Social Security Calculator – Personal finance Here’s why your Social Security retirement age is so vital Calculating your retirement age will help you know when to choose your benefits. Silver, a free withdrawal app, makes it quick and easy.

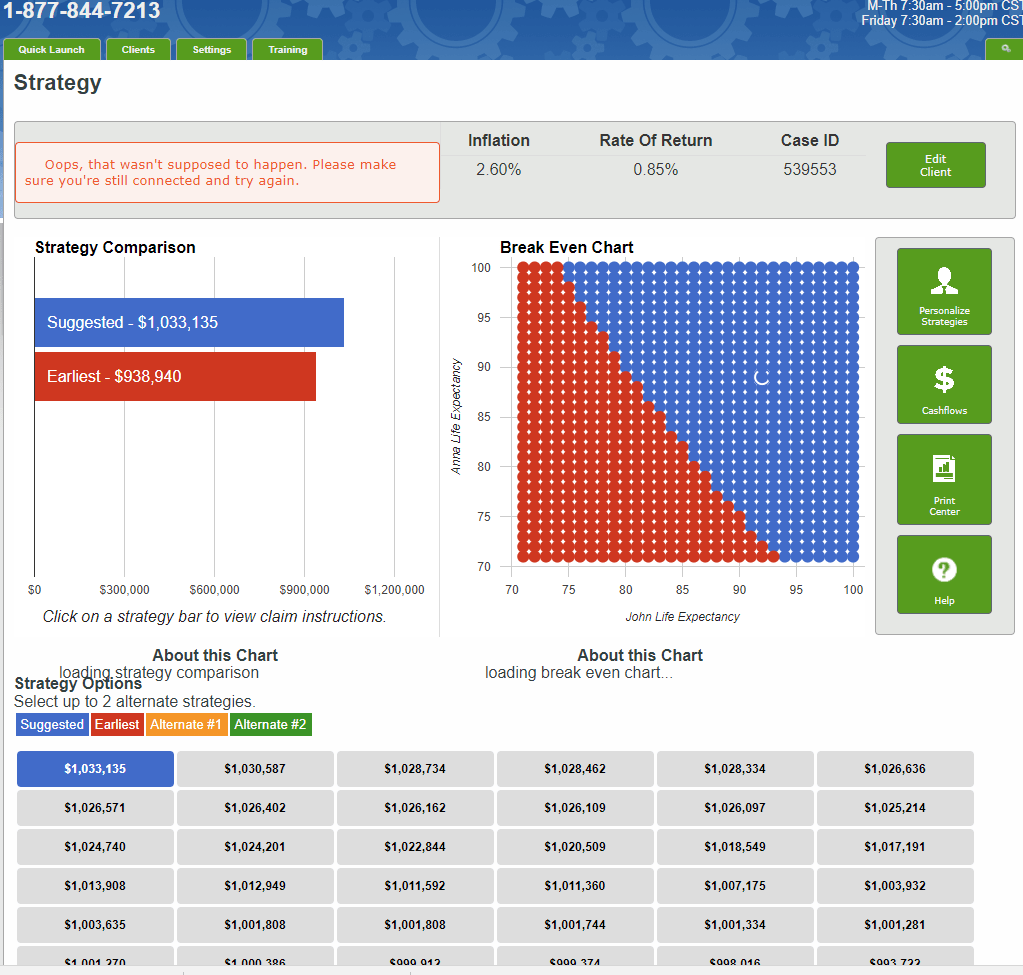

Silver lets you quickly and easily calculate your break-even point — the best time to start collecting Social Security benefits for your specific financial situation. (Shutterstock/wavebreakmedia)

Contents

- Social Security Calculator

- Social Security Calculator

- When You Delay Social Security Benefits, Here’s How The Math Works

- Your Basic Guide To Calculating Your Social Security Benefits

- Newretirement Plannerplus Retirement Calculator

- Social Security Benefits Faq

- Intergenerational Altruism And Retirement Transfers

- How Are Disability (ssdi) Benefits Calculated In Pennsylvania?

