile.

You can apply for coverage between $100,000 and $2 million without a medical exam – all you have to do is complete a medical interview over the phone. Legal & General America will then review your application and determine if a medical examination is required.

Pacific Life offers some of the lowest life insurance rates for all annuities. It is also the most competitive standard in terms of health and construction.

Pacific Life offers some of the most flexible terms for people between the ages of 18 and 70 to apply for life insurance, making it the cheapest and most popular type of life insurance for most people.

The Best Term Life Insurance Companies For 2021 + Rates

If you are under the age of 60 and do not have significant health conditions or risk factors, you will complete a medical interview to determine if you can receive emergency approval without a medical examination.

If you are between the ages of 60 and 70 or have additional medical conditions, Pacific Life will likely request an Attending Physician’s Certificate (APS) to first assess your health and determine whether you are eligible without of any research.

Mutual of Omaha is a reputable company that offers a variety of life insurance products – including non-health options – so you can choose the type of life insurance that best suits your needs.

United of Omaha offers many no-exam policies for seniors. Its options include coverage up to $300,000 for people 50 and under, $250,000 for people 60 and under, and $150,000 for people under 70. is

Best Life Insurance For Seniors In 2020: Top 5 Companies

Mutual of Omaha also offers no-test options with low coverage amounts — up to $40,000 — to cover final expenses, such as funeral or medical bills, for people who don’t qualify for traditional insurance because of health issues. This product is available for people above 85 years.

Transamerica is one of the oldest and largest life insurance companies, with more than 12 million active accounts today. It offers affordable rates for almost all ages, and you can even skip the medical exam if you’re under a certain age or insurance amount.

Transamerica offers no-exam policies for adults 18 and older and an easy application process — including a health questionnaire that can be completed online or over the phone.

Transamerica has a flexible financial policy for graduate students and undergraduate applicants to protect their future income, with insurance amounts up to $500,000. The company also offers small amount insurance — up to $50,000 — for young adults who are looking for it. For insurance options to pay the final costs in the worst case scenario.

Life Insurance For Seniors

When you apply for life insurance, you should usually take the same medical exam as the annual one.

No-exam policies allow you to skip the medical exam and instead complete a medical interview online or over the phone to determine if you qualify for coverage.

There are three types of life insurance policies that don’t require you to pass a medical exam: traditional term life and two different types of life insurance policies designed to cover end-of-life expenses, such as funeral or medical bills: Easy Continued Insurance and life insurance.

Term life insurance is often the best option for people who want to protect their loved ones from financial hardship in the event of their death. It is affordable, easy to maintain and understand, and only lasts a limited time.

Which Is Better

If you have to undergo a medical examination, it can take up to six weeks to be approved for long-term care. But with some no-examination options, like expedited deals or expedited life insurance, your application can be approved within days — or in some cases even during the first phone interview. The good news is that no-test life policies are just as affordable as comparable policies where you have to go through a full application process.

Just keep in mind that, depending on your age and health profile, some insurers may still ask you to undergo a medical exam even if you are actually eligible for the policy during the non-exam period.

Simple life insurance doesn’t expire and usually pays a small amount — up to $40,000 — to cover final expenses. This is usually for people age 45 and older who may not qualify for traditional life insurance for health reasons.

Although you do not need to undergo a medical examination, you need to answer some questions about your health. Certain conditions, such as certain types of cancer or terminal illness, may disqualify you from this policy. It may take up to two weeks to get approval.

Best Term Life Insurance Companies & Coverage Options

Guaranteed life insurance is another type of policy that provides a small amount – usually up to $25,000 – to cover eventual expenses. You don’t need to undergo a medical exam or answer any questions about your health as part of the application – approval is guaranteed for people aged 45 to 85, depending on the insurer – and you have three days You can get approval inside.

If you have a pre-existing condition that excludes you from almost any type of policy, a guaranteed issue may be your best bet.

If you’re not sure which of these options is right for you, an agent can help. At , our agents work for you, not the insurance company, and can walk you through the entire process of buying life insurance while providing sound, unbiased advice.

A 30-year-old woman can pay $22.99 per month for no-test term life insurance with 20 years of coverage and a $500,000 cash guarantee. A 30-year-old man would pay $29.33 per month for the same coverage.

Year Term Life Insurance With No Exam (see Rates)

Simple issues and guaranteed issues are usually the most expensive. How much you pay for life insurance will depend on the type of policy you’re applying for, as well as your age, gender and health.

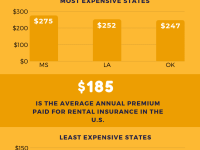

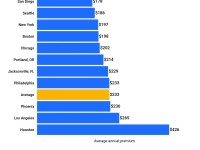

Methodology: Average monthly costs for male and female non-smokers in the preferred health category to obtain 20-year $500,000 life insurance were calculated. The average life insurance policy is based on a combination of non-medical-exam policies from Brighthouse Financial, Legal & General America, Transamerica, and Pacific Life. Prices may vary

Best whole term life insurance, nerdwallet best term life insurance, best term life insurance companies, best term life insurance providers, best term life insurance company, best short term life insurance, best term life insurance quote, best term life insurance quotes, best term life insurance plans, best affordable term life insurance, best term life insurance plan, best value term life insurance