- Gallery for Social Security Calculator

- Related posts:

Social Security Calculator

This post is sponsored and contributed by Brand Partner. The views expressed in this post are the author’s.

Social Security Calculator

While almost everyone looks forward to a comfortable and relaxing retirement, navigating your Social Security benefits can be challenging. One of the biggest hurdles for people planning their retirement is deciding when to stop working and when to start claiming Social Security benefits. Fortunately, Silver, a free retirement planning app, helps you calculate the best possible time for you to choose your Social Security benefits, based on factors including age, marital status, overall financial situation and more .

Another factor to consider when deciding when to collect Social Security benefits is the break-even point. Your break-even point is the moment in your life when the amount of money you receive by choosing to take your benefits early (at a reduced rate) becomes equal to the total benefits you would have received if you had delayed getting your benefits. benefits It may seem like it doesn’t make financial sense to wait to elect your benefits, since the higher payment you’ll receive for delaying benefits won’t make up for the income you’ve lost waiting. However, it will make a difference if you predict that you will have a longer life. If you opt out too soon, you may miss out on bigger benefits once you reach your breakeven point.

Calculating your parity score can help you decide when to retire and start taking your benefits. And with Silver, it’s never been easier. Simply enter your current salary, current age, expected retirement age and marital status, and

Then you can adjust your planned retirement age to see exactly when your total Social Security benefit amount will be highest. When you move over your planned retirement age on the calculator, you will notice that at a certain age, your lifetime benefits will be lower, depending on your estimated longevity. That’s your break even.

When You Delay Social Security Benefits, Here’s How The Math Works

Silver allows you to calculate your break-even point, which can help you decide when to retire and start taking your benefits. (silver)

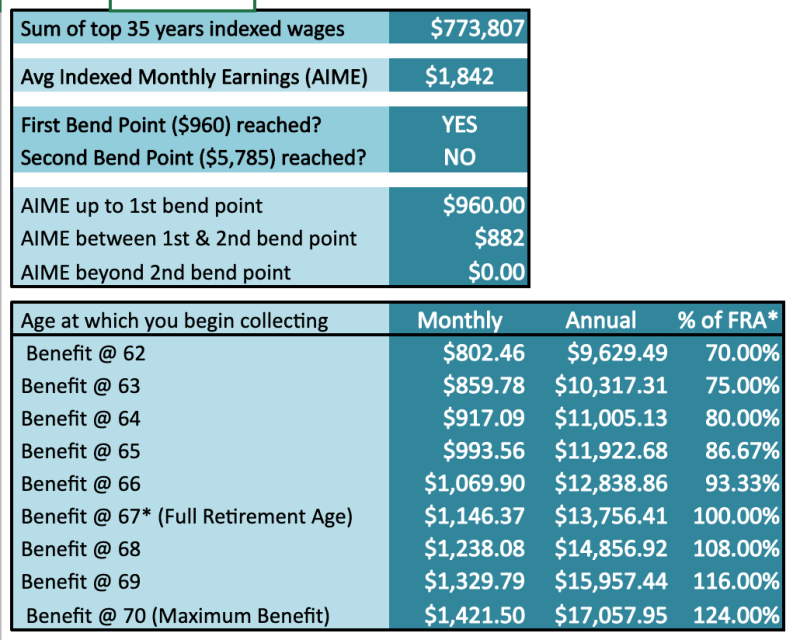

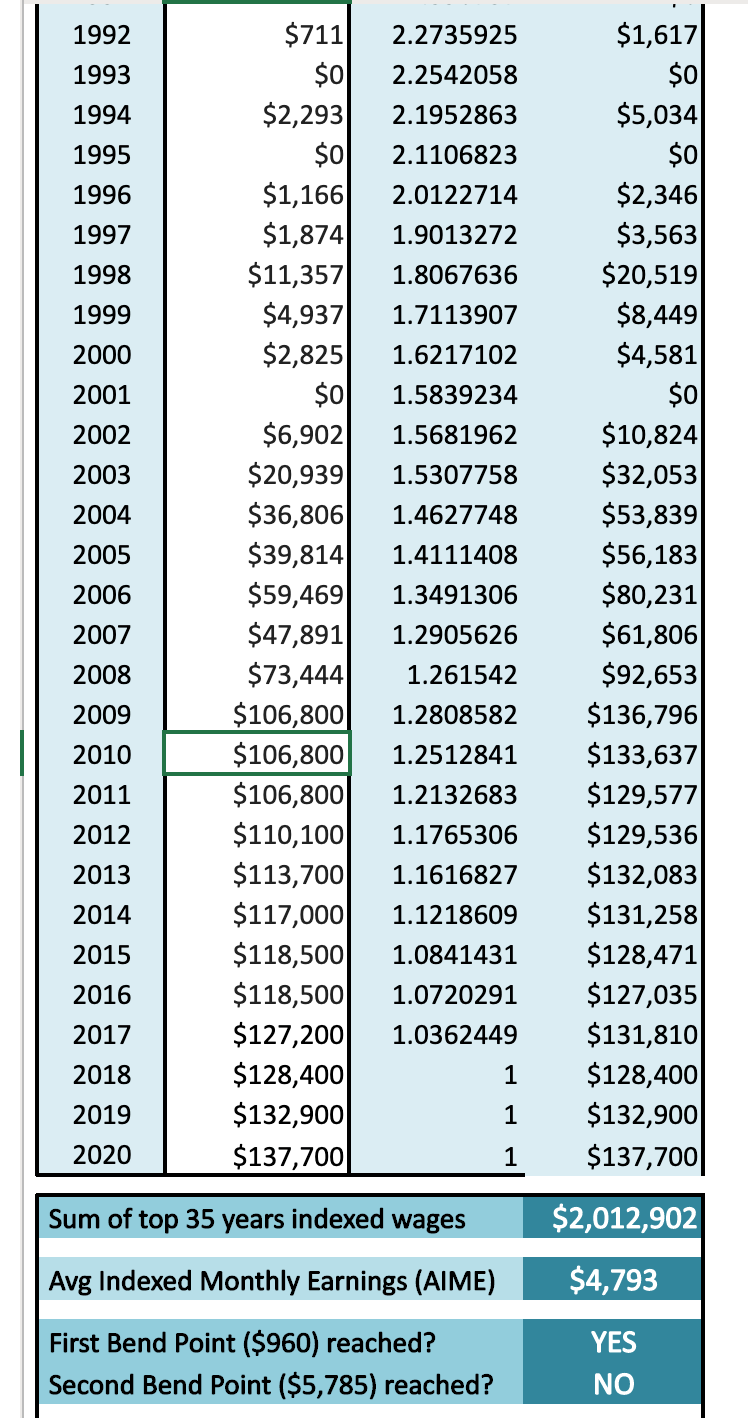

Your Social Security benefits are calculated based on the average of your best 35 years of earnings, up to a maximum annual limit (currently $137,000). This means anything you earn on top that will not be included in the calculation of your Social Security benefits. Full retirement age — which ranges from 65 to 67 — is the age at which you can collect 100 percent of the Social Security benefits you’ve accumulated during your lifetime.

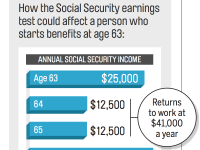

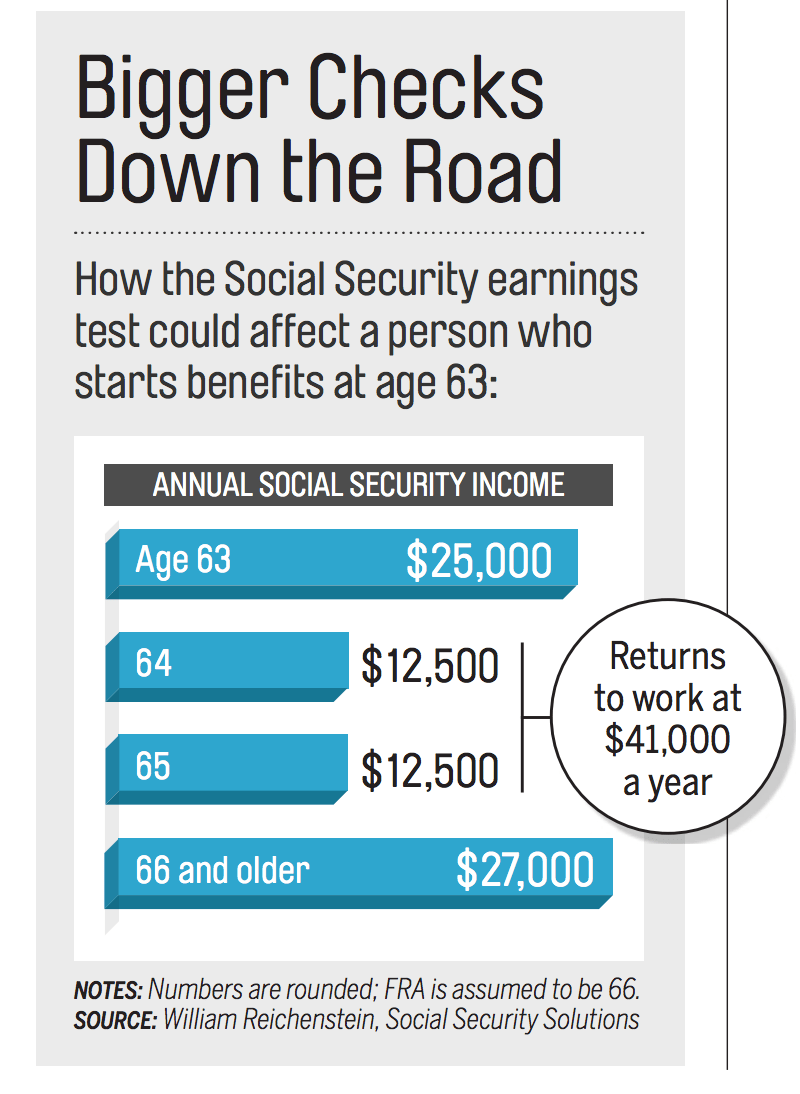

After age 62, you can choose to start collecting your benefits before you reach full retirement age. The downside to this is that if you start taking Social Security before your full retirement age, you will receive a permanently reduced benefit. For example, if you choose to start taking Social Security at age 62, your benefits will be reduced by 25 to 30 percent.

On the other hand, you don’t have to start collecting benefits as soon as you reach full retirement age. Instead, you can choose to delay your benefits, which means you’ll receive more money each subsequent year. For every month you don’t take Social Security before you turn 70, you’ll earn what’s known as a delayed retirement credit, which can increase your benefit by up to 8 percent a year. However, it is important to remember to calculate your break-even point to determine when you should choose your benefits – if you don’t, you could be leaving money on the table. There’s also no additional benefit to waiting past age 70 to cash in, since you won’t receive any delayed retirement credits afterward.

Your Basic Guide To Calculating Your Social Security Benefits

If you are in poor health, or your longevity estimate is on the shorter side, it may not make sense for you to delay the collection of benefits at all, as you may pass before reaching the age of parity.

If you decide when to elect your Social Security benefits, you must calculate the age of your Social Security balance to determine the right time to elect your benefits. First, determine when your full retirement age (FRA) is. Let’s say you were born in 1961, so your FRA is 67. So you go through two different scenarios: at 62 (when you can start collecting) and at full retirement age, 67.

Now, take your total earnings you received ($42,000) for that five-year period before your FRA. Then, divide by the additional income you received at FRA (which is $3,600) and add it to your FRA (67) to get your parity age. Your retirement age is 78 and eight months ($42,000 ÷ $3,600 = 11.67 years + 67 = 78 years and 8 months).

To calculate your break-even age, you can factor in other factors, such as health or longevity, to see if choosing your benefits before or after the healthy retirement age makes sense.

Newretirement Plannerplus Retirement Calculator

Determining the break-even age will help you determine whether choosing your benefits before or after full retirement age makes sense. (silver)

If you’re wondering if Social Security will still be around when you’re ready to retire, it’s understandable. In short, it is very likely. “Social Security is a program that is critical to the retirement of most Americans,” explains Rhian Horgan, CEO of Silver. “While there may be changes to help fund it properly, we don’t believe it’s going anywhere.”

Social Security provides benefits to 50 million people, and is paid for by the payroll taxes of more than 150 million workers and their employers, according to the Social Security Administration. Future changes in Social Security mechanisms and processes are almost a certainty, as the program has continually evolved to reflect the wants and needs of each new generation since 1935.

The Social Security Board of Trustees also projects that “the changes would be equivalent to an immediate reduction in benefits of approximately 13 percent, or an immediate increase in the combined payroll tax rate from 12.4 percent to 14.4 percent, or some combination of these changes, will be sufficient . . . to allow the full payment of the benefits expected for the next 75 years.”

Social Security Benefits Faq

Waiting until age 65 (or later) to collect your benefits may seem like the best course of action if you’re looking to receive as much money as possible later. However, your health and estimated life expectancy are both key factors to consider when making this decision. While it’s certainly not everyone’s favorite topic to discuss, if you’re in poor health and don’t expect to live into your 70s or 80s, it may make sense to take benefits early. Conversely, if you are in good health and expect to live another 20 years, waiting to collect Social Security is certainly something to consider.

Your marital status also helps determine when you will start receiving benefits. Eligibility for Social Security benefits depends on whether you are currently married, divorced or widowed. If you qualify, Silver can plan your benefits for life, as they vary from case to case.

Horgan notes that people who have already started taking their benefits should not feel as if they have lost savings, and that there is still time for them to earn delayed retirement credits and increase their benefits later . “If you’ve reached full retirement age and are collecting Social Security benefits, you can only stop once,” he said. “This is an SSA that gives you a ‘hit reset’ button. The good news is that if you take this option, you will continue to earn delayed retirement credits until age 70, which will increase your monthly benefit.”

Retirement planning doesn’t have to be difficult. With Silvur’s free and easy-to-use app, you can quickly calculate your parity score, project your lifetime income, analyze your expenses, assess your net worth and decide when to retire and when to start getting the your benefits.

Intergenerational Altruism And Retirement Transfers

Across America | Season and Holidays As El Niño wears off, spring is expected to arrive earlier in most of the U.S. Our ratings and opinions are not influenced by our advertising relationships, but we may earn a commission from our partner links. This content is created independently by the editorial staff of. Learn more about it.

If you’re like most people, you’re probably wondering, how much Social Security will I get when I retire? There has been a strong interest in retirement planning in recent years, especially since traditional defined benefit pension plans have largely disappeared.

While it’s important to learn all you can about saving and investing for retirement, it’s just as critical to be aware of what your Social Security benefit will be. Social Security benefits will likely play a large role in your retirement, as they represent a large portion of retirement income for most Americans.

Calculating your Social Security payment is an inexact science. This is because there is

How Are Disability (ssdi) Benefits Calculated In Pennsylvania?

Social security optimization calculator, estimate social security calculator, social security strategy calculator, social security benefit calculator, social security disability calculator, delaying social security calculator, social security penalty calculator, social security taxable calculator, social security projection calculator, social security pia calculator, social security worksheet calculator, social security tax calculator